Latest News

- Ethereum’s Major Event, Devcon, to Preview in the Philippines This April

- Ragnarok: Monster World Set to Launch on Ronin in Q3 2024

- Over 1,000 Attendees: YGG Pilipinas Kickstarts Roadtrip in Lipa

- P2E Space Nation Introduces ‘Cosmorathon’ for $OIK Airdrop

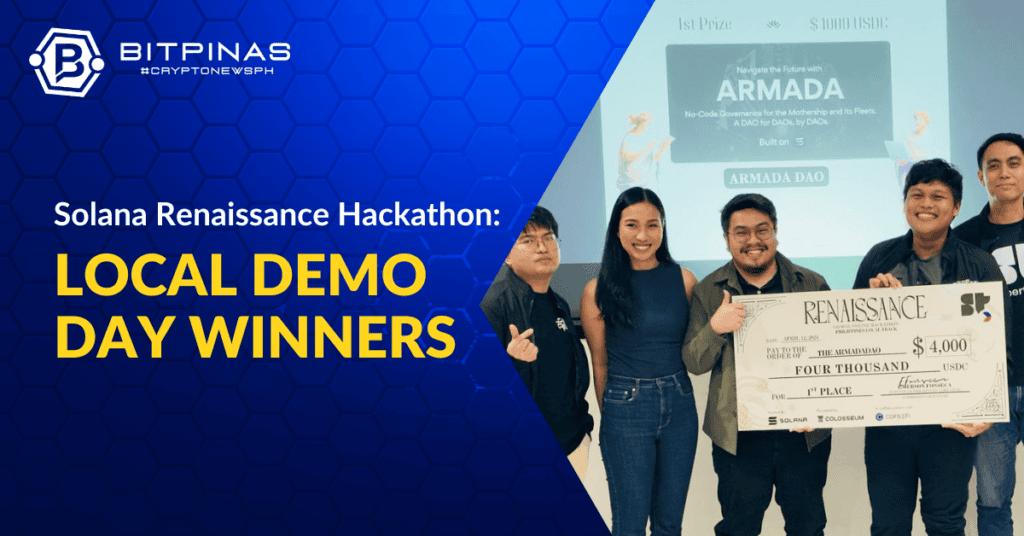

- Solana Renaissance Hackathon PH: Local Demo Day Winners

- YGG’s Native Token now Available in Local Platform GCrypto

- Axie Infinity Launches Play-to-Airdrop With Weekly 10K AXS Rewards

- BTC, ETH Price Up as Hong Kong Approves Spot ETF Ahead of Bitcoin Halving

- For Safer Cross-Chain Moves, Chainlink Unveils ‘Transporter’ App

- Bitcoin Runes 101 and Ecosystem Guide

Ethereum’s Major Event, Devcon, to Preview in the Philippines This April

Learn about the Ethereum Developer Conference (Devcon) in the Philippines with ETH63’s event, a precursor to Devcon Southeast Asia.

Ragnarok: Monster World Set to Launch on Ronin in Q3 2024

Ronin teams up with Ragnarok: Monster World, blending the beloved Ragnarok Online universe into blockchain gaming, scheduled for launch in Q3 2024.