Bitcoin to Php – Chart | BTC to PHP | Philippines | BitPinas

Check out daily, weekly, & monthly BTC to PHP chart. Check the Bitcoin Price in Philippine Pesos. Use the Converter to check specific BTC price in PHP.

What is the price of Bitcoin in PHP?

Wondering how much bitcoin you will get for X amount in PHP? Check out the tool below.

Check out the following BSP-licensed companies where you can exchange fiat for Bitcoin:

- List of Cryptocurrency Exchanges in the Philippines

- List of Licensed Virtual Asset Service Providers in the Philippines

Check out the following companies allowed by the BSP to exchange your money for cryptocurrency:

- How to Buy and Sell Bitcoin Cash Using Coins.ph

- Buy Bitcoin using Paxful

- How to transfer funds to Binance Crypto Exchange

- We Tried UnionBank Crypto ATM and This is How It Works

- 16+ Places/Websites to Buy Cryptocurrency in the Philippines

Overview: Price of Bitcoin

Around the world, bitcoin is usually traded with fiat money such as the U.S. Dollar (USD), Chinese Yuan (CNY), Euro (Euro), South Korean Won (KRW), and the Japanese Yen (JPY). Let us not forget how other alt coins (alternative coins) are tradeable to bitcoin.

Some popular exchanges that accept fiat to bitcoin are Coinbase, Coins.ph, Binance, Paxful, Localbitcoins, Gemini, and Kraken.

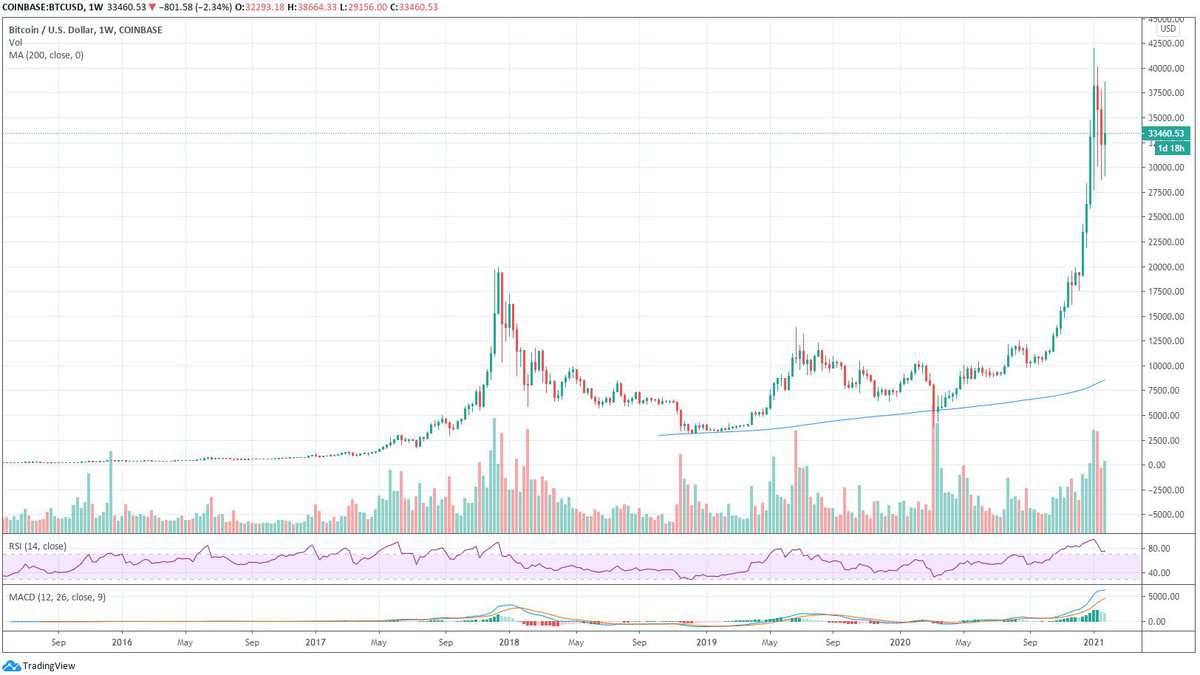

Lifetime Bitcoin Price Chart

When bitcoin first came out in 2009, it has little to no value at all until 2010. This is when a user of bitcointalk.org, Laszlo Hanyecz, posted on the forum on May 18, 2010 that he bought 10,000 BTC for 2 large pizzas. The price of bitcoin around that time is less than $0.01. By May 22, 2010, Laszlo Hanyecz posted again and stated that he was able to successfully trade 10,000 BTC for pizza. This made May 22 be celebrated as bitcoin pizza day. After 5 days of that transaction, the price of bitcoin soared to 900% from $0.008 to $0.08 a piece.

It reached a new milestone on February – April 2011 when it finally reached $1. From then on, it continued to grow amidst its extreme volatility. By December 2017, it reached its highest peak at $17,900 a token. This is also the year when bitcoin, blockchain, and other cryptocurrency have peaked the interest of many. Looking at its history, bitcoin will more or less regain momentum in the coming months and years.

On January 2021, the price of Bitcoin reached almost $42,000.

Bitcoin to PHP conversion rate?

The regulators in the country are not just curious but are also embracing the new technology, including bitcoin, other cryptocurrencies, and the blockchain. This resulted in a new trading pair in the country, BTC to PHP. Currently, there are a number of wallets like Coins.ph that let you convert bitcoin to PHP and vice versa.

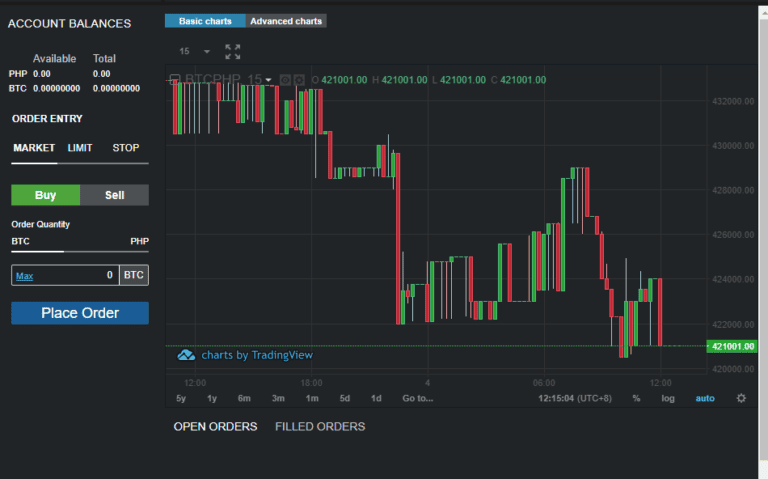

Cryptocurrency exchanges in the Philippines such as Coins.ph’s Coins Pro also has its own BTCPHP pair. Users only have to link their Coins.pro account to their existing Coins.ph account and transfer fiat or BTC from the wallet to the platform. Aside from Coins.pro, Paxful, BuyBitcoin.ph and LocalBitcoins can also let its users trade BTC to PHP or vice versa. These exchange platforms also let the seller set their own bitcoin prices.

As of this writing, there are a number cryptocurrency exchanges in the Philippines: *Coins.pro (formerly known as CX), Citadax, and PDAX. They have order-book style platforms similar to stock exchanges where users can set their own prices. Filipinos can also access international exchanges like Binance and OKEx.

Bitcoin to Php Converter

(Update: Currently not available) A BTC to PHP converter will let you check the price of bitcoin to PHP and vice versa. It is by Cryptocompare and you can either put the amount of bitcoin or Philippine fiat and it will convert the amount to either one. Using it is fairly easy. Just input an amount on either the I give ___ BTC or I get ___ PHP. We would recommend that if you will use PHP to bitcoin, start with at least 5,000 PHP as the BTC amount will only show up to two decimals and won’t include the additional Satoshis.

You can easily check the price of 1 BTC to PHP by simply putting in 1 on the BTC tab and wait for it to compute the PHP price. Using this converter will give you an idea of the total amount of bitcoin or PHP that you’ll get whenever you trade.

Bitcoin to Php

(Update: Currently not available) This chart will let you see the bitcoin movement in terms of 1 day, 1 week, 1 month, 3 months, 1 year, and All. You have three options; you can either view it on a Line, Candle, or OHLC (open-high-low-close chart). It will also let you choose between USD or PHP.

What is the difference in using the Line chart, Candle, or OHLC?

The line chart is best used if you want to do a high time-frame analysis, for example, 1 month. This will let you easily view, analyze the market flow, the exchange rates, and see the trend.

Candlestick chart is more detailed, since it shows the opening, high, low, and closing of prices at a specified period. This is unlike the Line chart that only plots a price in a specified time frame. In addition, the green candle means the price went higher than it opened during that period and the red candle means vice versa.

OHLC, on the other hand, is almost the same as the Candlestick chart as it also shows the open, high, low, and closing prices. This time, it shows horizontal lines and vertical lines. Horizontal lines extending to the left is the opening price, horizontal price extending to the right is the closing. Vertical lines will show you the volatility of the price, with high being high and low being low.

If you will also notice, the USD and PHP charts are slightly different. This is because these two are not direct conversions. The data from the PHP chart is from LocalBitcoins, Quoine, and Remitano. USD chart data, on the other hand, is from Bitfinex, GDAX, Bitstamp, Simex, and itBit.

Just in case you weren’t able to see the chart, kindly refresh the page. If it still didn’t show, open a new tab and go to cryptocompare.com and then go back to this page.

Why a BTC to Php Rate is useful

Whenever you want to buy or sell bitcoins with Philippine Peso, it is first recommended that you check out the conversion rate first. When you do this, you will have a general idea of the following:

- How much you want to get in Bitcoin

- How much Bitcoin you will get based on the amount of Php you want to invest

Knowing the above details will let you know how much money is on top of what you will pay when you buy or sell on Bitcoin Sites.

Buy BTC with Credit Card

Binance offers a seamless exchange of over 100 cryptocurrencies and will let you purchase bitcoin using credit card. However, the general advice is to only use funds you already have instead of purchasing BTC with credit card.

PDAX

Philippine Digital Asset Exchange (PDAX) also allows anyone to use credit card when buying Bitcoin. Check out this page to know more.

Buy BTC with USDT

You can do this with Binance and even PDAX.

Buy (or Sell) BTC

The Philippines is one of the countries in the world that has very supportive regulators that are embracing the technology and at the same time regulating it to protect its users. Currently, there are various ways to buy or sell BTC.

- Coins.ph – The leading cryptocurrency wallet and exchange in the Philippines. It is the first to receive the BSP’s Virtual Currency Exchange License on September 2017. As of this update, it has PHP, BTC, ETH, BCH, and XRP in its wallet.

- Binance – It is one of the largest cryptocurrency exchange platforms in the world. It has 152 BTC pairings, 148 ETH pairings, 76 BNB pairings, and 19 USDT pairings.

For a list of sites where you can purchase BTC in the Philippines, check out our article:

Also, check out where the recommended Bitcoin wallets.

Why is bitcoin volatile?

There are a lot of reasons why the price of bitcoin is volatile but the majority of it is supply and demand. The “price discovery” occurs between the current supply of sellers versus the demand from buyers. It is no doubt that the price of this token is susceptible to the early adopters and miners of the coin, also known as, whales.

One of the biggest whales is the token’s founder himself, Satoshi Nakamoto, who owns around 4.75% of the total 21 million bitcoin, this is around 1 million bitcoins. If he dumped his total number of BTC in the market, it will have a supply overflow and its price will crash. However, a rational individual will distribute his tokens overtime to not have a devastating price impact.

Miners, however, collectively can earn 900 BTC a day. A portion of this will cover their electricity expenses which can amount to 500,000 USD a day. The remaining BTC will then get converted to USD.

According to Google Trends data, the price of bitcoin and its demand are closely related. A good example is what happened last year in 2017. When bitcoin reached around 10,000+ USD, the media picked it up and uninformed speculators or FOMOs joined the bandwagon and helped reach its 17,900 USD peak. It became an inflation that leads to a bubble then a crash.

There are other reasons for bitcoin volatility such as banking blockades, fiat currency crises, market manipulation and more.

Is BitPinas advocating buying cryptocurrency?

It’s true that while bitcoin is initially majorly to be used initially as a mode of payment as per whitepaper, many have started to see it as a store value of wealth. According to blockchain enthusiast and cryptocurrency pioneer, Mr. Brock Pierce, the simplest way to understand blockchain and away from its intimidating jargons is to use its readily available cryptocurrency.

He said that just like the internet, it needs usage in order to be understood, and a great way to do it is through cryptocurrency.

It is also a fact that most Filipinos are unbanked or don’t have enough documents or funds to open a bank account. Using cryptocurrency and blockchain will help in financial inclusivity and will let its users feel a certain inclusion.