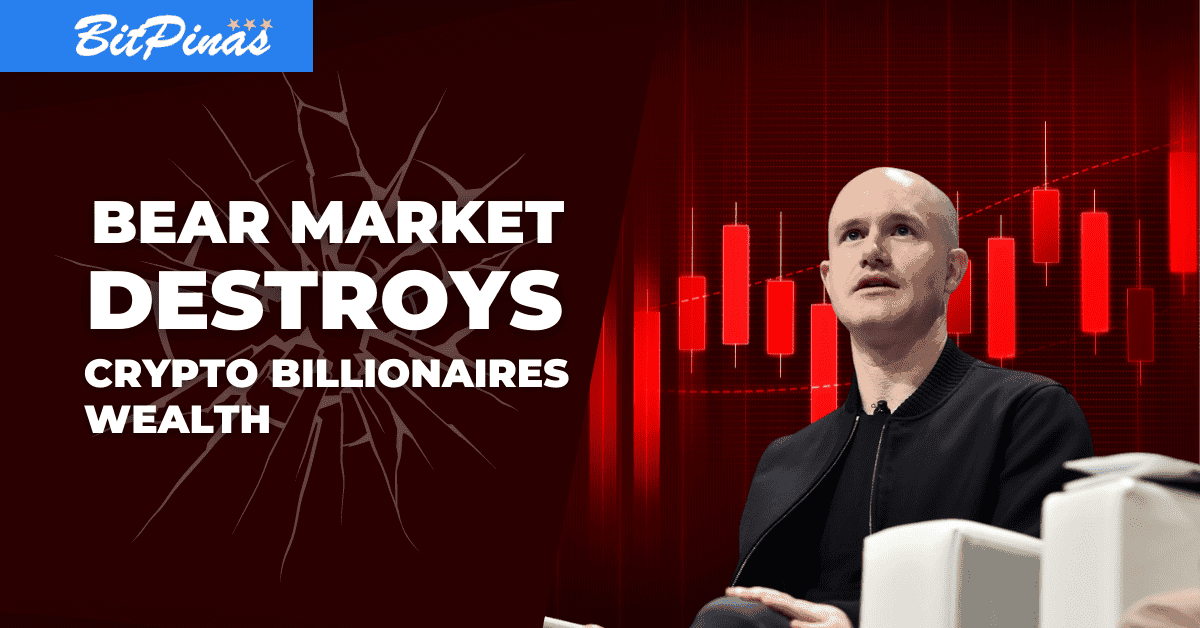

Bear Market Destroys Crypto Billionaires Wealth

As the bear market arrives, many of the wealthiest people in crypto see their fortunes dissolved in a matter of days.

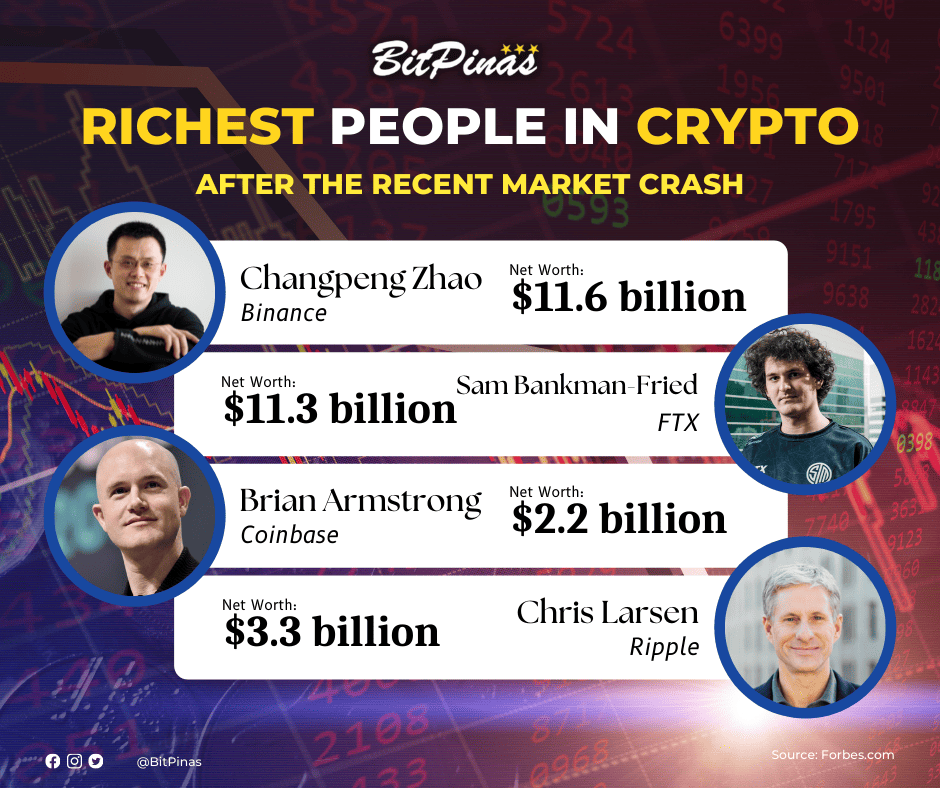

Following the continuous dip of cryptocurrency value and steady decline of trading volumes at Coinbase, its CEO Brian Armstrong’s net worth has dropped by over 84%, now $2.2 billion from his previous personal fortune of $13.7 billion in November.

Despite being the largest US cryptocurrency exchange, Coinbase was not safe from a selloff in digital currencies from Bitcoin (BTC) to Ether (ETH) which triggered a steep decline in the market value of the exchange. (Read more: Why Did USDT, UST, and LUNA Crash?)

From their first day of trading in April 2021 until May 13, the firm’s shares have recorded a collapse of 82% with a current value of $58.50 (approximately ₱3,000). Armstrong’s personal fortune has fallen alongside Coinbase’s shares; he owns about 16% of the company’s stock.

The value crash occurred after the company issued an advisory that trading volume and monthly transacting users were expected to be lower in the second quarter of the year than in the first. Following this, questions and doubts were raised about Coinbase’s ability to withstand the sharp decline in crypto prices. (Read More: It’s Here! What Should I Do During Bear Market?)

Armstrong answered this in a tweet defending the company. Despite the “blackswan” event, he explained that funds are safe “as they’ve always been.”

“We have no risk of bankruptcy, however, we included a new risk factor based on an SEC requirement called SAB 121, which is a newly required disclosure for public companies that hold crypto-assets for third parties.” –Brian Armstrong, Coinbase CEO

Aside from Armstrong several other crypto billionaires’ net worth also plummeted after the Bitcoin plunge.

Sam Bankman-Fried, the founder and CEO of crypto exchange FTX, has lost roughly half of his on-paper fortune since March and is now worth about $11.3 billion.

The twins Cameron and Tyler Winklevoss, founders of the crypto marketplace Gemini, have lost about 40% of their respective fortunes. They each lost more than $2 billion.

The fortune of Michael Novogratz, CEO of crypto merchant bank Galaxy Digital, also decreased to $2.5 billion, from $8.5 billion in early November.

Apparently, Binance CEO Changpeng Zhao appears to have suffered the worst losses which declined to an estimated $11.6 billion from his $96 billion net worth in January.

On the other hand, after the Bitcoin dip, cryptocurrencies USDT, UST, and LUNA also plunged and in a newsletter, BitPinas senior editor Michael Mislos explained what happened to these cryptocurrencies. (Read more: Newsletter: What happened to USDT, UST, and LUNA | May 12, 2022)

Interested in learning more about cryptocurrencies? Read more of our articles on the BitPinas website.

This article is published on BitPinas: Bear Market Destroys Crypto Billionaires Wealth

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.