XLD Finance to Enable Financial Access Through Crypto, Raises $13 Million

XLD Finance offers crypto-based payments, disbursements, and crypto-to-fiat offramp APIs

Borderless Web 3 infrastructure startup XLD Finance announced that they have successfully raised $13 Million in a pre-Series A funding round led by investment firms Dragonfly Capital and Infinity Ventures Crypto. XLD is a borderless decentralized ecosystem providing financial tools among emerging economies.

“People in emerging economies often encounter barriers that prevent them from creating financial accounts, paying for goods and services without their physical presence, sending money to loved ones cheaply, accessing affordable credit, and building a savings portfolio, hindering them from experiencing a better quality of life. I want to see a future where anyone with a mobile phone or computer and internet access can use “bank-like” financial tools through their favorite DeFi protocol or exchange,” says Ian Estrada, XLD Finance Co-founder and CEO.

XLD will use the acquired funds to scale its product and engineering teams and accelerate its API and product development efforts. The company will also utilize the investment to expand its network of licensed partner financial institutions and expand its merchant and biller network.

“We believe in XLD’s vision to deliver infrastructure that provides financial inclusion in emerging markets. Through blockchain and decentralization, there exists an opportunity to solve the very real global challenge of financial access with less complexity; XLD’s blockchain-based products will become as relevant as more traditional options,” says Brian Lu, Founding partner of Infinity Ventures Crypto

The investment round had the participation of Advance AI, Circle, Digital Currency Group (DCG), IDG Capital, Insignia Venture Partners, Integra Partners, Morningstar Ventures, Openspace Ventures, Sfermion, Shima Capital, Transcend Fund, TrustToken (TUSD), UOB Venture Management, Woo Network, Yield Guild Games (YGG), YOLO Ventures, Emfarsis, and twenty other investors.

XLD offers core products including crypto-based payments, disbursements, and crypto-to-fiat offramp APIs which allows web3 and crypto projects to offer tools to their users typically available only to traditional financial institutions. While its fintech arm, XLD Finance, currently serves customers in the Philippines, Indonesia, Malaysia, Vietnam, India, and Bangladesh, with a total merchant network of over 10,000 and growing.

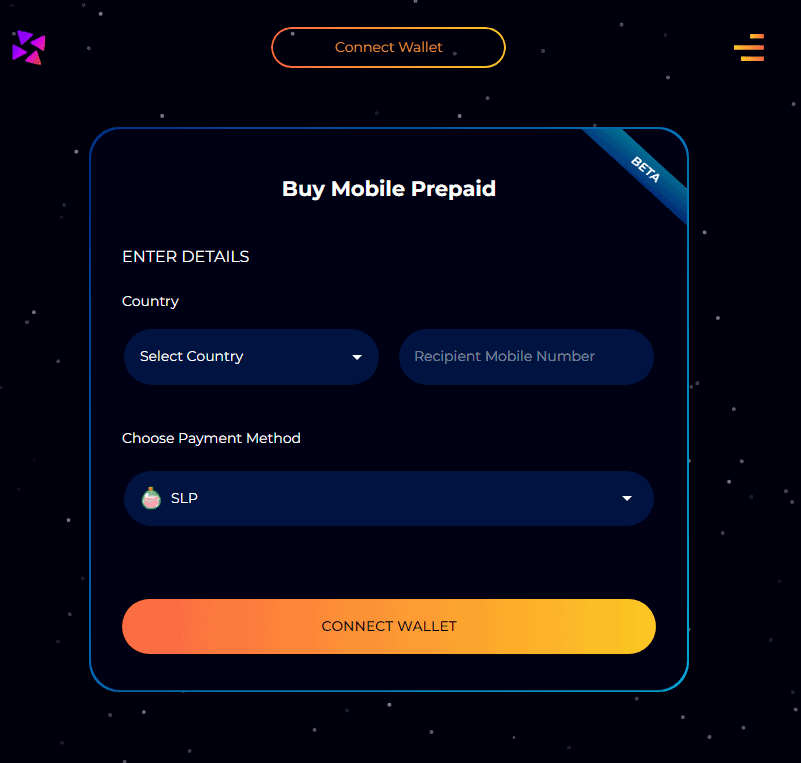

Prior to the funding round, the firm launched its first ecosystem project, xSpend, last January. It is a platform that enables users to spend their GameFi tokens and stablecoins to pay for utility bills, buy mobile credits, and purchase goods and services using only their Metamask, Phantom, or Ronin wallet.

This month, XLD Finance is set to launch OmniX, a crypto disbursement platform that simplifies crypto disbursements allowing guilds and projects to pay thousands of people with crypto in three clicks.

Aside from these launches, XLD Finance’s roadmap plots a release for a crypto settlement API for merchants, an algorithmic stablecoin, and a web3 wallet Software Development Kit (SDK).

This article is published on BitPinas: XLD Finance Raises $13 Million to Enable Financial Access Through Crypto

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.

![[Exclusive] COMELEC SPOX Warns: Vote-buying Using Crypto is Election Offense 8 [Exclusive] COMELEC SPOX Warns: Vote-buying Using Crypto is Election Offense](https://bitpinas.com/wp-content/uploads/2022/04/FEATURED-PART-2-2-1-768x402.png)