Bitcoin Miners Roughly Sold Everything They Mined in 2022

Out of 40,700 $BTC mined by public miners from January 1 to November 30 this year, 40,300 $BTC were sold, Messari’s Tom Dunleavy revealed.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

- Publicly listed Bitcoin miners have sold nearly all of the BTC they mined throughout 2022, putting downward pressure on the price of the cryptocurrency.

- The cost of mining BTC increased by 20% this year, which may have contributed to the decision to sell off newly produced Bitcoin.

- Reserves held by mining firms have also decreased significantly following the collapse of FTX in November.

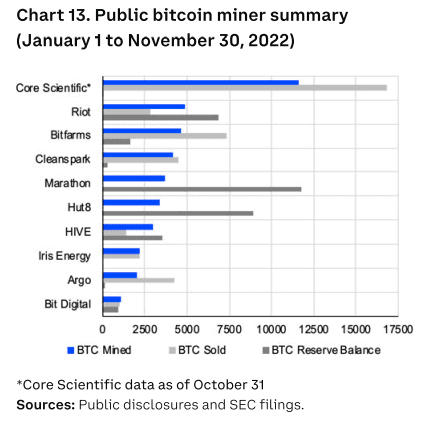

In a chart shared by analyst Tom Dunleavy from blockchain research firm Messari, the data showed that publicly listed Bitcoin miners have sold almost all of the $BTC they mined throughout the year.

As per the data, approximately 40,300 of the 40,700 BTC mined by public miners such as Core Scientific, Riot, Bitfarms, Cleans Park, Marathon, Hut8, HIVE, Iris Energy, Argo, and Bit Digital from January 1 to November 30 were sold off.

However, the results also suggest that these entities appear to have started accumulating reserves once again.

According to Dunleavy, the action of miners to consistently sell off newly produced Bitcoin places downward pressure on the price of Bitcoin—the largest cryptocurrency by market capitalization.

In a reply to his tweet, digital assets researcher AJ Medina shared that the sell-off might be because of the increase in the cost of mining BTC, which according to him, went up to 20%.

Moreover, it is also worth noting that, following the collapse of FTX last month, the reserves held by mining firms have decreased considerably. The FTX crash happened after a significant hole in its balance sheet was revealed by crypto publication Coindesk.

Where after the massive withdrawals on the exchange, FTX filed for bankruptcy on November 11. Currently, its founder and former CEO, Sam Bankman-Fried, is under investigation in the United States. (Read more: FTX Update: SBF Extradited and Released on Bail, Ellison and Wang Plead Guilty)

Consequently, according to The Block’s Data Dashboard, the daily spot market trading volume for cryptocurrency exchanges has fallen below $10 billion for the first time since December 17, 2020—the same time the price of bitcoin surged past $20,000 for the first time. (Read more: —)

Currently, as per the data from CoinGecko, BTC is trading at $16,646.97—a 75.9% decrease from its all-time high of $69,044.77 on November 10, 2021.

On April 1, 2022, BTC reached a total of 19 million minted token milestones, leaving two million Bitcoin to mint until the maximum supply set of 21 million. (Read more: Bitcoin Hits 19 Million Milestone; Only 2 Million Left to Mine)

This is not the only effect of the crypto winter in the industry, the report from financial data platform Token Terminal revealed that the number of daily active developers working on top blockchains and decentralized applications (dapps) has decreased by approximately 57% this year. Bitcoin currently has 18 active developers. (Read more: Report: Active Crypto Developers Decreased by Nearly 60% in 2022)

However, another report says otherwise for the non-fungible token (NFT) space as it predicts that the market is expected to grow in the next few years, reaching around ₱143.2 billion (US$2598.3 million) by 2022 and is set to increase and reach US$12796.4 million (~₱705 trillion) by 2028. (Read more: Despite Bear Market, A ₱140B Growth in NFT Industry is Expected — Report)

This article is published by BitPinas: Known Bitcoin Miners Roughly Sold Everything They Mined in 2022

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.