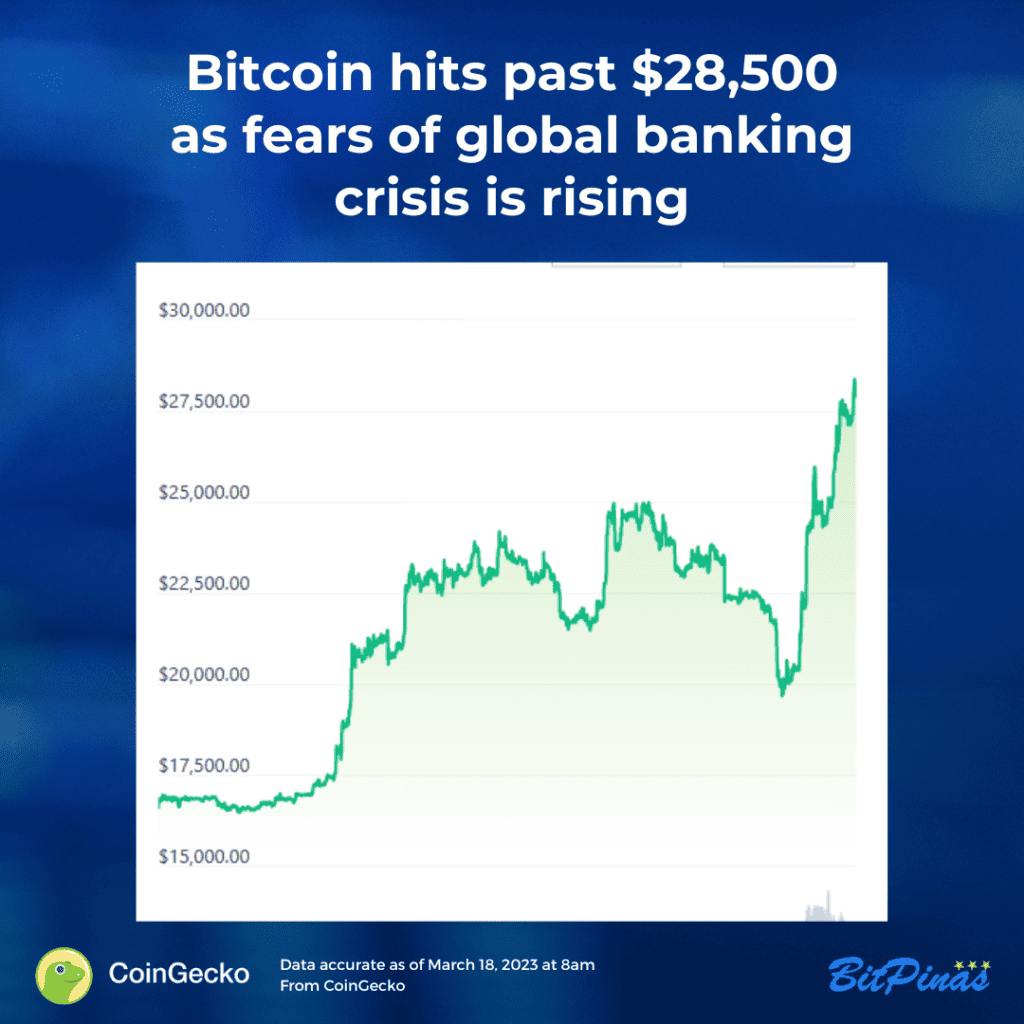

News Bit: Bitcoin Soars to $28,000 Amid Global Market Chaos and Bank Liquidity Crisis

Bitcoin breaks the $28,000 barrier for the first time since June 2022, as global markets face turmoil from bank failures and inflation concerns.

Subscribe to our newsletter!

Price data are accurate as of March 20 at 8:00 am (UTC+8).

Bitcoin Price Reaches $28,000 Amid Market Turmoil

What is the price of Bitcoin?

The price of Bitcoin has surged past $28,000, marking its highest level in 9 months, as turmoil in global markets continues to unfold. As of writing, the leading cryptocurrency is trading at $28,063, with its highest point during the day at $28,509.

Since the beginning of the year, Bitcoin’s price has risen nearly 70%.

Events influencing Bitcoin’s price increase

In the past few weeks, events in the United States have greatly affected the price of Bitcoin and the crypto market.

The U.S. banking sector has been experiencing chaos, with banks such as Silvergate, Signature Bank, and Silicon Valley Bank facing shutdowns and regulatory takeovers.

- No Local Bank Affected by Silicon Valley, Silvergate, Signature Bank Collapse—BSP

- US Silvergate Bank is Latest Victim of Crypto Meltdown

In Europe, UBS Group purchased Credit Suisse for $3.2 billion, a 73% discount on its closing price, while the Swiss National Bank offered $100 billion in liquidity as part of the deal.

Furthermore, concerns about inflation have intensified as the Consumer Price Index (CPI) was more than expected, leading some investors to call on the U.S. Federal Reserve to pause interest rate hikes.

Why these events caused Bitcoin’s price to increase

The uncertainty in the financial world has driven investors to seek alternative assets like Bitcoin as a hedge against inflation and market volatility. David Martin, head of institutional coverage at digital asset prime brokerage FalconX, stated, “In this instance, we are definitely seeing people look to Bitcoin”.

Bitcoin outperforms traditional assets

Bitcoin’s market capitalization has added $194 billion in 2023, representing a 66% gain year-to-date, outperforming Wall Street banks stocks and rising about 65% versus the S&P 500’s 2.5% gains and Nasdaq’s 15% decline.

The digital asset has also shown resilience amid internal strife, such as USDC losing its peg with the dollar, and the US Securities & Exchange Commission increasing scrutiny on digital assets.

Price levels to watch out for

As Bitcoin continues to rise, former Coinbase CTO Balaji Srinivasan claimed on Twitter that an impending global banking crisis could take the cryptocurrency to $1 million within less than 90 days. This, according to him, would be triggered by a US banking crisis, leading to the American dollar deflation and a subsequent hyperinflation scenario.

This article is published on BitPinas: News Bit: Bitcoin Soars to $28,000 Amid Global Market Chaos and Bank Liquidity Crisis

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.