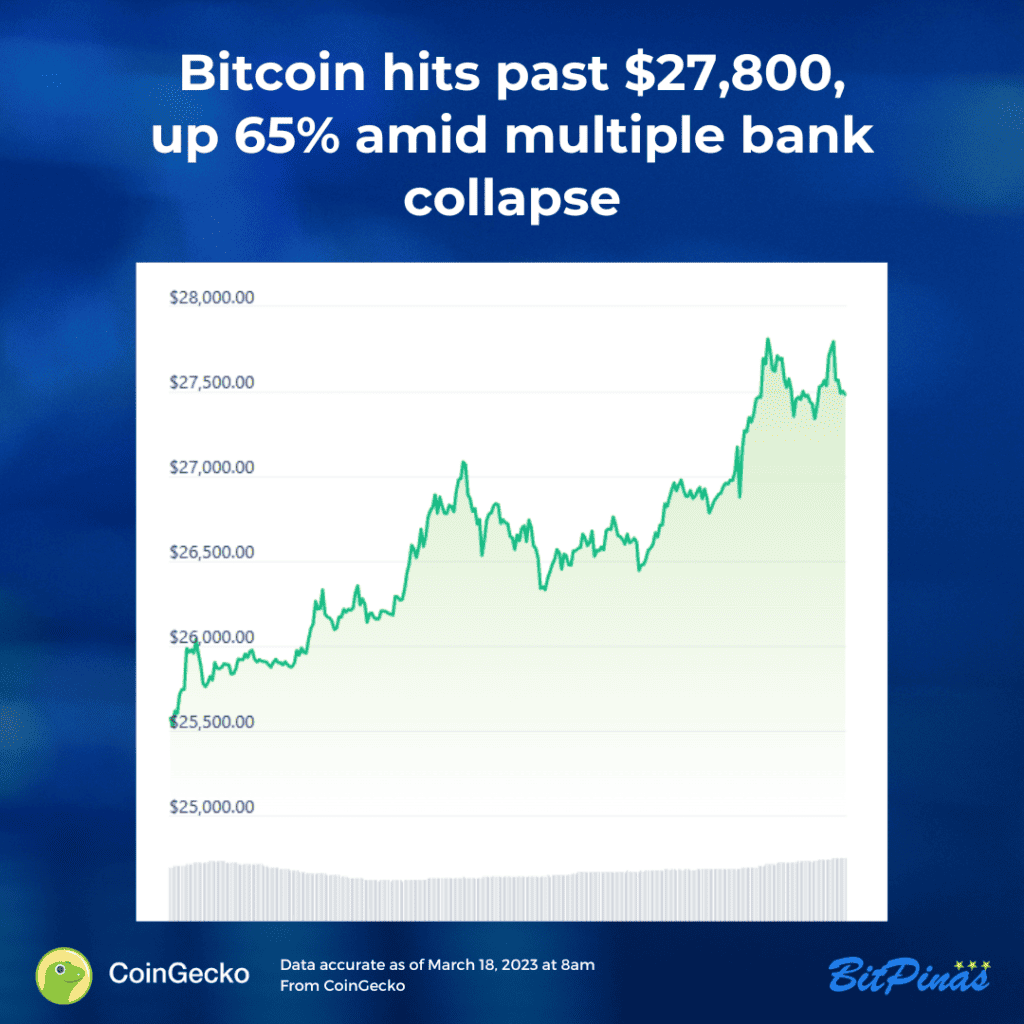

News Bit: Bitcoin Hits Past $27,800, Up 65% Amid U.S. Banking Crisis

Bitcoin reaches a 9-month high, closing at $27,467, driven by a banking crisis in the United States and issues with multinational banks like Credit Suisse. Analyst Markus Thielen sets the next price target for Bitcoin at $28,000 as the cryptocurrency gains momentum amid the ongoing banking crisis. Price data are accurate as of March 18…

Subscribe to our newsletter!

- Bitcoin reaches a 9-month high, closing at $27,467, driven by a banking crisis in the United States and issues with multinational banks like Credit Suisse.

- Analyst Markus Thielen sets the next price target for Bitcoin at $28,000 as the cryptocurrency gains momentum amid the ongoing banking crisis.

Price data are accurate as of March 18 at 8:00 am (UTC+8).

What is the price of Bitcoin?

Bitcoin reached as high as $27,800 before closing Friday at $27,467, which is an impactful 9% increase from the previous day ($25,161). So far Bitcoin is up 36% over the last seven days, and 65% since the beginning of the year.

This is a 9-month high for the largest cryptocurrency by market capitalization.

Here’s what happened so far:

- The Bitcoin rally is being fueled by the banking crisis playing out in the United States as well as on multinational banks like Credit Suisse.

- With the collapse of Silicon Valley Bank and Signature Bank, the U.S. Federal Reserve provided a $297 billion emergency to make sure their collapse will not hurt the U.S. economy.

- Another financial institution – First Republic Bank – will be rescued by U.S. lenders, including major banks, to the tune of $30 billion. First Republic Bank’s customers are mostly wealthy individuals.

Check some of this articles to catch up:

- What happened to Credit Suisse

- US Silvergate Bank is the Latest Victim of Crypto Meltdown

- What happened to Silicon Valley Bank

- Why Signature Bank failed

Why did these events cause the Bitcoin price increase?

During uncertainty, Bitcoin has historically been viewed as a safe haven and store of value, and because of the nature of the blockchain, it is viewed more favorably as a place where people can still take their money out in the events of financial crises. This is one reason why Bitcoin is popular in countries with very volatile national currencies, where people cannot immediately take out money from their banks, the irony is crypto is volatile as well.

“Bitcoin’s price has rallied on speculation that stress among U.S. and European banks will open people’s eyes to the leading cryptocurrency’s censorship-resistant, intermediary-free qualities.” Coindesk noted.

Liquidity has been the major concern so far for market participants. According to Arthur Hayes, the former CEO of BitMEX, the more central banks rescue banks and add more liquidity, the better for crypto.

“The ensuing Bitcoin rally will be one of the most hated ever. How can Bitcoin and the crypto markets in general rally sharply after all the bad things that happened in 2022?” he noted.

The latest crypto headlines

- Bitcoin Profit-Taking Transfers Spike As BTC Breaks $27,000

- Polygon Partners With Salesforce for NFT-Based Loyalty Program

- OpenAI’s GPT Is Helping Turn Text Into Custom Metaverse Worlds

- Coinbase Considers Overseas Crypto-Trading Platform Amid Regulatory Challenges

Bitcoin price level to watch out for

According to Markus Thielen, analyst and author of “Crypto Titans”, the next target is $28,000:

This article is published on BitPinas: News Bit: News Bit: Bitcoin Hits Past $27,800, Up 65% Amid U.S. Banking Crisis

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.