News Bit: USDC Depegs From One Dollar

What Happened Circle Internet Financial’s USDC stablecoin, the second-largest stablecoin with a market cap of $42 billion, temporarily lost its peg to the U.S. dollar due to contagion from the collapse of Silicon Valley Bank. The USDC/USDT trading pair dropped as low as $0.94 on Kraken, the lowest price since April 2021, but recovered to…

Subscribe to our newsletter!

What Happened

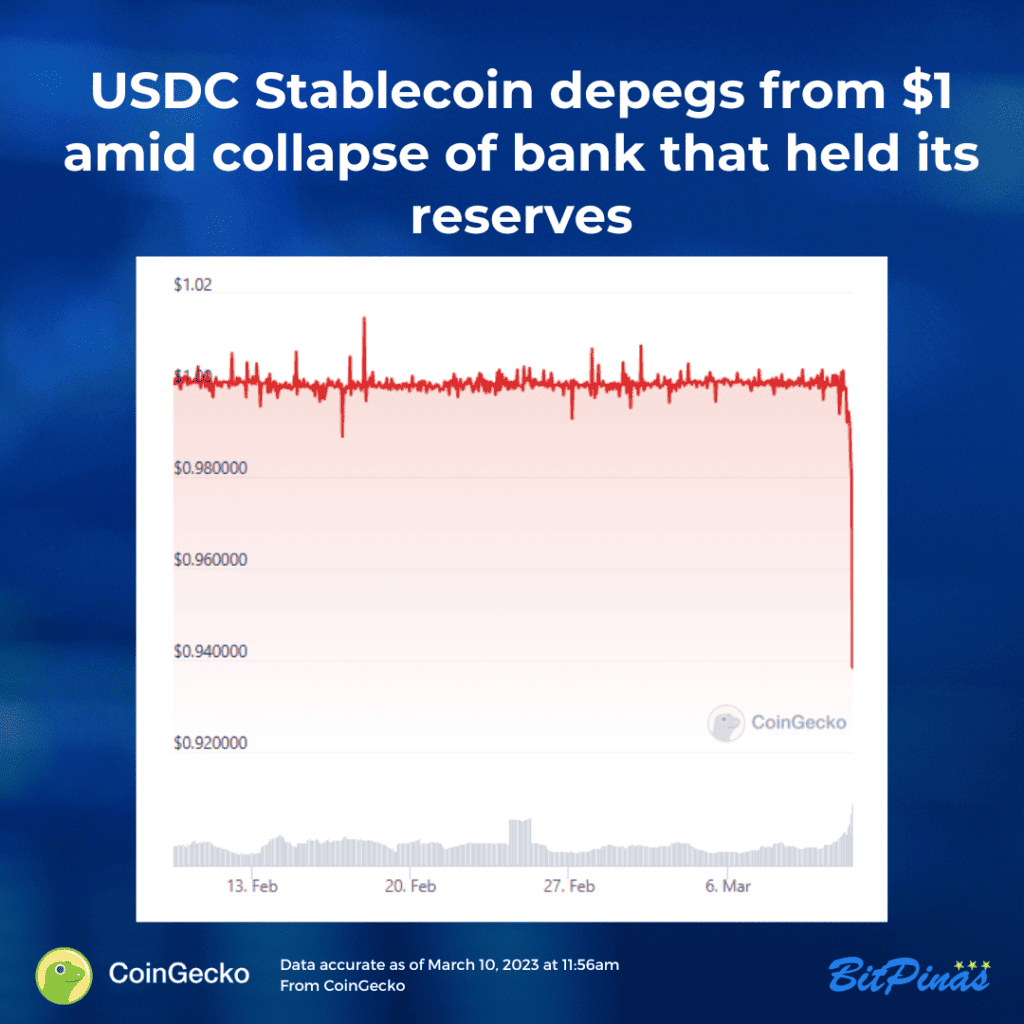

- Circle Internet Financial’s USDC stablecoin, the second-largest stablecoin with a market cap of $42 billion, temporarily lost its peg to the U.S. dollar due to contagion from the collapse of Silicon Valley Bank.

- The USDC/USDT trading pair dropped as low as $0.94 on Kraken, the lowest price since April 2021, but recovered to around $0.984 on Saturday.

- Some of USDC’s cash reserves were parked at Silicon Valley Bank, which was shut down by regulators on Friday after suffering a run on deposits.

- Circle said that $3.3 billion in cash deposits remained at Silicon Valley Bank, representing about 8% of the total reserves backing USDC.

Role of USDC

- Concerned investors redeemed over $1 billion of USDC tokens on Friday, causing the stablecoin to temporarily lose its dollar peg on some exchanges and pushing the largest stablecoin swap pool on Curve into heavy imbalance.

- Stablecoins like USDC are a crucial part of the crypto industry’s foundation, and when they deviate significantly from their peg, it raises concerns about their financial footing.

Zooming out – What happened to Silicon Valley Bank

- Silicon Valley Bank collapsed on Friday, March 10th, 2023, following a bank run and a capital crisis, which resulted in the second-largest failure of a financial institution in US history.

- The FDIC took control of the bank and will liquidate the bank’s assets to pay back its customers, including depositors and creditors.

- The wheels started to come off on Wednesday when SVB announced it had sold securities at a loss and would sell new shares to shore up its balance sheet.

- Key venture capital firms reportedly advised companies to withdraw their money from the bank, triggering a panic.

This is a developing story.

This article is published on BitPinas: News Bit: USDC Depegs From One Dollar

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.