Solana DeFi Platform SOLEND Approves Whale Wallet Takeover, Raising Fears About ‘Decentralization’

With the successful governance vote, Solend Labs was granted “emergency powers” to liquidate the whale’s vulnerable assets.

The users of Solend, a Solana-based borrowing and lending service with over $1 billion in deposits, have voted yes to a governance proposal to force a takeover of the protocol’s largest account. According to Solend contributors, the whale account’s “extremely large margin position” was getting dangerously close to a catastrophic on-chain liquidation cliff; the take over will allow the funds to be withdrawn instead of automatically liquidated on the open market.

“Despite our efforts, we’ve been unable to get the whale to reduce their risk, or even get in contact with them,” the proposal wrote. “With the way things are trending with the whale’s unresponsiveness, it’s clear action must be taken to mitigate risk.”

Abruptly launched on June 19, the Solana DAO governance proposal, dubbed “SLND1 : Mitigate Risk From Whale,” was closed with a 97% approval rating. Disturbingly, the Solend users have reportedly been incentivized to vote with “50K SLND distributed proportionally among voters through an airdrop.”

With the successful governance vote, Solend Labs was granted “emergency powers” to liquidate the whale’s vulnerable assets—around $20 million in SOL—through over-the-counter (OTC) trades instead of decentralized exchanges if the price of SOL drops too low.

According to SolendLabs, the on-chain liquidation of the whale’s assets “could cause chaos” in Solana’s DeFi markets. They noted that liquidating via an OTC service would likely avoid such an outcome.

However, the governance vote and the takeover bypasses the De-Fi and smart contract–coded protocol Solend programmatically follows for every other borrower liquidation. (Read more: Decentralized Finance 101 | DeFi Guide)

While some disagree, there are also those that see Solends actions as a radical choice.

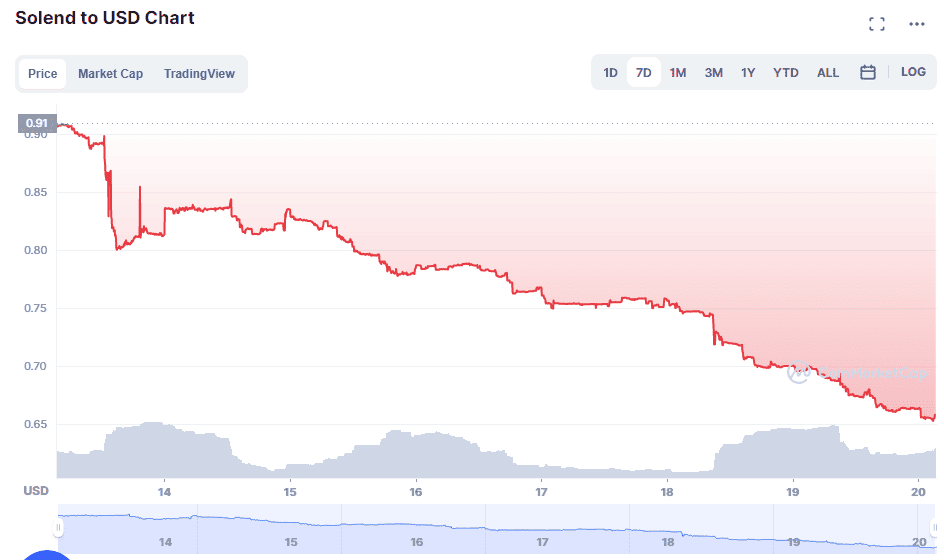

These worries have roots from the on-going bear market and the liquidation debacle of Three Arrows Capital. (Read more: CryptoCrash: ETH, YFI, KP3R. DeFi Coins Down by 90% as Bear Market Humbles Everyone)

Accordingly, big crypto firms are also trying to mitigate the effects of the market slide by laying off a fraction of their workforce. Cryptocurrency entities Coinbase, Gemini, BlockFi, and Crypto.com decided to let go of employees.

Coinbase reduced its workers by 18%, which totals to almost 1,100 people affected. Crypto platform Gemini also laid off 10% –100 employees– of the employees while BlockFi, a platform for trading and lending cryptocurrency, announced via a blog post that it laid off 20% of its 850 employees — around 170 to 200 people and Crypto.com laid off around 260 workers, or around 5 percent. (Read more: What Layoffs? What Crypto Winter? Binance is Hiring 2,000 People)

This article is published on BitPinas: Solana DeFi Platform SOLEND Approves Whale Wallet Takeover, Raising Fears About ‘Decentralization’

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.