Binance CEO Urges Regulators to Let Crypto Industry Mature Before Imposing Boundaries

Binance CEO emphasizes the need for active engagement and understanding the differences between crypto and traditional finance.

Subscribe to our newsletter!

Editing and Additional Reporting by Nathaniel Cajuday

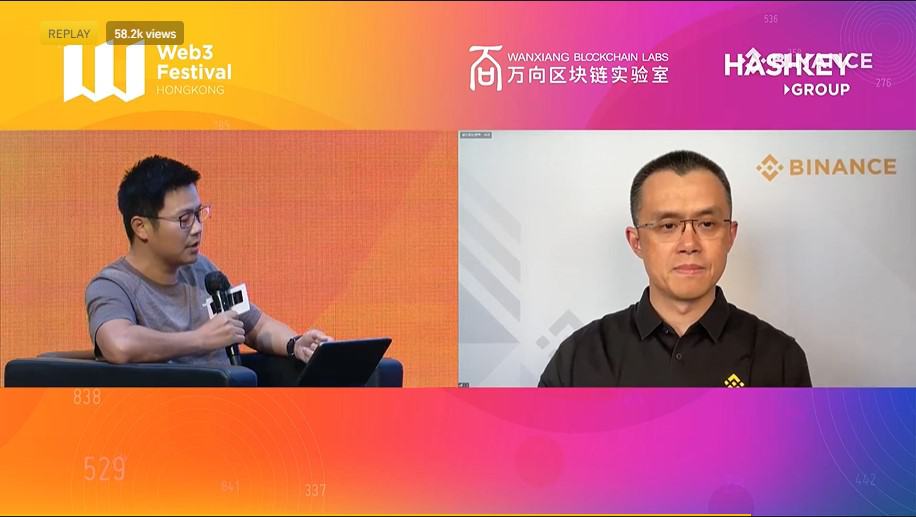

- Binance CEO Changpeng Zhao, during a fireside chat at the Hong Kong Web3 Festival, urged regulators to wait for the crypto industry to fully develop first before imposing a regulation because it is different from the traditional finance industry.

- Crypto, Zhao said, as a digital asset, may look like securities, others like commodities or utility tokens, and some may even have a combination of those characteristics.

- Zhao also talked to crypto natives and said that the crypto industry should have active engagement with regulators because regulators that are trying to control crypto may, in fact, help grow its adoption.

During the fireside chat hosted by HashKey Capital CEO Deng Chao at the Hong Kong Web3 Festival, Changpeng “CZ” Zhao, the CEO of global cryptocurrency exchange Binance, stressed that it is best to let the industry develop fully before regulators decide the boundaries of the industry because, while there may be a “very natural tendency” for regulators to apply guidelines from the traditional financial industry to crypto, the crypto industry is different and still in its early stages of development.

“Having no regulatory clarity is the worst. Having bad, restrictive regulations is better than that… and then having unclear ones and then chasing people by enforcement is really, really bad,” he explained during the Web3 Festival. (Zhao’s interview begins at 1:25:00 of this video.)

Crypto Industry Should Connect with Regulators

According to Zhao, many current regulators around the globe are “very acceptive,” while some are “still skeptical.” But for him, it is just fine, but “we need to have conversations, and we also need to have patience.”

This is where the Binance Chief emphasized the need for the crypto industry to have active engagement with regulators because regulators that are trying to control crypto may, in fact, help grow its adoption:

“They are trying to control crypto by shutting down banks, shutting down fiat access, putting more restrictions on the traditional financial markets, which actually pushes more people into crypto, which is doing the reverse of what they want to do.”

Zhao said the slow improvements in the traditional finance (tradfi) sector will push more people to use crypto transactions because they have lower transaction fees and are easier.

“If they want to keep people in the traditional financial markets, they will need to help lower fees, make transactions easier, and improve the user experience,” he clarified.

Regulators Should Consider that Crypto is Different from Banks and TradFi Industry

While financial regulators who have worked for banks have a better understanding of the traditional financial industry, Zhao pointed out that regulators often lack the experience and expertise to regulate digital assets as the crypto industry is still relatively new.

He also highlighted that regulators should realize that the crypto industry is different from the TradFi industry because crypto, as a digital asset, may look like securities, others like commodities or utility tokens, and some may even have a combination of those characteristics.

However, Zhao admitted that there are still bad players in the industry, doing scams and taking advantage of other people:

“There’s always nefarious players, scammers, etc., so we need to find ways to limit those guys.”

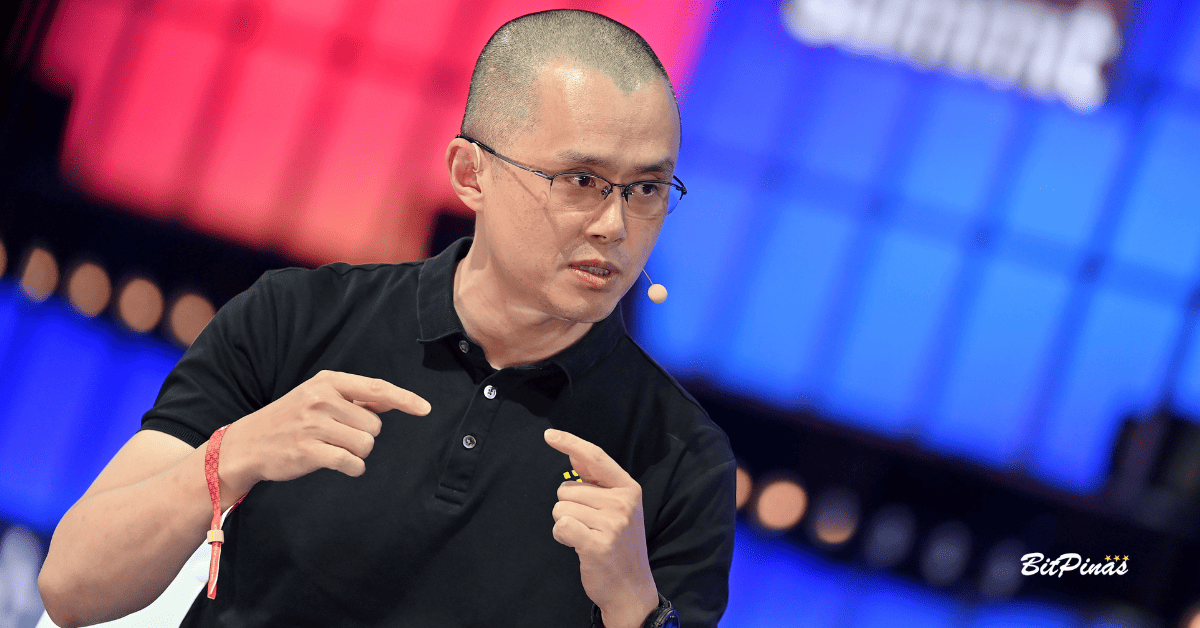

This is where the CEO further emphasized that Binance has been actively hiring compliance executives, registering its entities with regulators, and applying for licenses, indicating a significant change in tone compared to previous statements where he claimed Binance was a decentralized company with no headquarters.

Binance’s Relationship with Other Regulators

As of this writing, according to Binance, the exchange giant has secured licenses and registrations to operate in the following countries:

- France

- Italy

- Lithuania

- Spain

- Cyprus

- Poland

- Sweden

- Kazakhstan – Astana International Financial Centre (AIFC)

- Abu Dhabi Global Market (ADGM)

- Bahrain

- Dubai World Trade Center (DWTC)

- Australia

- Japan

- New Zealand

- South Africa

- Canada

- Mexico

However, last month, Zhao, Binance, and its Chief Compliance Officer (CCO), Samuel Lim, were sued by the U.S. Commodity Futures Trading Commission (CFTC) for allegedly encouraging their employees and customers to go around compliance controls. The CFTC also noted that Binance never registered with the U.S. federal agency in any capacity and has “disregarded federal laws.”

Zhao responded to the allegations and expressed his disappointment, pointing out that they have been cooperating with regulators such as the CFTC.

Earlier this month, the Australian Securities and Investments Commission (ASIC) also announced that it had canceled the Australian financial services (AFS) license of Oztures Trading Pty Ltd, the firm behind Binance Australia Derivatives.

Bloomberg also reported that the United Arab Emirates Virtual Assets Regulatory Authority (VARA) is asking Binance to submit more detailed information on its ownership structure, governance, and auditing procedures.

This article is published on BitPinas: Zhao to Regulators: Let Crypto Industry Fully Develop First to Be Regulated

Featured Image via Wikimedia

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.