What is the FATF Travel Rule on Cryptocurrency?

The Travel Rule states that countries must ensure that “…beneficiary VASPs (Virtual Asset Service Providers) must obtain and hold required originator information and required and accurate beneficiary information on virtual asset transfers and make it available on request to appropriate authorities.”

February 28, 2020 – In 2019, the Financial Action Task Force (FATF) has issued its directives that seeks to establish regulation to the cryptocurrency sector like how banks are regulated.

What if FATF?

As an international body tasked to promote measures against money laundering and terrorist financing, its paper “Guidance for a Risk-based Approach to Virtual Assets and Virtual Asset Service Providers” had gained notoriety for establishing rules that seems to be in contrast, in principle, to the very basis of why hold and use cryptocurrency in the first place. Simply put, many people are in favor of it and many as well do not see it as necessary.

The FATF guidelines is a long read, but right now, we focus on its key guideline, which is popularly called the “Travel Rule”

What are Virtual Asset Service Providers (VASPs)

FATF defined VASPs as any person or business that conducts any of the following activities on behalf of another person.

- exchange between virtual assets and fiat currencies (a fiat and virtual currency or asset exchange)

- exchange between one or more forms of virtual assets (exchanging one virtual asset to another virtual asset)

- transfer of virtual assets

- safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets

- participation in and provision of financial services related to an issuer’s offer and/or sale of a virtual asset.

The Travel Rule Clause:

The Travel Rule states that countries must ensure that “…beneficiary VASPs (Virtual Asset Service Providers) must obtain and hold required originator information and required and accurate beneficiary information on virtual asset transfers and make it available on request to appropriate authorities.” There is a requirement to disclose personal information for transactions that are equal or more than US$1,000

Also, the “originating VASPs must obtain and hold the required and accurate originator information and required beneficiary information on virtual asset transfers, submit the information to beneficiary VASPs and counterparts (if any), and make it available on request to appropriate authorities.”

The guidelines said “countries must,” which effectively means it is the responsibility of the countries to enforce this rule to the virtual asset service providers in their jurisdiction.

Requirements for Compliance

The Virtual Asset Service Providers (both the beneficiary and the originator) must share the following information:

- The originator’s name and account number

- The originator’s physical address or national identity number, customer’s identification number, or place/date of birth

- The beneficiary’s name and account number.

As an example, Dave wants to send some crypto worth US$1,000 from his wallet at a crypto exchange to Angelica on her mobile crypto wallet.

- The crypto exchange company must take note of Dave’s name (obviously), account number, physical address, national identity number, place and date of birth, customer’s identification number.

- The crypto exchange must also note the beneficiary’s name and account number.

- The crypto wallet company must also have the same details on their part.

… and make the above available upon request of authorities.

What Countries Must Comply With FATF:

The 39 official member countries and member countries of the 9 FATF-Style Regional Bodies). By the way, the Philippines is not an official member but a member country of the Asia/Pacific Group on Money Laundering, which is one of the FATF-Style Regional Bodies.

You will ask if this FATF recommendation is legally binding. It is not. However, it creates an expectation of future compliance. FATF is a very influential organization founded by the G7 around 30 years ago. The G20 countries and the United Nations fully support FATF in combating money laundering. Countries are expected to comply with FATF regulations. Period.

Technically, the FATF Guidelines are for the member countries to comply, and then the countries will make sure the virtual asset providers in their jurisdiction will comply.

Which means:

- If the country does not comply, the FATF might recommend that it gets listed in its BlackList, Graylist, or list of non-cooperative countries.

- If the Virtual Asset Service Provider like a crypto exchange does not want to comply, the member country may choose to kick it out of its jurisdiction or force a shutdown (alternative, the crypto company has the option to go somewhere else.) The country will bear the penalty and not the crypto exchange. As mentioned, FATF is a pretty powerful body, the country cannot afford to not follow its recommendations.

Countries and Virtual Asset Service Providers are expected to come up with solutions based on these recommendations by June 2020. Ahead of the deadline, Singapore, for example, announced its Payment Services Act, requiring crypto businesses to comply with the FATF rule.

What are the Hindrances for Countries to fully comply?

Blockchain, the technology behind cryptocurrency, is created in such a way that it does not need information (such as data) to be stored in order for transactions and/or data to be recorded. As such, many wallets and exchanges do not record this information. Also, if you are reading this site, you know just how much some people in the industry do not like government interference Now, upon imposition of the countries where they are based (which is upon imposition of FATF),the crypto company must record what is required by the international body.

What’s the Situation in the Philippines?

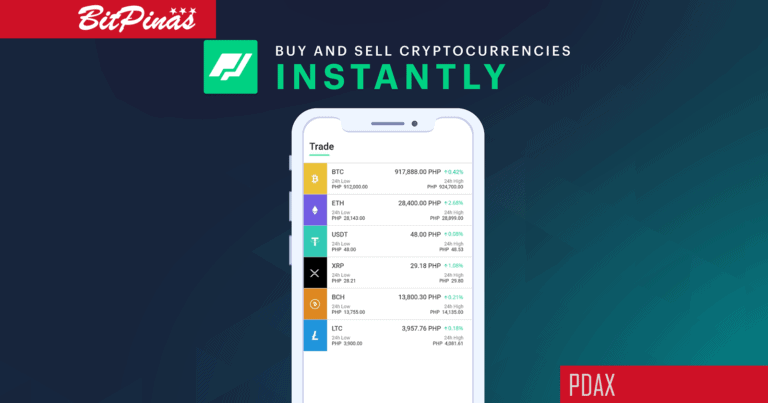

The Philippines has one of the most advanced crypto regulations globally. Circular No. 944 from the Bangko Sentral ng Pilipinas (BSP), requires licensed virtual currency exchanges to comply with anti-money laundering rules. This is the reason why wallets like Coins.ph, BuyBitcoin.ph, and PDAX have verification and tier limits. For example, if you want to transact $1,000, you must verify your identity, your address, etc. Check out our article below:

Also, the upcoming rules on digital assets and the formation of a cryptocurrency task force will take into account the FATF rules.

What’s the Situation in International Cryptocurrency Exchanges

For all intents and purposes, crypto exchanges are borderless. I can go to Binance or OKEx to transact even though I am not in the country where these exchanges are registered. Different exchanges have different ways of making sure they follow AML. They have different ways to verify identity through KYC, but most of the time, exchanges (at least, the ones I used) record your personal information and obtain a copy of atleast 1 of your national IDs. Of course, there are exchanges that don’t record this. There are also exchanges that allow you to transact freely and only ask you to provide ID once you reach a certain tier or transaction amount.

These exchanges and other Virtual Asset Service Providers as well as member countries will (or currently) work/working together so that there is a unified solution to adopt the FATF guidelines. Binance, for example, partnered with the Shyft Network to make sure its decentralized infrastructure will comply with the FATF rule.

This article is written by Mike Mislos for BitPinas: What is the FATF “Travel Rule” in Cryptocurrency?