Luis Buenaventura II: Number Go Up, But Not Always

You probably expect me to now instruct you all to HODL tight, Diamond Hands. At the risk of getting my crypto membership card revoked, I think what I’ll tell you instead is this …

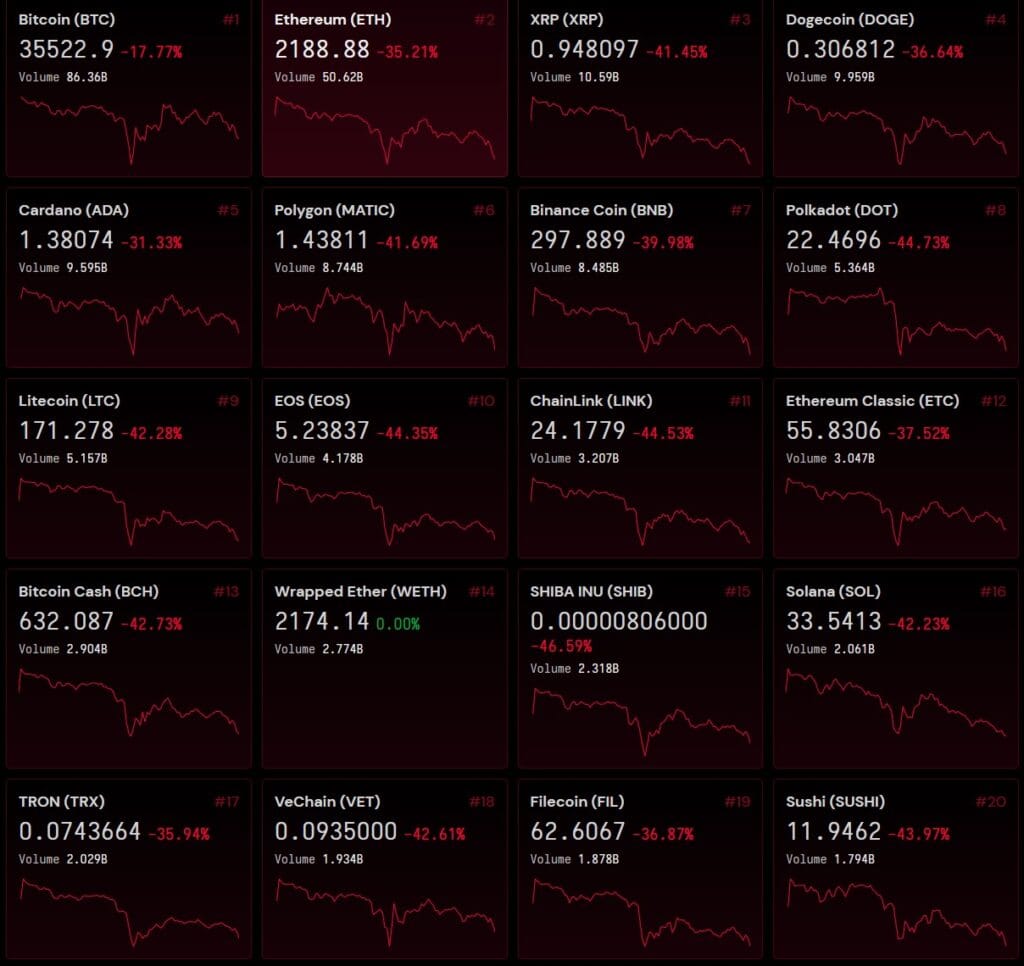

It’s Wednesday night as I begin writing this daily #crypto briefing. I’m slightly tipsy from some scotch that we LBC’d here to La Union and I’m at an overall energy level that echoes today’s crypto markets. $BTC began the day at an unconvincing $43,000, with $ETH not much better off at $3380. By dinnertime both had plummeted by nearly 20%, finally finding floors at $36,000 and $2400, respectively.

Both have just about erased their respective gains from recent months. Overall, the crypto marketcap shed about 25% of its weight yesterday, finally settling at $1.5T this Thursday morning. Bitcoin’s RSI is at 21 indicating that we’re well into the oversold territory now.

For those of you who have seen this before, salud! You probably don’t need to read the rest of this.

And for those of you who are just now witnessing their first big crypto crash, I hope you find this post useful.

My first big $BTC crash was on Sept 19, 2014. From $503, we all watched helplessly as it screamed all the way down to $375, setting 25% of our profits aflame in a matter of hours. The next one I remember was on Aug 18, 2015: $260 to $188, about 30% drop on that one.

The next one was Jan 16, 2016: from $430 to $360. Then Aug 2, 2016: $600 to $475. Jan 5, 2017: $1,150 to $850. And so on.

You get the idea. Big crashes in $BTC happen regularly. They’re a feature, not a bug. If you didn’t have volatility then you also wouldn’t have price discovery, and we wouldn’t have seen that rather incredible $64,000 ATH two months ago.

In other words: this is what you signed up for when you started investing in crypto. Many of you came in during these last couple of months and saw nothing but multipliers, and even though your rational brain told you this couldn’t last forever, that other part of your brain, the part that keeps making you buy Toblerone at Ministop, worked as hard as it could to make you forget that one incontrovertible fact:

Number Go Up … but not always.

You probably expect me to now instruct you all to HODL tight, Diamond Hands. At the risk of getting my crypto membership card revoked, I think what I’ll tell you instead is this …

You’re in this game right now for a variety of reasons. If one of those reasons is that you believe in the goals of this technology, in its ability to liberate people and resist censorship, then nothing has changed in the last 48 hours. Bitcoin is still freedom money. Ethereum is still a decentralized world computer. Monero is still protecting identities. Dogecoin is still … doing whatever it is that Doge does.

If you’re here for ideological reasons, those ideologies have not been invalidated by these price movements.

If you’re in it for The Gainz though, and it’s totally OK if that’s the case, you have two choices now: stop loss or ride it out. I don’t have a universal way to make that decision, because that decision is unique to your situation.

If you’re playing with money that you can’t afford to lock away for a few months, then it might be time to stop the bleeding. If you’ve got enough personal liquidity to tide you over while the market regains lost ground, then feel free to apply for your HODLer license. (But be aware that those applications are typically approved after 4 years of proven HODLing.)

These are not binary decisions either: you can abandon some of your positions, and HODL others. The most important thing you can do right now is to suppress those feelings of despair and disappointment. Take a deep breath (perhaps take a virtual step outside via https://www.instagram.com/1minute.outdoors.ph), and then look at your holdings as objectively as possible.

Talk to others and share your stories, but don’t judge. Whatever decision YOU make right now is the right one, right now for YOU. And don’t worry about future you and all the gainz it may have missed out on, because your priority should be survival. You can’t continue playing if you can’t stomach a few defeats here and there.

Finally, although you should suppress the negative feelings, you should remember them. Keep them in a bottle that you can occasionally bring out to look at, because this is how you stay level-headed during the next big pump.

Number Go Up … but not always.

Good luck out there, cryptofam!

(Everything on sale!)

The article is a published originally the author’s Facebook post and republished with permission on BitPinas: Number Go Up, But Not Always

This price action shows us that we are currently in a multiyear bearmarket and Bitcoin is going back to $700