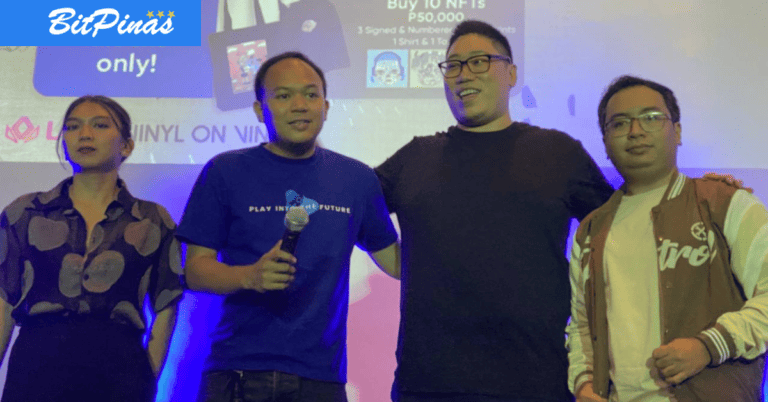

Tim Ying, GOW Exchange, [PH 2019 Crypto & Blockchain Year in Review]

Tim Ying: What I would personally love to see is more Filipino projects starting to emerge and the nascent Decentralized Finance trend coming to fruition. What is necessary for this to happen, however, is more regulatory clarity and clear taxation guidelines, without which bigger firms will continue to be reluctant to make any major commitment to this space.

![Tim Ying, GOW Exchange, [PH 2019 Crypto & Blockchain Year in Review] 1 Photo for the Article - Tim Ying, GOW Exchange, [PH 2019 Crypto & Blockchain Year in Review]](https://bitpinas.com/wp-content/uploads/2020/01/2019-Blockchain-and-Crypto-Philippines-16-3.png)

January 2, 2020 – Depending on who you ask, 2019 is another turbulent year for the crypto and blockchain industries. Globally, we’ve seen companies refocus their efforts or merge with others to survive. In the Philippines, we’ve read about more pending regulations, developments in the space, and more education drive. BitPinas sought the opinion of people who work in the blockchain and crypto industry in the Philippines, including leaders and influencers here and abroad on what they think about 2019 in general and what they look forward to in 2020.

Tim Ying is the Co-founder and CEO of GOW (Global Overseas Worker) Exchange, a central bank-licensed exchange in the Philippines. Tim has had a long career at HSBC before GOW, whose mission is to lower remittance costs and on-off ramps across G10 currencies.

Can you please share the latest developments from your company/project/group this year?

The biggest development for GOW this year was getting the green light from the Bangko Sentral ng Pilipinas to not only go live, but to launch our services to facilitate remittances for Overseas Filipino Workers throughout the world and offer G10 currency settlement and fiat channels for eCommerce firms and other entities that are involved in the new economy.

Please share a personal highlight for you this year in the crypto and blockchain community.

The biggest highlight was being recognized by Cebuana Lhuillier and claiming the Leader in Growth award in recognition of our international sales, where we placed top-5 within the APAC region.

In addition, we secured partnerships with the biggest regional banks operating out of the Philippines to offer debit card payout channels for remittance beneficiaries, local and international currency settlement, while seeing foot traffic in our Makati branch grow exponentially.

What do you think is the most important blockchain and/or crypto development in the Philippines/Globally in 2019?

![Tim Ying, GOW Exchange, [PH 2019 Crypto & Blockchain Year in Review] 2 Photo for the Article - Tim Ying, GOW Exchange, [PH 2019 Crypto & Blockchain Year in Review]](https://bitpinas.com/wp-content/uploads/2020/01/gow-exchange-2.jpg)

Broadly speaking, this can be divided into two separate parts.

Central banks are increasingly starting to follow the lead of Bangko Sentral ng Pilipinas in looking towards taking a more proactive stance with digital assets. 70% of institutions are looking at making potential forays into the digital assets space, but the vast majority of these are still in their embryonic stages. With Mario Draghi of the ECB and Christine Lagarde lending support to stablecoins, smaller nations like the Marshall Islands announcing that they will be launching their own Central Bank Digital Currencies, and the People’s Bank of China looking at developing its own Digital Currency Electronic Payment coin, it’s looking increasingly likely that central banks globally will become fully invested in embracing digital assets.

The second part of this is the Libra coin, which helped move government-issued stablecoins to the top of the policymaking agenda. In saying this, however, with the validity of the project being called into question by US lawmakers, it’s showing the necessity of working closely with regulators when launching projects, something I believe Filipino firms have hitherto been very successful in doing.

What is your company/project/group looking forward to this 2020 in this space?

We have been working very closely with leading financial institutions and business to help bring real-life use cases for digital assets to the forefront of the Philippine economy, which is why we are looking forward to making some exciting announcements about projects that we are partnering with to leverage digital assets to address real-world problems in remittance, payroll, and the provision of payment services, which will make international commerce and financial aid more simple, streamlined, and cost-effective.

What do you personally look forward to in this space?

What I would personally love to see is more Filipino projects starting to emerge and the nascent Decentralized Finance trend coming to fruition. What is necessary for this to happen, however, is more regulatory clarity and clear taxation guidelines, without which bigger firms will continue to be reluctant to make any major commitment to this space.

What do you see for the Philippines in 2020 in this space?

The Philippines has already been very proactive in establishing itself as a technological base in Southeast Asia by issuing VCE licenses. The most important thing is making the tangible benefits of digital assets known to the regular person and educating people about their potential, which I believe that the UnionBank i-to-i initiative has been very successful in achieving.

Follow Tim Ying:

- Tim Ying on Linkedin and GOW Exchange

This article is published on BitPinas: Tim Ying, GOW Exchange, [PH 2019 Crypto & Blockchain Year in Review]

More Articles from BitPinas’ 2019 PH Crypto and Blockchain Year in Review:

- Colin Goltra – Crypto Adviser and Formerly from Coins.ph

- Emerson Fonseca – CEO of NEM Philippines and Paylance

- Gail Macapagal – Country Director from DynaQuest

- Isabel Laurel – Fintech Consultant and Founder of Coinfemme Brand

- Lance Pormarejo – Business Dev at Gameworks

- Luis Buenaventura – Co-Founder of BSP-Licensed Bloom Solutions

- Miguel Cuneta – Co-Founder of BSP-Licensed SCI Ventures

- Miko Ilas – Head of Binance Filipino Community

- Myrtle Ramos – Founder of Blockchain Firm BlockTides

- Peter Ing – Country Manager of BlockchainSpace

- Atty. Rafael Padilla – Legal Director at Farcove Consulting and Co-Founder of BlockDevs Asia

- Randy Knutson – CEO of Blockchain Solutions DynaQuest

- Tim Ying – CEO of GOW Exchange