BPI Can Compete Head-to-Head with Digital Banks – President

BPI has more assets and physical branches to assist its consumers, according to its President Jose Teodoro Limcaoco.

The Bank of the Philippine Islands (BPI) can compete head-to-head with digital banks because it has more assets and physical branches to assist its consumers, according to BPI President Jose Teodoro Limcaoco.

“Our advantage is that we have assets that can mitigate the high cost of liabilities that these fintech and digital banks are putting on, we got brick and mortar branches that can serve customers,” said Limcaoco in his interview on ANC.

According to the BPI Official, the bank’s mobile application is considered as the top two mobile app in the country, next to mobile wallet giant GCash.

At the time of writing, BPI Mobile has more than 5 million downloads on Google Appstore, with a rating of 3.9 stars. Mobile wallets GCash has more than 50 million downloads, while all-in-one app Maya, which also has Maya Bank, has 10 million downloads.

Meanwhile, BPI’s microfinance arm, BanKo, recently launched a digital savings account at four percent interest rate per annum. Its BPI BanKo Mobile app currently has more than 100,00 downloads with a rating of 4.1 stars.

“We may not be as agile as them only because we need to be careful in our systems because we have millions of customers so we have to be more careful, but I think we will compete head-to-head and we will come out quite successful,” Limcaoco concluded.

There are currently six digital banks that the Bangko Sentral ng Pilipinas (BSP) has granted a license to operate, namely: namely: Overseas Filipino Bank of Land Bank of the Philippines (March 25, 2021); Tonik Bank of Singapore (June 3, 2021); UNObank of Singapore (June 3, 2021); UnionDigital of Union Bank of the Philippines (July 15, 2021): GOtyme of Robinsons Bank Corp. (August 12, 2021); and Maya Bank, owned by PayMaya of PLDT Inc. (September 16, 2021).

Supposedly, there are seven slots that the BSP opened for a digital bank license, but other applicants failed to meet the requirements needed. (Read more: BSP Unlikely to Approve More Digital Banks in Near Future)

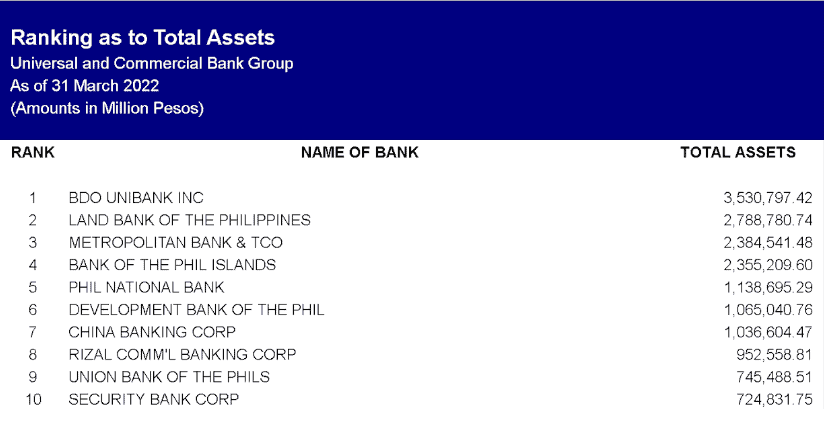

As of now, BPI belongs to the Universal and Commercial Bank Group, according to the data of BSP.

It is the fourth bank in the country with the highest Total Assets as of March 2022 with 2,355,209.60.

This article is published on BitPinas: BPI Can Compete Head-to-Head with Digital Banks – President

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.