BSP Implements Stricter Rules for E-Money Amid Heightened Cybersecurity Risks

The BSP has decided that electronic money issuers (EMIs) should be divided into two groups: banks and non-bank financial institutions.

Subscribe to our newsletter!

- The Bangko Sentral ng Pilipinas (BSP) has changed the rules that govern how electronic money (e-money) works in the Philippines.

- The BSP has decided that electronic money issuers (EMIs) should be divided into two groups: banks and non-bank financial institutions. The rules for each group will be different.

- The new guidelines for EMIs include rules about how much money they need to have to operate, how they must keep their money safe, and how they must report what they are doing to the BSP. The rules are meant to make sure that electronic money is safe and works well for everyone who uses it.

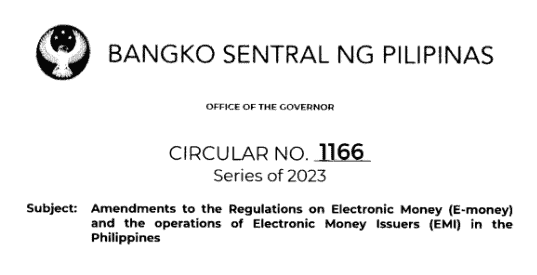

In its circular no. 1166, series of 2023, the Bangko Sentral ng Pilipinas has confirmed that the Monetary Board has approved the amendments to the pertinent provisions of the Manual of Regulations for Banks and Manual of Regulations for Non-Bank Financial Institutions on the regulations governing the issuance of electronic money (e-money) and the operations of e-money issuers in the Philippines.

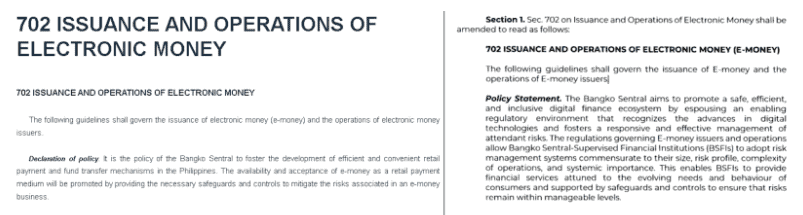

The Monetary Board, the agency responsible for making policy decisions related to the management, operation, and administration of the Central Bank, has primarily amended Section 7O2 on lssuance and Operations of Electronic Money of the mentioned manual.

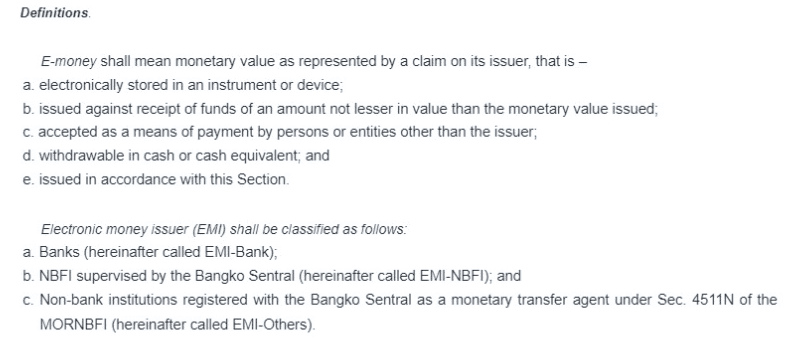

According to the circular, e-money shall refer to an electronically-stored monetary value that is:

- maintained in a non-interest-bearing non-deposit transaction account;

- denominated in or pegged to Philippine Peso or other foreign currencies;

- pre-funded by customers to enable payment transactions;

- accepted as a means of payment by the issuer and by other persons or entities including merchants/sellers;

- issued against receipt of funds of an amount equal to the monetary value issued;

- represented by a claim on its issuer; and

- withdrawable in cash or cash equivalent or transferable to other accounts/instruments that are withdrawable in cash.

Also, the circular likewise classified EMIs into two categories: EMI-Banks and EMI Non-Bank Financial Institutions (EMI-NBFI). EMIs previously classified as EMI-Others will now be grouped under EMI-NBFI, which will also include cooperatives.

Aside from the amended definitions mentioned, the revision also imposes rules on liquidity, capitalization, load limits, reporting, and sanctions.

This is where the BSP has defined large-scale EMIs as institutions with a 12-month average value of aggregated inflow and outflow transactions that are equal to or greater than ₱25 billion and must maintain a minimum capital of ₱200 million. For small-scale EMIs, on the other hand, institutions need to have a minimum capitalization of ₱100 million.

In addition, the new rules also require EMIs with monthly outstanding e-money balances of at least ₱100 million to maintain liquid assets in trust accounts equivalent to at least 50% of their outstanding balance and cover the remaining balance with placements in bank deposits, government securities, or other liquid assets acceptable to the monetary agency.

“The amendments are geared towards equipping EMIs in attending to the evolving needs and behaviors of consumers and in responding to the existing and emerging risks in the financial sector, such as cybersecurity and money laundering. The revised guidelines reaffirm the BSP’s commitment to uphold the welfare of Filipinos by promoting a safe, secure, and inclusive financial system,” BSP Governor Felipe Medalla, who is also the signatory of the circular, concluded.

Lastly, the Central Bank has also declared that the said circular shall take effect 15 calendar days following its publication in the Official Gazette or any newspaper of general circulation. The signed circular was dated February 7, 2023. The EMIs also have one year to comply with the amendments.

This article is published on BitPinas: BSP Implements Stricter Rules for E-Money Amid Heightened Cybersecurity Risks

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.