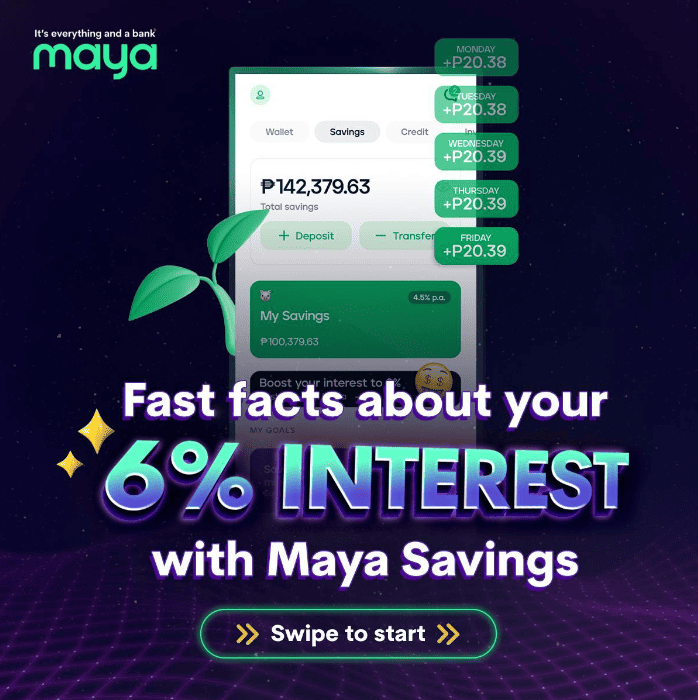

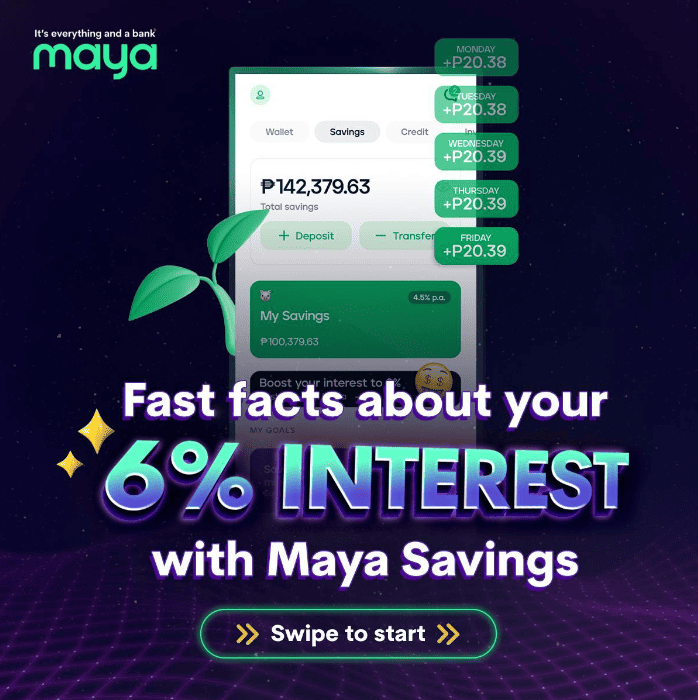

All-in-one Digital Bank Maya Extends 6% Interest on Savings Accounts

Currently, Maya offers a 4.5% annual interest rate, with earnings credited daily. Users can boost it to 6% on their first P100,000 for the next 30 days.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

- All-in-one digital bank app Maya is offering an interest rate of up to 6% on savings accounts.

- Customers can earn this rate by making everyday payments with Maya, including using the app to pay bills, buy load, or scan QR codes.

- The offer is available until February 28, 2023 and is part of Maya’s mission to make money management easy and rewarding for its customers.

Starting this month until February 28, 2023, mobile money and crypto wallet Maya will be offering up to a 6% interest rate on users’ savings accounts. The initiative aims to provide their customers with better management of their finances while gaining rewards.

“Now is the best time to save your Christmas bonus and kickstart your 2023 ipon goals as Maya continues to give up to a 6% interest rate p.a. on your savings account!” the fintech firm stated.

Currently, Maya offers an interest rate of 4.5% p.a., with earnings credited daily. With the promo, users will be able to boost it higher to 6% on their first ₱100,000 for the next 30 days.

“We want our customers to be able to grow their savings even more just by doing everyday transactions. This is part of our mission to make money management as easy and as rewarding as possible,” said Angelo Madrid, Maya Bank President.

To avail of the promo, Maya users must do their everyday payments with the app and spend an accumulated amount of ₱250.00 when completing transactions. Customers can pay via Maya QR code, card, or mobile number. They can also settle bills and buy loads via the Maya app to boost their interest rate.

Benefits of Interest growing daily: Because the interest is deposited to the Maya account every day and not monthly, every peso earned daily counts towards bigger savings for the user.

“On top of offering one of the highest savings interest rates in the market, Maya bundles innovative features and top-notch security so that it becomes the only app you’ll need to efficiently and conveniently manage your money,” Madrid added.

Moreover, with their boosted interest rate, Maya encourages its users to utilize their Personal Goals feature to achieve their personal milestones. This service allows users to compartmentalize their savings based on different purposes; be it a dream vacation, emergency funds, or business capital.

Last May, the firm changed its name from Paymaya to Maya to rebrand itself and to include online banking services alongside its e-wallet, cryptocurrency trading, and micro-investments.

Its rebranding also integrated its digital banking license obtained last year, which enabled them to offer new features such as Maya Savings, Maya Credit, and Maya Wallet. They also launched Maya Crypto to drive its further adoption in the country. (Read more: How to Buy Crypto, BTC, ETH, ADA, on PayMaya Philippines)

Recently, Maya announced that they released a new app feature that now allows users to convert select cryptocurrencies to Bitcoin within the app—previously, cryptocurrencies in Maya could only be converted back to fiat (pesos). (Read more: Maya Now Allows Converting Select Crypto to Bitcoin)

The following cryptocurrencies are available in Maya:

- Algorand (ALGO)

- Apecoin (APE)

- Avalanche (AVAX)

- Axie Infinity (AXS)

- Bitcoin (BTC)

- Cardano (ADA)

- Chainlink (LINK)

- Decentraland (MANA)

- Dogecoin (Doge)

- Ether (ETH)

- Polkadot (DOT)

- Polygon (MATIC)

- Shiba Inu (SHIB)

- Solana (SOL)

- Stellar (XLM)

- The Sandbox (SAND)

- Quant (QNT)

- Tether (USDT)

- Uniswap (UNI)

This article is published on BitPinas: Maya Extends 6% Annual Interest on Savings Account

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.