GCash Goes Global: Filipino Fintech App Launches Services for Filipinos Abroad

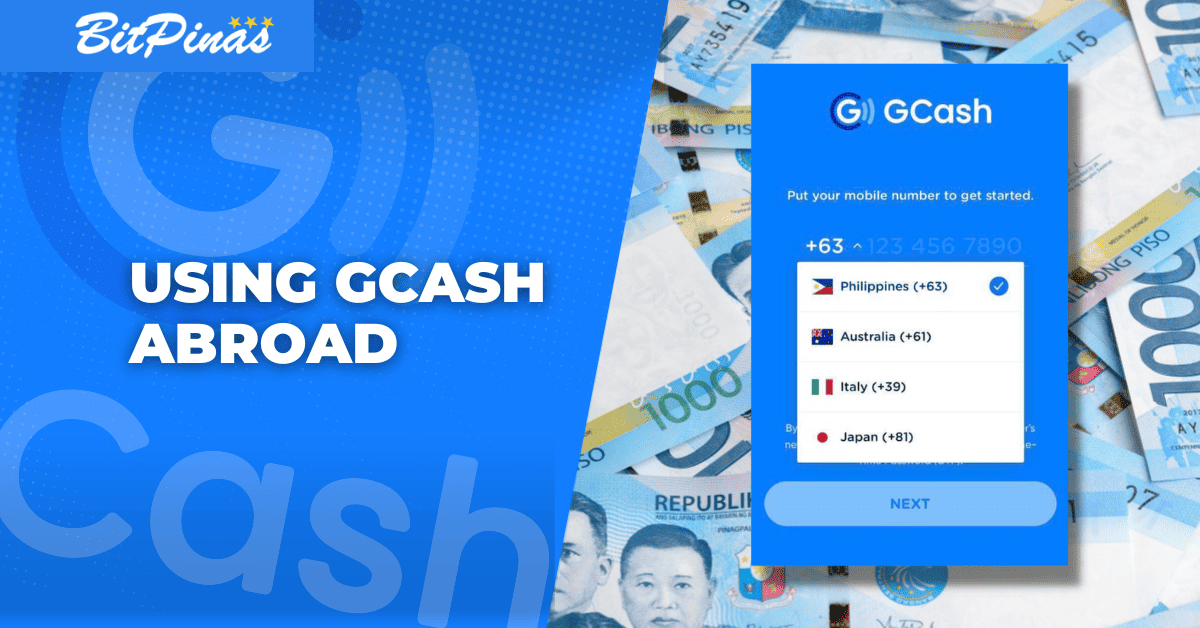

GCash has launched GCash Overseas, which allows Filipinos in Japan, Italy, and Australia to use the fintech app with international SIM card.

Subscribe to our newsletter!

- GCash has announced the beta launch of GCash Overseas, which allows Filipinos in Japan, Italy, and Australia to use the fintech app with international SIM cards, after receiving approval from the Bangko Sentral ng Pilipinas. The first 1,000 users from each country will be given access to GCash services without the need for a Philippine SIM for a limited time.

- Once fully verified, Filipinos abroad can use GCash to send money, pay bills, and buy load credits. The full launch is expected later this year.

- GCash has partnered with four Asian e-wallets to enable cross-border transactions when traveling to South Korea. It has also announced the start of operations for its GStocks PH service by March, and made its GCrypto available to selected users.

The Bangko Sentral ng Pilipinas (BSP) has approved the beta launch of GCash Overseas, which allows Filipinos working and residing in Japan, Italy, and Australia to register an account using an international SIM, the fintech app announced.

“With around 10 million Filipinos living abroad, we want them to also be able to take advantage of GCash services even as they use international SIMs. As more people put their trust in GCash, we strive to remove more barriers and create a better experience for all,” said Martha Sazon, GCash president and CEO.

Under the beta launch, only the first 1,000 users from the three countries will be able to access GCash, even without a Philippine SIM, for a limited time. The full launch is expected to happen later this year.

“We continue to make a difference in Filipinos’ lives by making financial services easier and more accessible to our 76 million-strong registered users,” Sazon added.

According to GCash, Filipinos overseas, once they are fully verified, can begin supporting their families in the country by sending money for free (GCash-to-GCash mode), paying bills, and buying load credits.

It can be recalled that in September 2022, Chinese fintech giant Ant Group announced its partnership with four Asian e-wallets, namely: GCash; Hong Kong’s AlipayHK; Malaysia’s Touch ‘n Go eWallet; and Thailand’s TrueMoney, to make cross-border transactions when traveling to South Korea.

A month later, the Chinese fintech giant also revealed that its partnership with GCash has expanded to three more countries, namely, Japan, Singapore, and Malaysia

The partnership has allowed GCash users to pay using the GCash app to different merchants to the four mentioned countries through Alipay+.

Meanwhile, the fintech app has also announced that its GStocks PH service is set to start its operation by March. A month-long dry run will first happen in partnership with stock brokerage house AB Capital Securities Inc. for selected users who will be able to register and apply for a trading account with AB Capital.

Consequently, GCrypto is now available to GCash’ selected users. As of writing, the available cryptocurrencies offered by the fintech app include Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), Uniswap (UNI), Chainlink (LINK), Aave (AAVE), Basic Attention Token (BAT), The Graph Token (GRT), Enjin (ENJ), Litecoin (LTC), Bitcoin Cash (BCH), Avalanche (AVAX), Polygon (MATIC), Polkadot (DOT), Axie Infinity Shards (AXS), Smooth Love Potion (SLP), Cardano (ADA), Solana (SOL), Binance Coin (BNB), Stellar (XLM), and SushiSwap (SUSHI).

This article is published on BitPinas: GCash Goes Global: Filipino Fintech App Launches Services for Filipinos Abroad

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.