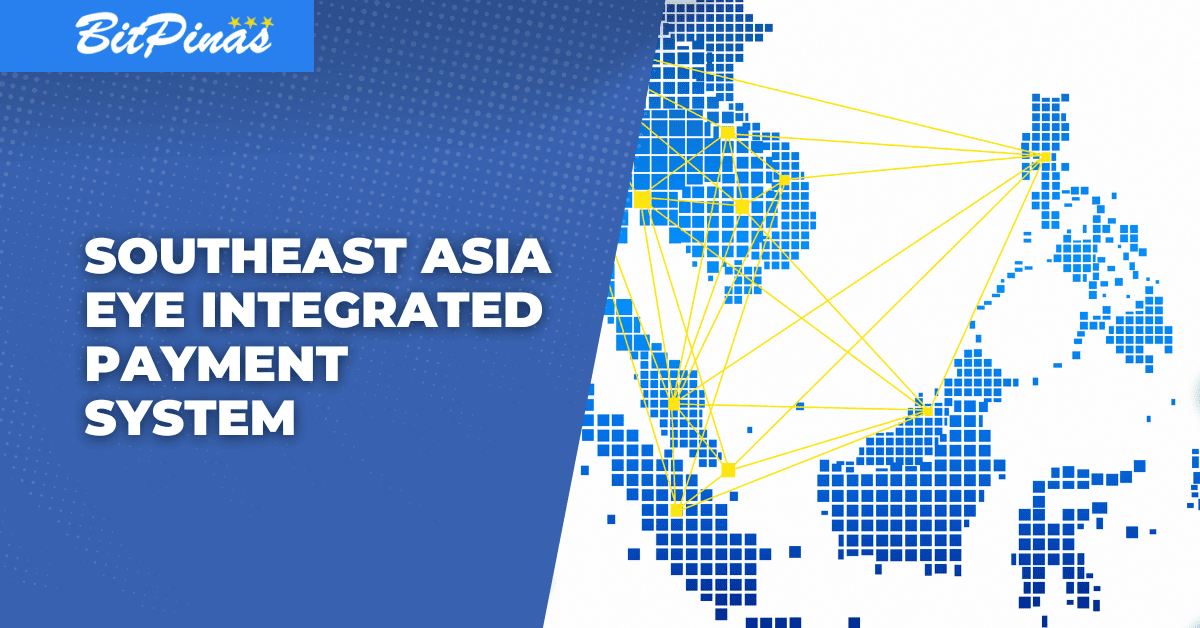

Philippines, SEA Countries to Offer Integrated Digital Payment System by November

The integration will let people buy goods and services throughout the region by just scanning QR codes.

Five Southeast Asian (SEA) countries are set to sign a deal that will integrate each other’s payment systems by November to allow easier transactions for travelers, tourists, and even locals within the region.

The countries involved are the Philippines, Malaysia, Indonesia, Singapore, and Thailand, the five biggest economies in the SEA.

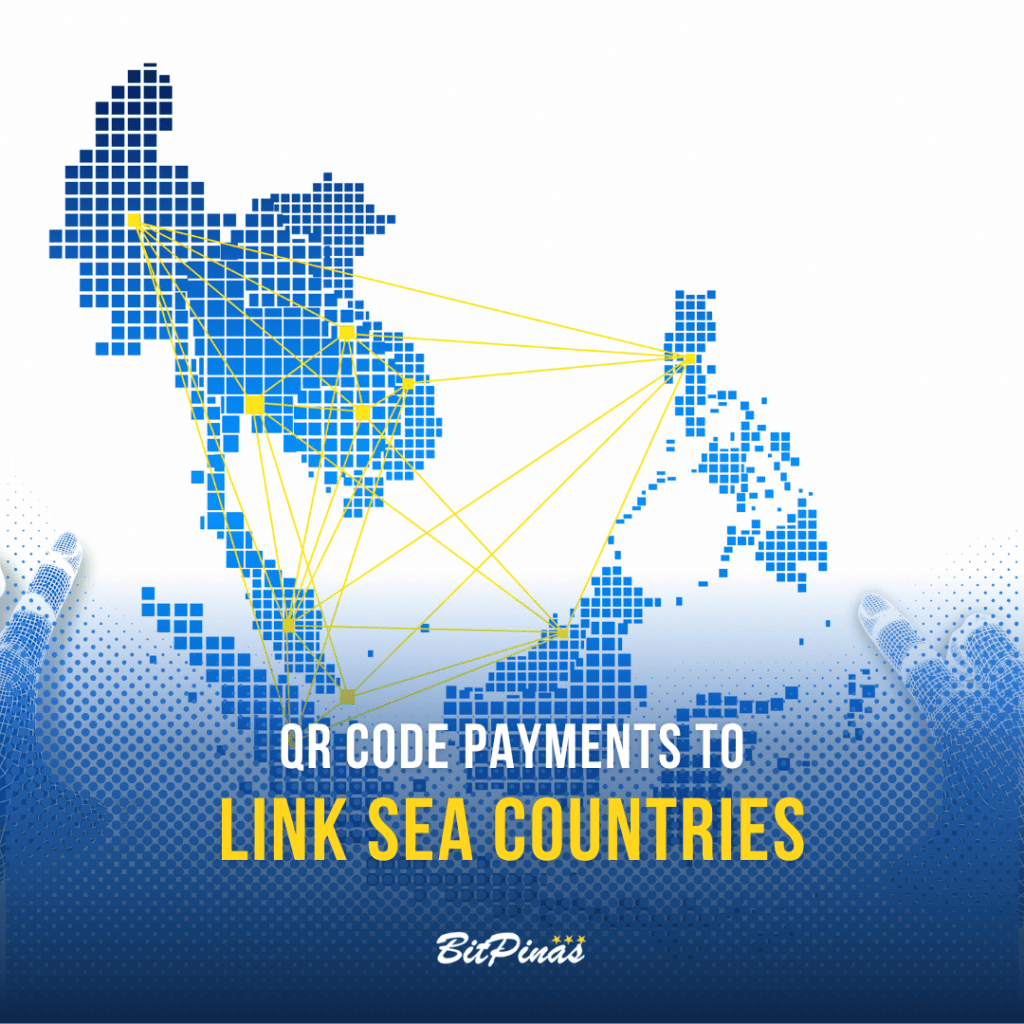

The integration will let people buy goods and services throughout the region by just scanning QR codes, where the payment will use local-currency settlements between the countries.

For an instance, a payment that was done in the Philippines using a Singaporean app, the payment will directly be exchanged from Philippine Peso to Singapore Dollars.

This is different from the scenario before, where a Philippine Peso needs to be converted to US Dollars first, then from US Dollars to Singapore Dollars.

The completion of this integration is set to be finished before this year ends.

Currently, only Malaysia, Indonesia, and Thailand, are already connected to each other, and are already accepting cross-border payments using QR codes.

While Singapore and Malaysia have already signed a deal to link PayNow and DuitNow for their cross-border payments, though it is not yet operational.

On the other hand, the Philippines already signed a deal last year with Singapore and is targeting to sign a similar deal with Malaysia and Thailand.

According to the agreement of each country’s central banks, after the integration, they are targeting next to expand it to other regions around the globe.

They are also aiming to adopt this concept to real-time bank transfers and even central bank digital currencies.

“This can be a deeply impactful move that we can build to the rest of the world. It is a public good infrastructure which improves financial inclusion, enhances efficiency and creates new business opportunities for all citizens,” said Ravi Menon, Monetary Authority of Singapore Managing Director.

This integration is revealed by Perry Warjiyo, the Governor of Indonesia’s central bank, during a panel discussion of G20 in Bali, Indonesia.

The G20 or Group of Twenty is an intergovernmental group that includes 19 countries and the European Union, it aims to address the major issues related to the global economy, such as international financial stability, climate change mitigation, and sustainable development.

Recently, the Financial Stability Board, an international body that monitors and makes recommendations about the global financial system to the G20, said that it is currently working to ensure that crypto-assets are subject to robust regulation and supervision, and that it will report to the G20 Finance Ministers and Central Bank Governors in October about it.

This article is published on BitPinas: Philippines, SEA Countries to Offer Integrated Digital Payment System by November

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.