BAKKT Launch Provides Institutions to Take Positions in a Regulated Venue

As the Bitcoin price reaches its lowest point in the last 3 months, it will be interesting to see how BAKKT and institutional investors will affect the cryptocurrency market.

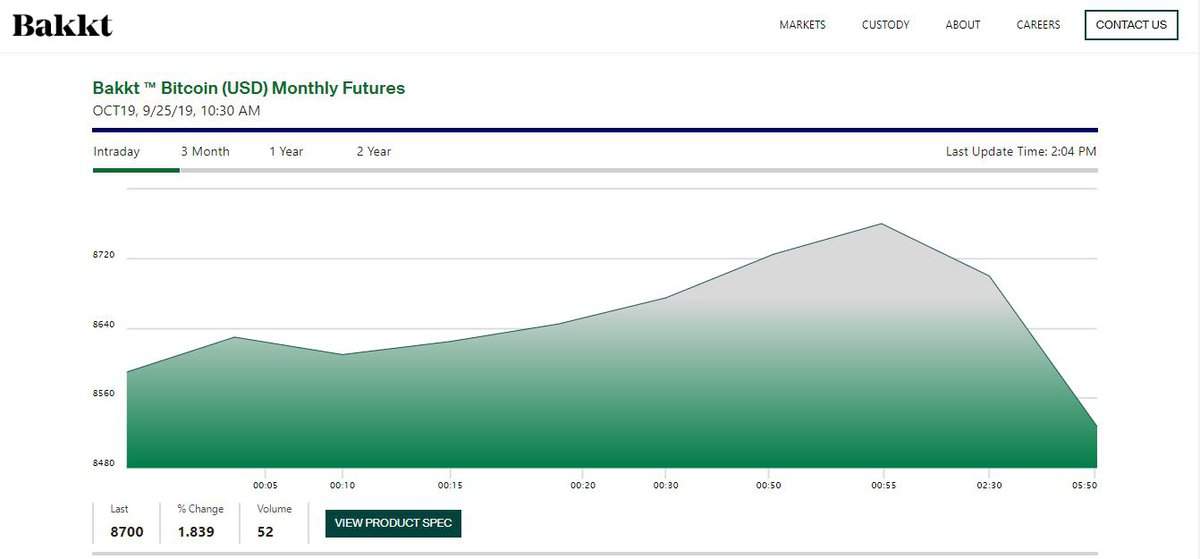

September 25, 2019 – 18 Bitcoin (BTC) in volume has been traded on the first day of the launch of Bitcoin futures contracts on the Intercontinental Exchanges (ICE) BAKKT platform last September 22, 2019.

It was much-anticipated; the first of its kind to be physically settled in Bitcoin. The most recently available data at the time of writing is that 216 BTC has been traded, with a last recorded trading price of $8,700.00.

Crypto analysts have commented on the slight volume levels, with one trader comparing the BAKKT Launch to patterns typically seen in CME Bitcoin Futures:

“CME bitcoin futures traded $460 million on its first week. The current volume is around $700 million. The Van Eck fake ETF traded $0 on its first week.”

Mr. Ari Paul, a cryptocurrency investor argued that physical delivery will have a slightly slow adoption at least initially;

“Probably a more gradual scale-up since it’s physical. With CME futures, anyone with the right FCM [Futures Commission Merchant] could immediately trade on launch […] I’d think the incremental demand (beyond CME) would come from people who want to buy or sell physical for delivery, at least at first. Receiving could be instant (use FCM to convert), but I’m kind of thinking depositing physical will be gradual.”

Institutional landscape impacts the Price

BAKKT provides institutional investors to take positions on cryptocurrency in a “federally-regulated” venue. Meaning – in avenues these institutions are more familiar with (compared to trading on cryptocurrency exchanges, keeping Bitcoins in their own wallets, etc). Note that BAKKT offers “trading” and “warehousing” As per Coinfemme website, the initial hedge requirement for daily and monthly futures contracts is $3,900 while the speculative initial requirement for both contracts is $4,290. Isabel Laurel, founder of Coinfemme Consulting also noted the pros and cons of the BAKKT Launch on her website:

Pros:

- Larger Trading Volume – There is an expectation that institutional investors will move from opaque OTC markets to more transparent platforms like BAKKT;

- ETF Approval;

- Custody – Clearing members will no longer be required to handle Bitcoin themselves;

- Regulated ICOS – Bakkt will attract more corporate issuers to raise capital via initial coin offerings.

Cons:

- High-Risk Crypto Derivatives – the institutional investors could use derivatives to manipulate or exaggerate the price of Bitcoin and other cryptos.

As the Bitcoin price reaches its lowest point in the last 3 months, it will be interesting to see how BAKKT and institutional investors will affect the cryptocurrency market.

This article is first published on BitPinas: BAKKT Launch Provides Institutions to Take Positions in a Regulated Venue

![[Scoop] Filipino Music Icon Ely Buendia's Flaming Lullaby NFT Collection to Launch on PDAX's Mintoo Platform 4 [Scoop] Filipino Music Icon Ely Buendia’s Flaming Lullaby NFT Collection to Launch on PDAX’s Mintoo Platform](https://bitpinas.com/wp-content/uploads/2023/04/mintoo-ely-buendia-pdax-nft-artifract-1-768x402.png)