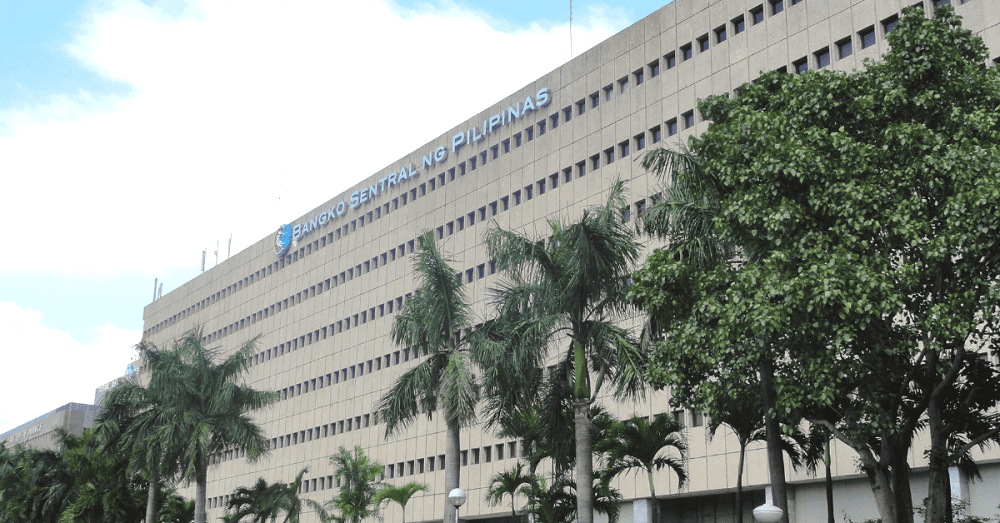

BSP Issues Preventive Measures Against Illegal Investment Activities

The BSP now issues Memorandum No. M-2019-028 – Preventive Measures Relevant to Illegal Investment Activities or Schemes – instructing banks, non-bank financial institutions, and BSP-supervised businesses to adopt a risk management system to “identify, detect, prevent, and mitigate risks” that will arise from these illegal activities.

December 2, 2019 – Just this year, a number of scams have been identified by government agencies like the Securities and Exchange Commission. Fraudulent persons entice unsuspecting investors by promising high return of investments. These “returns” are normally not offered even by other legitimate financial services. The fraudulent business will create an illusion that there are “returns” by using the money paid by new investors to pay off previous investors. This is an illegal investment scheme and they normally collapse once new investments (from new investors) cannot pay or satisfy the payment obligations to the previous investors.

BSP Issuance

The Bangko Sentral ng Pilipinas (BSP) understands that banks and financial institutions are normally used to transfer funds from unsuspecting investors to the perpetrators and their business entities. The BSP now issues Memorandum No. M-2019-028 – Preventive Measures Relevant to Illegal Investment Activities or Schemes – instructing banks, non-bank financial institutions, and BSP-supervised businesses to adopt a risk management system to “identify, detect, prevent, and mitigate risks” that will arise from these illegal activities.

The issuance includes relevant practices and common red-flag indicators that should be considered so that these types of illegal transactions are prevented from being undertaken:

Basic Preventive Measures

- Establishing and verifying a customer’s identity and source of funds

- If enhanced due diligence (EDD) is required, then requesting for additional information and/or securing senior management approval before going through with transactions

Surveillance Mechanism

- Incorporate a surveillance mechanism in the transaction monitoring process to capture information, advisories, and news reports in a timely manner.

- For example, SEC releases regular advisories against fraudulent businesses and individuals. The legitimate business must be on top and updated with these news and advisories so that if these individuals suddenly tried using their business to transact, they will be able to flag it immediately.

Background Checks

- Examine the purpose of complex and unusually large transactions and identify unusual patterns in any transaction.

- This will allow the BSP-supervised institution to capture unusual pattern of account activities or transactions for proper investigation.

- If the BSP-supervised financial institution believes that conducting a customer due diligence (CDD) process will tip off the customer, they can file a “suspicious transaction report”, and then closely monitor the account and review the business relationship.

Proactive Watchlist Monitoring

- Checking transfer parties against existing customer database for any individual or entity with negative or adverse/derogatory information based on an Internal Negative File Database System (NFDS).

Being Informed of Policies

- Ensuring everyone within the BSP-supervised institution is updated with policies and procedures when it comes to handling customers and/or transactions.

Establishing Common Red Flag Indicators

- Identify common red-flag indicators that might signify that a transaction or a set of transactions are related to Ponzi activities. This includes frequent cash deposits not aligned with the customer’s business or profile, sudden spikes of activity, having several accounts, new businesses with unusually large transactions immediately, and high volume of check issuances and/or clearing.

This article is published on BitPinas: BSP Issues Preventive Measures Against Illegal Investment Activities

Source: BSP Memorandum