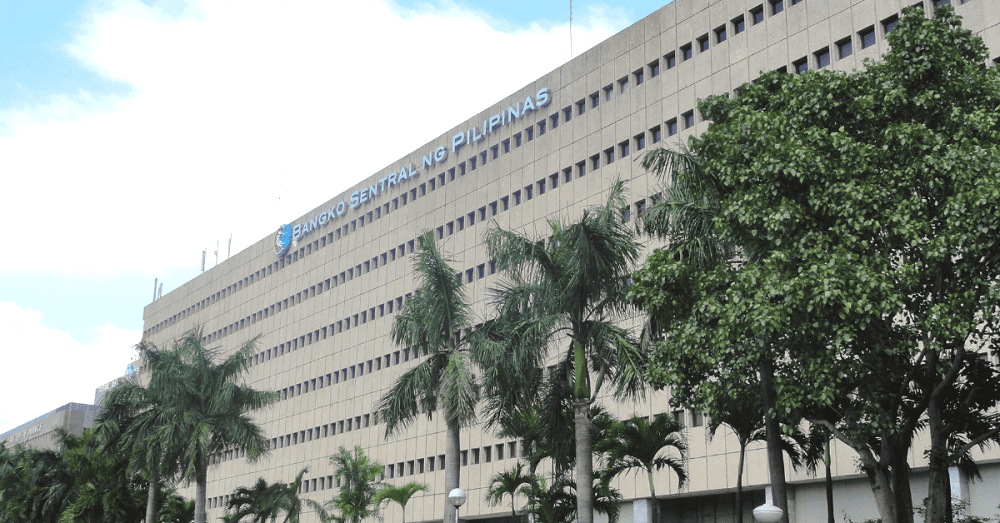

BSP Revises Regulation on Financial Consumer Protection

The Central Bank said they want to ensure “financial service providers” are conducting “ethical business practices” and do not engage in activities that will harm their customers.

September 10, 2019 – Citing increasing complexity of financial products, the Bangko Sentral ng Pilipinas (BSP) is revising its regulations on Financial Consumer Protection Framework under Circular No. 857 issued in 2014.

The Central Bank said they want to ensure “financial service providers” are conducting “ethical business practices” and do not engage in activities that will harm their customers. In a press release, the Central Bank is establishing guidelines (Circular No. 1048 Series of 2019) that will make “consumer protection” as an integral component of corporate governance and culture among the BSP-supervised institutions. These include banks and non-bank financial institutions. Included in the list of non-bank Financial institutions are licensed virtual currency exchanges in the country.

The Central Bank noted the emerging risk* associated with digital financial products and services. Thus the Circular “provides flexibility for the BSFIs to strategize its consumer protection approach commensurate with its business model, corporate structure and risk profile.”

The 5 consumer protection standards of conduct are:

- Disclosure and transparency;

- Protection of client information;

- Fair treatment;

- Effective recourse mechanism;

- Financial education and awareness

The BSP is requiring banks to perform a gap analysis of their current consumer protection practices in relation to these new rules.

Since banks count virtual currency exchanges as their clients, the exchanges are expected to face the scrutiny of their own consumer protection practices. The previously released Circular No. 944 established rules, including consumer guidelines for such exchanges.

A copy of the Circular can be found on the Central Bank website or here in BitPinas.

This article is first published on BitPinas: BSP Revises Regulation on Financial Consumer Protection

*Of course, the BSP had, in the past, had discussed the benefits of fintech. Currently it is pushing the country to have an overall increase in e-money payments by 2020.