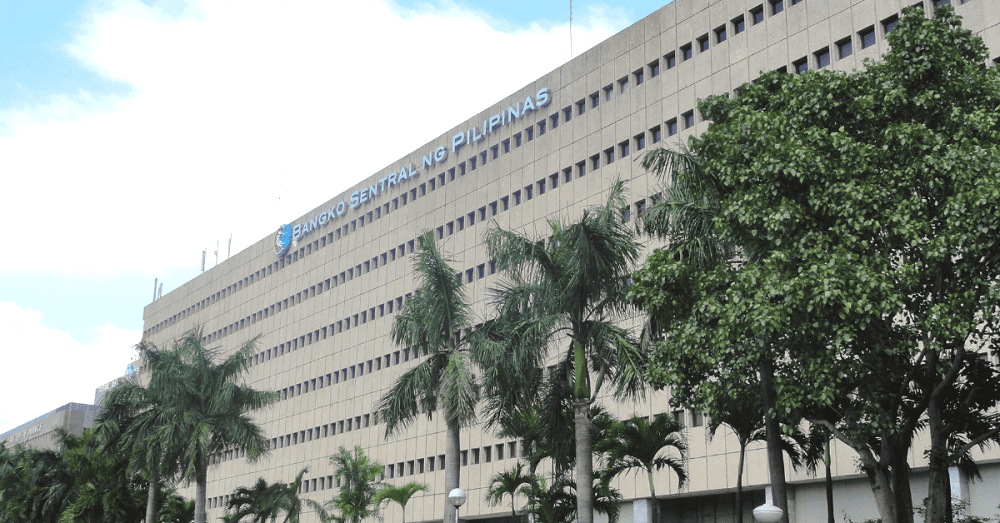

BSP Tells Banks: No Interest on Interest, Fees, and Charges During Enhanced Community Quarantine

Covered institutions must not charge or apply interest on interest, fees, and charges during the 30-day grace period to future payments/amortizations of the borrowers.

April 6, 2020 – The Bangko Sentral ng Pilipinas (BSP) instructed all BSP-supervised institutions to comply with the R.A. No. 11469 or the “Bayanihan to Heal As One Act”. Section 4 of the law discussed the grace period to be applied to all loans falling due within the Enhanced Community Quarantine (ECQ) period. The implementing rules and regulations of the law was approved by the Department of Finance (DOF).

In a letter by BSP Governor Benjamin Diokno, he said the rules mandate all covered institutions to implement a 30-day grace period to all loans with principal and/or interest falling due within the ECQ period without incurring interest on interest, penalties, fees, and other charges. The 30-day grace period shall apply to each loan of individuals and entities with multiple loans.

Who are the covered institutions?

Covered institutions are all lenders, including, but not limited to the following:

- banks

- quasi-banks

- non-stock savings and loan associations

- credit card issuers

- pawnshops

- other credit-granting financial institutions under the supervision of the Bangko Sentral ng Pilipinas, Securities and Exchange Commission (SEC), and Cooperative Development Authority, public or private, including the Government Service Insurance System, Social Security System, and Pag-Ibig Fund

Covered institutions must not charge or apply interest on interest, fees, and charges during the 30-day grace period to future payments/amortizations of the borrowers. They are also prohibited from making their client sign waivers to waive the application of the provisions of the Bayanihanto Heal As One Act. Also, no waiver previously executed by borrowers covering payments falling due during the ECQ period shall be valid.

Likewise, the accrued interest for the 30-day grace period may be paid by the borrower on a staggered basis over the remaining life of the loan. Of course, borrowers may also pay them in full.

The 30-day grace period shall automatically be extended if the ECQ period is extended by the President of the Philippines.

Read BSP MEMORANDUM NO. M-2020-017 here

This article is published on BitPinas: BSP Tells Banks: No Interest on Interest, Fees, and Charges During Enhanced Community Quarantine

Our employees complaining about Security Bank’s 300 pesos service charge for falling below ADB

I heard a similar thing with BPI naman where they charge when the account is below maintaining balance fees: https://www.linkedin.com/posts/michael-vincent-mislos-39973450_bsp-tells-banks-no-interest-on-interest-activity-6652926018887741440-SSkR

Grabe lang. Check out Eastwests’ FAQ (specifically item. no. 9) https://www.eastwestbanker.com/Pressroom/PressRelease/Article?title=frequently-asked-questions-on-the-payment-extension-for-credit-cards

Our employees complaining about Security Bank’s 300 pesos service charge for falling below ADB

I heard a similar thing with BPI naman where they charge when the account is below maintaining balance fees: https://www.linkedin.com/posts/michael-vincent-mislos-39973450_bsp-tells-banks-no-interest-on-interest-activity-6652926018887741440-SSkR

Grabe lang. Check out Eastwests’ FAQ (specifically item. no. 9) https://www.eastwestbanker.com/Pressroom/PressRelease/Article?title=frequently-asked-questions-on-the-payment-extension-for-credit-cards