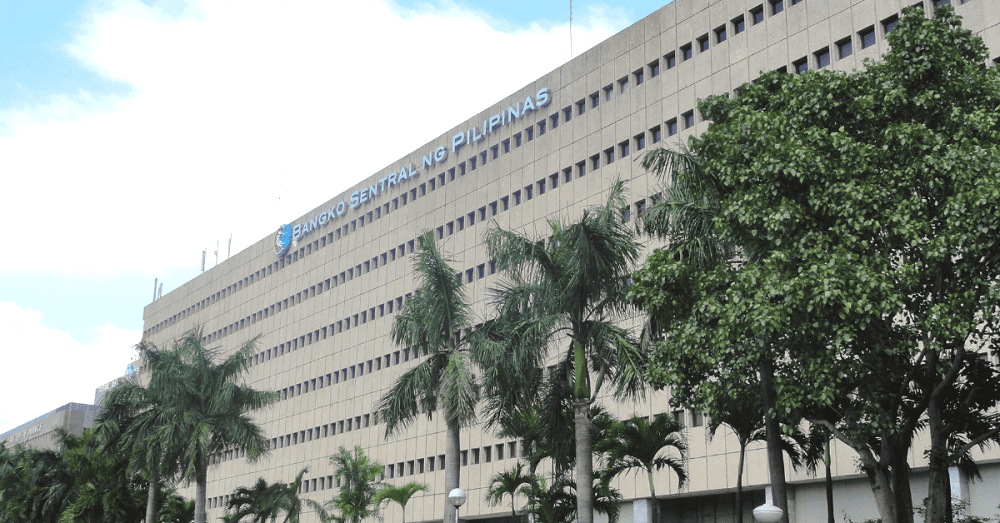

Cashless Transaction Rising in the Philippines

BSP has a firm target – raise the percentage of digital payments to 20% in 2020 compared to just 1% in 2013.

October 15, 2019 – Cashless transactions in the Philippines are increasing, according to a survey by the Better Than Cash Alliance (BTCA) as communicated by the Bangko Sentral ng Pilipinas (BSP).

While the survey results are not yet finalized, the preliminary results reveal that the number of people opting for transacting using electronic money (e-money) has increased. BTCA said the results will be revealed this November 2019.

BSP has a firm target – raise the percentage of digital payments to 20% in 2020 compared to just 1% in 2013. The Central Bank has launched initiatives such as PESONet and Instapay, infrastructures that allow financial institutions to facilitate batched or instantaneous money transfer between the participating banks. PESONet and Instapay already coursed around Php 109 billion in June 2019.

Read More: Using Abra to Buy Bitcoins in the Philippines

The Better Than Cash Alliance is a partnership between governments, companies, and international organizations that aims to accelerate the transition from cash to digital payments, with the goal of reducing poverty and driving inclusive growth.

In the Philippines, initiatives such as fintech are being mobilized to drive financial inclusion. E-wallets partner with last-mile remittance outlets not just to reach far-flung areas but also to provide financial access to people who cannot get the services of banks because of the lack of required amount of money for deposits and verifiable identity. For example, Paymaya, Coins.ph, and GCash have a range of partners – from convenience stores to pawnshops – for sending and receiving of cash.

To cut the cost and increase transaction speed, companies are making use of blockchain and cryptocurrency for money transfer.

President Duterte has already signed Republic Act 11127 called the National Payment Systems Act that will provide oversight, regulation, and supervision of payment systems.

Source: Philstar

This article is published on BitPinas: Cashless Transaction Rising in the Philippines