Google Trends for Bitcoin at its Highest This Year

Google Trends recorded peak search interest for Bitcoin in recent weeks. Analysts call this a quiet rally.

November 26, 2020 — The price of Bitcoin has increased significantly and with the recent rally to $19,400, it appears search interest is also increasing again for the dominant cryptocurrency.

Bitcoin closed Tuesday at $19,091, according to the aggregate data of Coingecko. On Coinbase, it closed at $19,172 after reaching as high as $19,469. It is up 167% since the beginning of the year and 35% in the last 30 days.

Despite Bitcoin’s rally to $19,000 causing a lot of enthusiasm in the cryptocurrency community, mainstream interest has been muted. Bloomberg went as far as to say that the first crypto is “gunning for a record but no one’s talking about it.” The mania that surrounded digital currencies back in 2017, Bloomberg reported, is largely absent despite Bitcoin increasing to a new 2020 high of $16,800 at that time.

That appears to be changing.

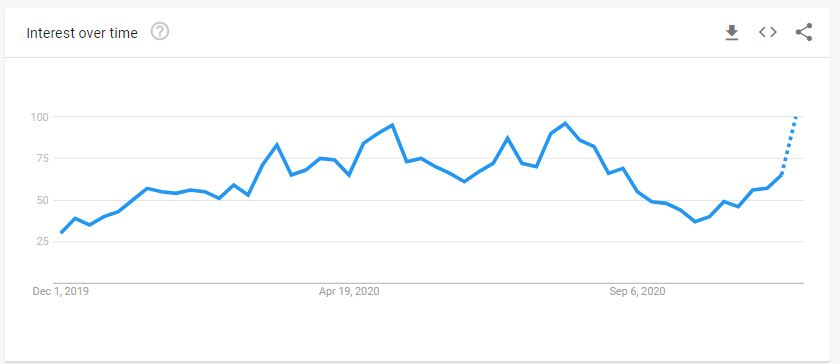

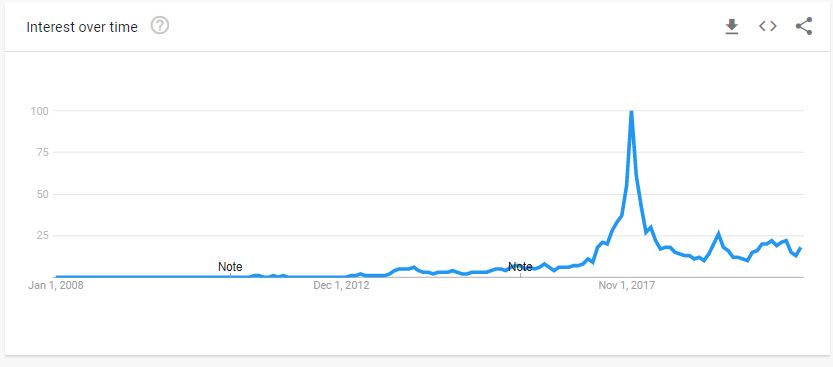

Google Trends, which gauges search interest for a particular term or topic relative to its peak level of interest during a given period, recorded peak search interest for Bitcoin in the U.S. during the week of Nov. 15 – 21, 2020.

Examining Google PH Search Trends for the last 12 months shows that August 2 – 8 was the peak search interest for Bitcoin, followed by April 19, but early data shows we will equal or exceed that same level of Bitcoin interest by November 22-28.

When compared to Bitcoin’s all time data on Google Trends, peak interest for the cryptocurrency was still December 2017, when it reached an all-time high of just below $20,000.

The graph above shows that the current search volume for Bitcoin is less than 25% of 2017 figures. It suggests that Bitcoin is now as expensive as it was in 2017 but roughly only 25% of people are interested compared to last time.

Multiple crypto personalities on Twitter are describing the current rally as a “quiet” one.

A Quiet Rally

Multiple crypto personalities on Twitter are describing the current rally as a “quiet” one.

A recent report from investment firm Panterra Capital claims that PayPal, which recently allows its U.S. customers to buy Bitcoin, and Square, which put $50 million worth of Bitcoin in its reserves, are buying 100% of all the new Bitcoin supply. The firm said that if more larger institutions followed, there will be an even more supply scarcity for this increased demand.

“The only way supply and demand equilibrates is at a higher price,” the report concluded.

This article is first published on BitPinas: Google Trends for Bitcoin at its Highest This Year