2020 Bitcoin Halving Countdown, Why it Matters, and What Happens Next

The Bitcoin halving, which occurs every 4 years is set to happen around May 2020. The issuance of new bitcoin will decline by 50%.

Taking place around May 2020, the Bitcoin halving is a significant event wherein the number of bitcoins given during block rewards will again be reduced in half. Previously, it was 12.6. After halving, it will only be 6.25. This event happens every 4 years until all 21 million bitcoins are mined in the year 2140. We will explore the significance of the Bitcoin halving in a series of halving-related topics in this article.

Halving Hype Drives Spot Volumes

By staff writer

May 11, 2020 – On April 30, 2020, the second-largest daily trading on spot exchanges has been recorded. Cointelegraph reported that $66.2 billion worth of crypto assets changed hands on that day as Bitcoin rallied above $9,000.

According to Cryptocompare, 73% of these trades happened on what they classify as low-tier exchanges. Binance, OKEx, and Coinbase, however, represented 10.4% of the total trade.

Tether-BTC trades represented 74% of all trades between Bitcoin and stablecoins or fiat currencies.

Bitcoin Halving 101

By Evan Ezquer, BitPinas staff writer

April 28, 2020 – Many pundits expect that the forthcoming Bitcoin halving will cause an upsurge in the crypto market. But how likely is that going to happen? And should we buy now?

The halving is days away and opposing theories are sprouting from all directions. Some crypto proponents actually don’t agree that BTC will go up right after the halving. In fact, they think it’s the opposite.

All things considered, it is of utmost importance to get as much objective analysis on the situation before we should even consider making a move. Therefore, we should take a closer look at what we have so far.

Bitcoin Halving Guide

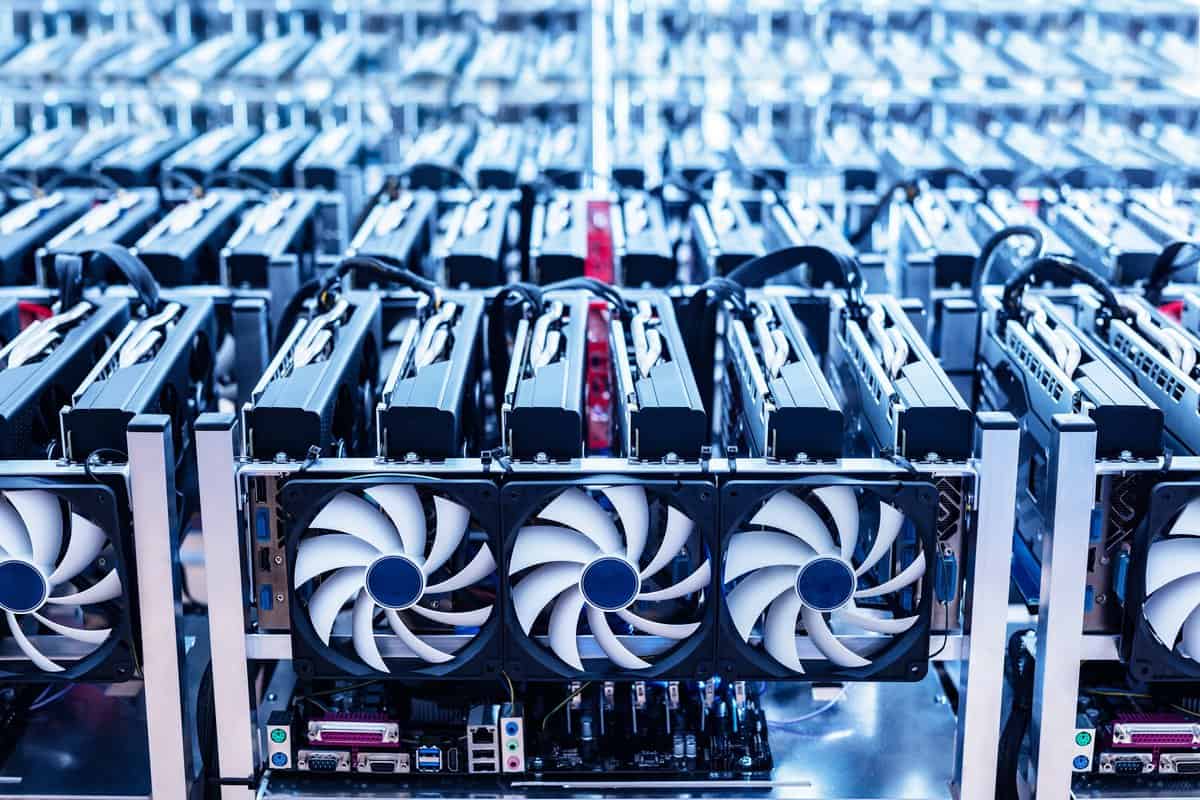

The Bitcoin blockchain is considered a non-inflationary financial system since its supply is capped (at 21 million). Right now, roughly 18 million BTC are in circulation but more are being generated through a minting process called mining.

Bitcoin mining is a process in which a multitude of miners attempts to solve a mathematical puzzle using special hardware. This occurs every 10 minutes and is an essential part of the network’s operations.

Every time a miner or mining pool successfully mines a block, they get to keep the newly-minted bitcoins as it enters circulation. This is known as the miner reward.

But miner rewards are not fixed. They halve every time 210,000 blocks are mined, which happens approximately every four years.

This is what we call the Bitcoin halving, popularized as the “halvening,”

Why the Halving Matters

The reason why the Bitcoin halving is such a big deal is that it lowers the minting rate of the BTC, which disrupts the supply and demand of the digital currency. To put it simply, the number of Bitcoins that are added to the market (supply) shrinks while the demand, in theory, remains the same.

With that in mind, the obvious conclusion would be that Bitcoin’s price should go up to balance the decrease in BTC emission. However, many crypto proponents don’t think it’s that simple, and that we should look into this crucial event a little deeper.

If so, how will the Bitcoin halving influence the crypto market? As with anything that affects price, opposing viewpoints are to be expected.

Previous Bitcoin Halvings

Two Bitcoin halvings have transpired in the past. With that in mind, we have two obvious hints on how the market might react to the 2020 halving; or not. It depends on who you ask.

The first halving occurred in November of 2012, with BTC fluctuating around $12 at the time.

As seen from the past chart, Bitcoin moved sideways for about 11 months before surging to $1,100 in November 2014.

The second halving took place sometime in July 2016.

BTC fluctuated around $600-$800 after the halving until the end of the year, until finally breaking above $1,000 in January 2017.

At that point, Bitcoin remained sideways, even falling back to the $800 region. Around August, it started moving more parabolic, reaching $6,000, then peaked at $20,000 in December 2017.

Looking back, we have witnessed Bitcoin skyrocket, not once, but twice, several months after a halving event occurs. They never happened immediately.

By deducing from past charts, one might conclude that Bitcoin will likely skyrocket again 6-12 months after the halving in May. But tread carefully.

As sensible as it sounds, some trading analysts refute this idea of using past charts to indicate future outcomes for the halving.

Why Past Halvings May Be Unreliable References

Trading analysts argue that before 2016, only a few major exchanges traded Bitcoin, which made it quite difficult to acquire the digital currency. With that in mind, market data during these times might not accurately reflect its true conditions.

Therefore, if we expect history to repeat itself, then we might be in for an unpleasant surprise. But let’s say these trading analysts are right, what then?

What else could be our basis for predicting Bitcoin’s movements post-halving?

How it will affect mining

As stated before, mining is an integral part of the Bitcoin system. And they happen to be the most affected by the halving. It is, after all, their main source of revenue.

If you were a miner and you knew your revenue is going to be halved sometime in the future, what would you do? Well, for those that could, they would likely prepare.

What usually happens is that mega-mining farms sell a portion of their bitcoins 10 to 12 months before the halving event. They do this to ensure that they can stay afloat even if Bitcoin’s price does not increase right away.

If it plays out this way, many small-time miners will likely be driven out of business post-halving, while the big ones endure depending on how much cash they can afford to burn while mining remains unprofitable.

The main concern is that most miners might go out of business and stop mining altogether. There are many theories stating that this could lead to Bitcoin’s death spiral, compromising the security of the network. But as of now, historical data and on-chain research contradicts the notion that a decline in mining revenues could actually trigger this.

And as of today, there are no noticeable negative impacts on Bitcoin’s hashrate, despite the upcoming halving.

In fact, it remains relatively high.

But how many miners can continue to operate? This is where the breakeven price comes in. A breakeven price in mining is simply the market value BTC has to maintain in order for miners to finance their daily operations.

And according to Tradeblock’s head of research John Todaro, the estimated breakeven price after the halving would be around $12,000-$15,000.

If he is right, then that means BTC will have to nearly double its current price (roughly $7,700) in order for miners to remain profitable.

Conclusion

We can’t be certain what’s going to happen to BTC after the halving. There are too many variables involved. This is exacerbated by the coronavirus pandemic, which some individuals consider a ‘Black Swan’ event — one that could render all our preconceived notions of the crypto market nearly irrelevant.

What we do know is that Bitcoin is more than likely to survive all this chaos, at least for a while. Whether it will go up or down, we must prepare for the worst. Plan your trades and trade your plans. That’s the best course of action.

“Bitcoin Halving” Google Trends Search Interest Highest in the Last 5 Years

April 15, 2020 – Google Trends represents “Interest Over Time”, which is the search interest relative to the highest point on the chart for the given period of time. A value of 100 is the peak popularity for the term. Below is the Google Trends search interest for Bitcoin Halving:

The worldwide search interest for Bitcoin halving has peaked relative to the previous halving that had occurred.

Top searches include “what is bitcoin halving” and “bitcoin price”, suggesting that a lot of searchers want to find out what it means and how it will affect the price of Bitcoin. Check out price of bitcoin in PHP here.

How the Bitcoin Halving will Affect Bitcoin Miners

February 20, 2020 – Research firm Tradeblock said the upcoming Bitcoin halving will trigger a doubling of costs for crypto miners.

The Bitcoin halving, which occurs every 4 years is set to happen around May 2020. The issuance of new bitcoin will decline by 50%.

Tradeblock

According to TradeBlock, currently, mining operators are operating on profit as bitcoin price increased in 2019 and especially these last 2 months. The other side of this is that the Hash Rate, the general measure of the Bitcoin network’s processing power, is also increasing – almost making new highs each week. If the hash rate increases, the resources needed to secure the network through mining activities also rise. For miners to maintain profit margins, if the hash rate rises, the bitcoin price must also rise.

Of course, miners will also be looking to reduce mining costs. This is normally done through using newer and more efficient mining devices. And in line with that, the cost to acquire these newer rigs must be taken into account.

Current Gross Cost to Mine Bitcoin

TradeBlock said that based on their research, the current gross cost to mine one bitcoin is $6,851. However, assuming that hash rate will increase over the next three months and assuming that many commercial mining operators will transition to newer mining rigs, the gross cost to mine 1 bitcoin will be $15,062. TradeBlock also said that if the hash rate stays at current levels, the the cost will be $12,525.

In summary, TradeBlock assumes that miners are expecting that bitcoin’s price will (must?) likely reach around $12,000 – $15,000 in order for them to continue generating profit. Or else, they will reduce their resources, which will result in a hash rate decline as profitability falls.

Source: TradeBlock

This article is published on BitPinas: [One Effect of Bitcoin Halving] Cost for Miners Will Double