SEC Issues Warning Against Sengre and its Crypto Coin Scheme

The Commission is advising the public not to invest in any investment scheme being offered by people allegedly for or on behalf of Sengre.

Following the advisory issued against Leefire/Leefire Limited/Leefire Ph/Leefire Philippines last April 26, the Securities and Exchange Commission published another warning to the public about transacting with “SENGRE.” The issuance was after the Commission found out that the illegal investment solicitation activities of Leefire are apparently being continued by Sengre with an identical scheme.

The SEC earlier issued an Advisory against Leefire for enticing the public to invest on its platform through “farming,” referring “friends,” and by their “LFC Coin” which they claim to be a crypto coin “expected to launch on mainstream exchanges.” (Read more: SEC Issues Warning Against Leefire Limited’s Enticing Investment Scheme)

What is Sengre? What is its investment scheme?

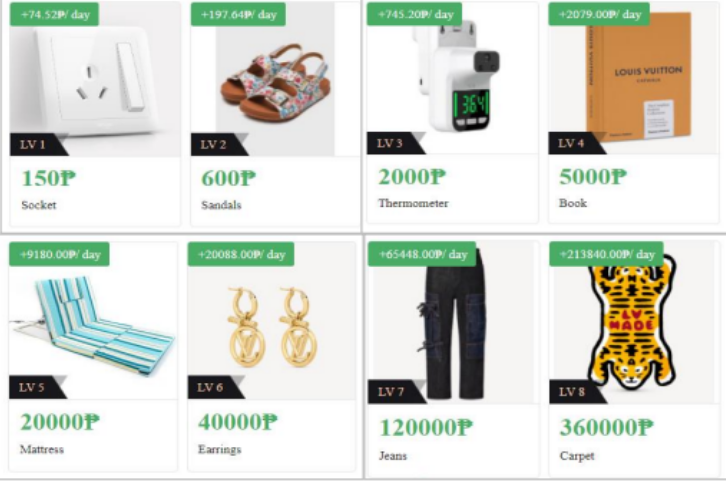

In Sengre’s case, the Commission said that it is offering investments to the public through the website, encouraging prospective investors to sign up through a personal mobile number or email address. After signing up, investors are promised to get a cash bonus of PHP 150 which can be used to buy corresponding levels of goods. Accordingly, users may earn more commission and rewards by accomplishing a higher-level of task. They can also get an additional earning of PHP 150 per friend if they are able to invite other people. The only difference between Leefire and Sengre’s offer was P30 for Leefire only promises a P120 sign up reward and invite reward,

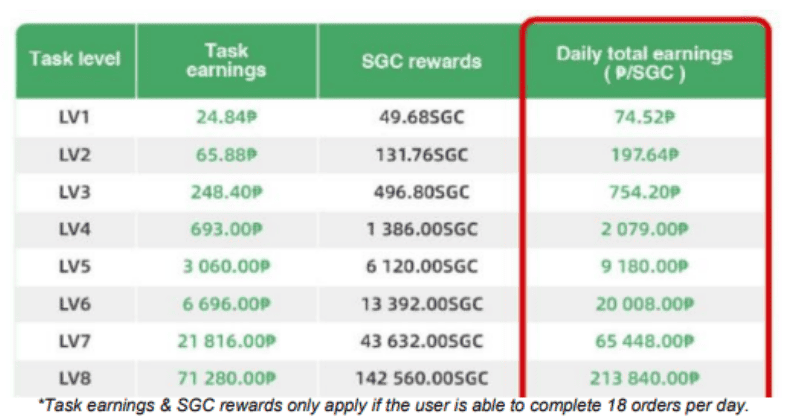

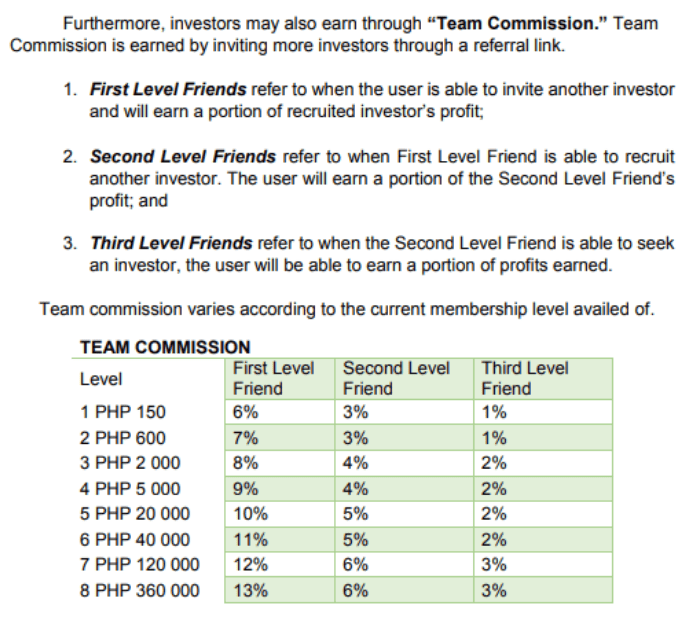

Sengre also has a tier for their products divided by levels, the initial cash bonus of PHP 150 is given to be used to buy the lowest level of product referred to as “level 1”. For level 2, level 3, level 4, level 5, level 6, level 7, and level 8 are priced at PHP 600, PHP 2 000, PHP5 000, PHP 20 000, PHP 40 000, PHP 120 000 and PHP 360 000, respectively.

What is the SEC Advisory on Sengre?

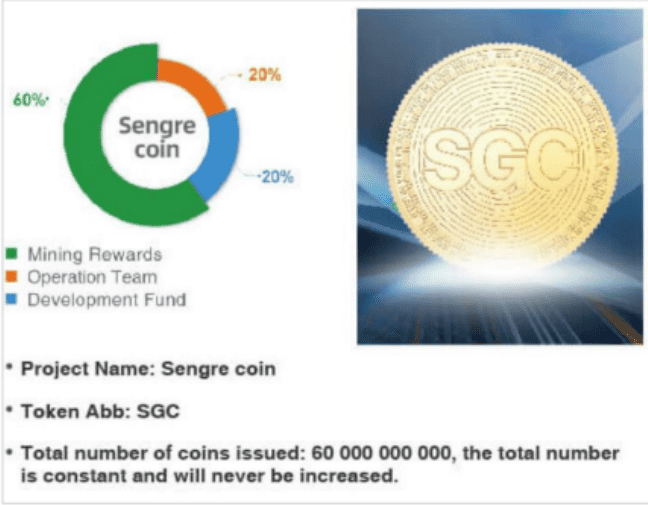

What is SGC Coin?

Sengre also asks its users to complete a “click farm task” and for every level, the investor should complete eighteen (18) orders per day to maximize earnings for each day. The SEC noted that users’ receive “SGC coin” for their expected income and withdrawable per order.

According to Sengre’s website, SGC will be launched on mainstream exchanges before 30 August 2022.

Just like Leefire, Sengre investors can also earn through their own version of “Team Share”: “Team Commision.” It is a reward earned by inviting more investors through a referral link.

More Details About Sengre’s Scheme

To top it off, Sengre also offers a level advance by topping up the amount needed to avail of the desired level. There are also two ways to top up; through mobile e-wallet Gcash (with a minimum amount of 500); and Coin recharging, which encourages Investors to top up with stablecoin USDT (Tether) in exchange with a five (5) percent (1% lower that Leefire’s) free cash when choosing this option to “recharge.”

Lastly, Sengre now has a higher minimum top-up value and return offer compared to Leefire’s minimum (₱2000), but with just an additional earning of approximately 30% up to 60% for premium products per day. If Sengre users are able to accumulate the top up value of the First Level Friend and reach a minimum of ₱3,000, the user may claim a maximum additional earning of approximately 60% to 98% for premium products per day.

The SEC noted that considering that the above-described schemes involved the sale of securities to the public, the Securities Regulation Code (SRC) requires that these securities are duly registered and that the concerned corporation and/or its agents have the appropriate registration and/or license to sell such securities to the public pursuant to Section 8 of the SRC.

“The records of the Commission show that SENGRE is not registered with the Commission either as a corporation or as a partnership. Further, it is NOT AUTHORIZED to solicit investments from the public since it has not secured prior registration and/or license from the Commission as prescribed under Sections 8 and 28 of the SRC.” – SEC

Moreover, the Commission emphasized that with Sengre’s promise to distribute its native cryptocurrency “SENGRE COIN (SGC)” in an apparent Initial Coin Offering (ICO), the SEC is apt to once again remind the public that in the SEC Advisory on Initial Coin Offerings and Virtual Currencies posted 08 January 2018, an ICO was defined as the first sale and issuance of a new virtual currency to the public usually for the purpose of raising capital for start-up companies or funding independent projects.

The SEC pointed out that depending on the facts and circumstances surrounding SCG Coin’s issuance, “some of these new virtual currencies follow the nature of a security as defined by Section 3.1 of the Securities Regulation Code (SRC) whereby a person invests money in a common enterprise and is led to expect profits primarily from the efforts of others.”

“The same goes for the SENGRE COIN (SGC) where SENGRE seeks to use the money it gathered from the public to fund its purported project on the promise of profits. Hence, since what is being offered by SENGRE are securities, Section 8 of the SRC requires that all offers and sales of said securities must be duly registered with the Commission and SENGRE and/or its agents must have appropriate registration and/or license to offer and/or sell such securities to the public,” the Commission explained.

Consequently, the SEC notes that Sengre is not registered as a Virtual Asset Service Provider (VASP) with the Bangko Sentral ng Pilipinas (BSP) and does not have a corresponding certificate of authority as a Money Service Business (MSB) required under the Guidelines for Virtual Asset Service Providers (BSP Circular No. 1108, Series of 2021). Also, Sengre’s name does not appear among those listed as registered MSBs as of January 2021 with the Anti-Money Laundering Council under the Anti-Money Laundering Act, as amended.

Therefore, the Commission is advising the public not to invest or stop investing in any investment scheme being offered by any individual or group of persons allegedly for or on behalf of Sengre.

Aside from Leefire, the SEC also flagged and warned the public against eight crypto trading and play-to-earn entities; YDYS Trading, MetaProfit, Autotrade International, Crypto Asset, CryptoStakers, CryptoPayz, Future Farming, and Outrace Play-to-earn.

The SEC together with Commissioner Kelvin Lester Lee emphasized that investors must be cautious in dealing with digital and cryptocurrency investments. (Read more: SEC Advises Public to be Cautious on Crypto Investments)

This article is published on BitPinas: SEC Issues Warning Against Sengre and its Crypto Coin Scheme

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.