Weekly Wrap-Up: Surge in Interest in Crypto Mining (March 22, 2021)

Crypto mining operations are buying more crypto mining rigs. Plus retail investors are buying more crypto.

Good morning. Welcome to Monday Markets Wrap-up, part of our new series: BitPinas Daily. We will look back at all the major news and updates that happened this week. Crypto is global, but sometimes news that matters happens while we sleep. So we bring to you what’s happening in our space here and abroad. We highlight three to four important news of the past week and list down the rest.

Market Price as of March 22, 2021:

| Bitcoin | $57,574 | -1.37% |

| Ethereum | $1,790.38 | -1.47% |

| BNB | $265.05 | -0.08% |

| DOT | $36.77 | -1.95% |

| ADA | $1.19 | -1.65% |

| SLP | $0.07 | +3.5% |

Bitcoin closed March 21, 2021, at $57,574 per BTC. We’re down 4% in the last 7 days and up 96% since the year began. This is also 6.7% below the all-time high of $61,711, which was hit on March 13, 2021.

Bitcoin’s market capitalization stands today at $1,066,136,778,936 which is 58% of the entire cryptocurrency market. The entire crypto market, by the way, now has a market cap of $1,817,259,608,772 (-2%).

On the table above, there’s the cryptocurrency SLP. If you wonder what that is, check out this article: Playing Axie Infinity vs Minimum Basic Salary in the Philippines.

Crypto Mining

Surge in Interest in Crypto Mining

It is no wonder that after the increase in just about anything in this space, firms and everyone turn their attention to mining – the point in the ecosystem where Bitcoin and crypto get created.

The9 Limited, a Chinese gaming company listed in the Nasdaq is reportedly buying 24,000 Antminer S19j, the total cost of the purchase is $120 million. S19j is Bitmain’s latest mining equipment model prices at around $5,000.

Blockcap, a North American mining firm, has purchased 12,000 Antminer S19 machines, the total cost of the purchase is $33 million. Each S19 is priced $2,800. This is Blockcap’s additional purchase since it bought 10,000 S19 miners last month to double its hashrate.

Blockcap’s aim is to make the U.S. a global player in the bitcoin mining space. China corners 65% of the industry.

In a bid to increase their hashrate, even old mining rigs are being bought by mining operations. Chinese firm 500.com bought older machines to scale up their operations. Another publicly traded Bitcoin mining firm Bitfarms has parched 48,000 new machines from MicroBT to expand its hashrate.

Such behavior from mining firms, analysts said, may indicate that the miners are expecting more growth in the industry moving forward.

And we’re not even touching Ethereum mining:

AMD

AMD Refuses to Limit Cryptocurrency Mining

Truth be told, for the first time, I wanted to go down the rabbit hole of PC gaming. But it turns out I can;t do that. The graphics cards are being hoarded by cryptocurrency miners, so that means the PC master race cannot welcome me for now.

Nvidia announced before that its GPUs will have a “limiter” to prevent it from being used for mining. (However, Nvidia also “accidentally” released a workaround to that limiter. The keyword is “accidental”. Yeah right.

So will AMD do something similar? Create a limiter to prevent their GPUs to be used in mining?

“The short answer is no,” Nish Neelalojanan, a product manager at AMD, said about its Radeon RX 6700 XT. He did say the following:

“That said, there are a couple of things. First of all, RDNA was designed from the ground up for gaming and RDNA 2 doubles up on this. And what I mean by this is, Infinity Cache and a smaller bus width were carefully chosen to hit a very specific gaming hit rate. However, mining specifically enjoys, or scales with, higher bandwidth and bus width so there are going to be limitations from an architectural level for mining itself.”

Yeah right, with crypto prices skyrocketing, and GPU is better than none at all. Even if prices are at double the SRP will still be worth it.

And for those saying that the GPU scarcity will be over once Ethereum switches to proof-of-stake, the reality is that it’s possible for the miners to just switch to other proof-of-work coins that are in demand.

Batman

DC Comics Exploring NFT

In a letter to freelancers penned by the company’s senior vice president of legal affairs, DC is exploring opportunities to enter the NFT market.

“DC is exploring opportunities to enter the market for the distribution and sale of original DC digital art with NFTs including both new art created specifically for the NFT market, as well as original digital art rendered for DC’s comic book publications.”

Banks

Morgan Stanley to Offer Rich Clients Access to Bitcoin Funds

Morgan Stanley is planning to offer wealthy clients access to three funds that will enable ownership of Bitcoin. The first two funds will be managed by Galaxy Digital while the third is by FS INvestments and NYDIG.

“Only wealthy clients with “an aggressive risk tolerance” and at least $2 million held by the New York-based firm will have access to the funds.”

Crypto is, of course, for everyone. It was the first time anyone could participate and invest in. Coins.ph or BloomX will allow one to invest as little as Php 100. So no worries if we can’t access these funds from Morgan Stanley!

Speculations

eToro’s CEO Speculates on What’s Driving the Crypto Bull Market

Yoni Assia, the CEO of eToro, thinks there are multiple factors at play as to why Bitcoin and the entire crypto markets are still in a bull run.

First is the current economic situation in the United States coupled with the COVID-19 pandemic in the background. “We’re seeing unprecedented monetary and fiscal sort of reactions from federal governments all around the world leading to zero interest rates, and even negative interest rates in some places.”

But fiscal stimulus is not unique to the United States, many other countries are doing it as well: ““We’re seeing an unprecedented amount of money being printed by governments all around the world — some of them in a very unique and new concept of direct stimulus checks to consumers.”

Now that people are worried their fiat money might get devalued more in the future, it’s understandable that many of them are looking into crypto, specifically Bitcoin, because of its fixed supply, coupled with scarcity and high demand. Check out Yoni’s interview here.

Coinbase

Coinbase Fined $6.5 Million Over Trading Irregularities

The Commodity Futures Trading Commission has announced that Coinbase agreed to pay $6.5 million to settle with the regulator over allegations on how it recorded trades on Coinbase’s GDAX platform from 2015 to 2018. GDAX is now known as Coinbase Pro.

“The agency points in particular to activity related to two in-house software programs used by Coinbase known as the Hedger and Replicator. The CFTC alleges that, in some instances, those software programs effectively traded with each other, which may have served to artificially inflate prices and trading volumes on the GDAX platform.”

Read more on this issue here.

Retail Investors

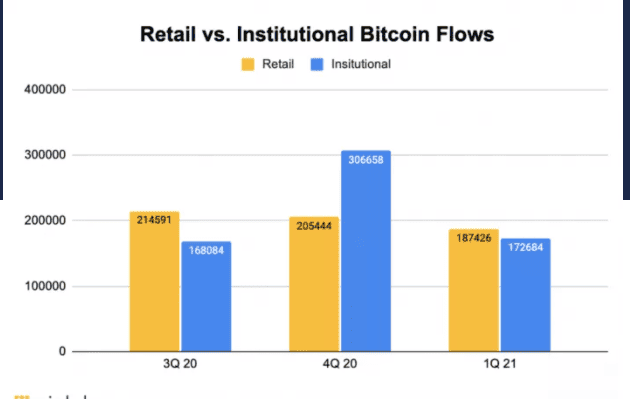

Retail Bought More Bitcoin Than Institutions Did in Q1 2021

According to a report from JPMorgan, retail investors have powered the recent rally to $60,000. Retail purchased 187,426 bitcoins this quarter versus institution’s 172,684. The number may be close, but that’s still a 14,742 difference ($797,483,379).

Looking at this chart however, it is clear that retail buys have gradually declined in the last three quarters and that institutions just returned to their usual volume.

Feature: Having a Bias For Action

In celebration of Women’s Month and in collaboration with Microsoft, BitPinas produced articles featuring women driving change in the Philippines and using their skills and platforms to build a more inclusive future for young women and starting entrepreneurs.

Katrina Rausa Chan said that young entrepreneurs should be continuously proposing and testing new things and gaining something from that whole process. “Judging whether you succeeded or failed is not just about ‘did my company get an investment.’ Building a company or joining a startup is almost better than getting an MBA. You get exposed right away to all sorts of roles. You’re in the position to make decisions and see things happen very quickly. That’s something I hope young people would focus on more. You learn a lot just from going through the process.”

Kat is engaged with Microsoft and their startup initiatives, which aims to help B2B startups scale their companies successfully in the Philippines and globally. Startups can build on platforms like Microsoft Azure, as well as leverage Microsoft’s in-house training, mentorship support, and network of long-standing enterprise clients. In this way, the enterprise gets access to the latest innovative technologies while the emerging startups are able to de-risk their journey and get traction. To learn more about this program, visit the Microsoft for Startups Initiative Website.

What else is happening

- Literary World Is Latest to Embrace NFTs

- Latin America’s first bitcoin ETF receives approval in Brazil

- Canadian Firms to Develop Bitcoin Mining Facility Partly Powered by Wind, Solar

- If Stock-to-Flow Is Right, Bitcoin Volatility Should Wane

- Over 6,000 XRP holders volunteer as third-party defendants in SEC lawsuit

- DeFi Projects Cream Finance, PancakeSwap Hit With ‘DNS Hijacks’

- Suspicions raised as Alameda Research denies affiliation with Reef Finance

- Korean Crypto Trading Volume Has Surpassed The National Stock Exchange

This article is published on BitPinas: Weekly Wrap-Up: Surge in Interest in Crypto Mining (March 22, 2021)