Coinbase Seeks Help from Court to Oblige SEC to Respond Over Rulemaking Petition

A clear and functional regulatory framework for digital asset securities is necessary to establish a well-functioning market, said Coinbase.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

- Coinbase has appealed to the federal court to intervene and prompt the SEC to provide more explicit regulations on cryptocurrency, nine months after submitting a rulemaking petition requesting the regulator to develop and implement rules for securities in digital assets.

- A clear and functional regulatory framework for digital asset securities is necessary to establish a well-functioning market for these assets, facilitate the use of digital asset securities, and allow for the efficient allocation of capital in financial markets, the exchange argued.

- According to Coinbase’s Chief Legal Officer, the appeal is only to make the SEC respond yes or no to their petition, as the rulemaking process is a critical step in giving the public notice about what activities they can and cannot engage in. The SEC has not yet answered the court’s appeal and the petition.

Nine months after it sent its petition for rulemaking, cryptocurrency exchange Coinbase has appealed to the federal court to intervene and prompt the U.S. Securities and Exchange Commission (U.S. SEC) to respond even “yes or no.”

The Petition

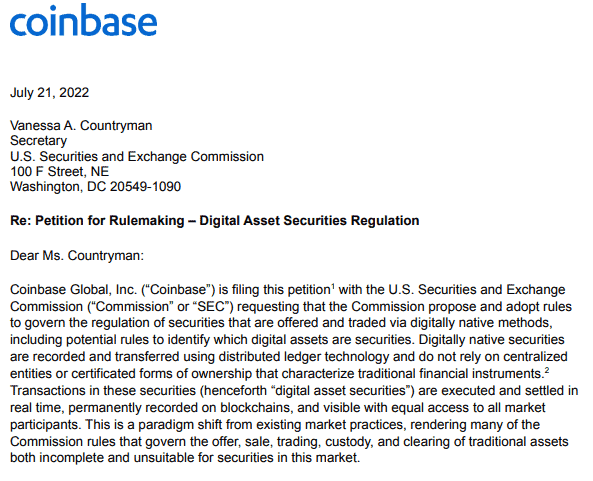

In July 2022, Coinbase submitted a rulemaking petition to the U.S. SEC, requesting the regulator develop and implement rules for securities in digital assets.

“Coinbase Global, Inc. (“Coinbase”) is filing this petition with the U.S. Securities and Exchange Commission (“Commission” or “SEC”) requesting that the Commission propose and adopt rules to govern the regulation of securities that are offered and traded via digitally native methods, including potential rules to identify which digital assets are securities,” the petition read.

A petition for rulemaking is a type of request that allows people, companies, states, local governments, and federally-recognized tribes to ask agencies to adopt, revise, or withdraw existing regulations.

This time, Coinbase has submitted this request because “the U.S. does not currently have a functioning market in digital asset securities due to the lack of a clear and workable regulatory regime.”

The 32-page petition also asks the SEC 50 specific questions, aiming to obtain clarity and certainty on how digital asset securities will be regulated.

According to Coinbase Chief Legal Officer Paul Grewal, who is also the lone signatory of the petition, the health of the US capital markets can be improved by responding to questions and establishing new regulations pertaining to digital asset securities.

The petition also advocates for the creation of new rules that will facilitate the use of digital asset securities, allowing for the efficient allocation of capital in financial markets.

As of this writing, the SEC has yet to answer the court’s appeal and the petition.

Coinbase’s Position

In a blog, Grewal stated that their appeal was only to make the SEC respond yes or no to their petition.

“The Administrative Procedure Act (APA) requires the SEC to respond to Coinbase’s rulemaking petition ‘within a reasonable time.’ If the SEC says no to our rulemaking petition, which it has the right to do, then Coinbase would be allowed to challenge that decision in court and explain in that formal setting why rulemaking is required. So it’s important for the SEC and any other agency petition for rulemaking to respond to the petition once the agency has made up its mind, especially if the answer is no; otherwise the public can never exercise its right to ask a court if the agency’s decision was proper,” he said, pointing out that the crypto industry urgently requires regulatory clarity, which has been overdue for some time.

In addition, Grewal emphasized that Coinbase takes regulatory litigation seriously, particularly when it concerns one of their regulatory bodies. But despite not receiving any guidance from the SEC on how they believe the law applies to their business, Coinbase and other crypto companies are potentially facing regulatory enforcement actions:

“The rulemaking process is a critical step to giving the public notice about what activities they can and cannot engage in. So until the crypto industry gets that clarity, we will continue to take every step available to us to seek it, which includes today’s filing. We also remain available to the SEC and all of our regulators for dialogue at any time on these issues.”

The Love Stories of the U.S. SEC and Crypto Firms

The Commission has been actively going after cryptocurrency entities recently.

Last February, Terraform Labs, and its co-founder and CEO, Do Kwon, were sued by the US SEC for allegedly engaging in multi-billion dollar securities fraud related to an algorithmic stablecoin and other crypto asset securities.

The SEC also filed a lawsuit against Paxos, a blockchain and trust company, over the issuance of their stablecoin Pax Dollar (USDP) and Binance USD (BUSD) tokens, which the SEC claims to be in violation of investor protection laws.

Last year, it also planned to launch an investigation into Binance, a cryptocurrency wallet and exchange, over its 2017 initial coin offering of the BNB token, which currently ranks as the fifth largest in the world.

Kraken, a cryptocurrency exchange, has settled with the SEC after being charged for failing to register its “crypto asset staking-as-a-service program” with the commission. As part of the settlement, Kraken will pay $30 million in disgorgement, prejudgment interest, and civil penalties, and will stop its staking activities.

This article is published on BitPinas: Coinbase Seeks Help from Court to Oblige SEC to Respond Over Rulemaking Petition

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.