Is Ether a Security or a Commodity? YGG, Binance Execs Weigh In at Bloomberg Event in Manila

Philippine crypto leaders stressed the need for new regulatory categories for cryptocurrencies and virtual assets.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

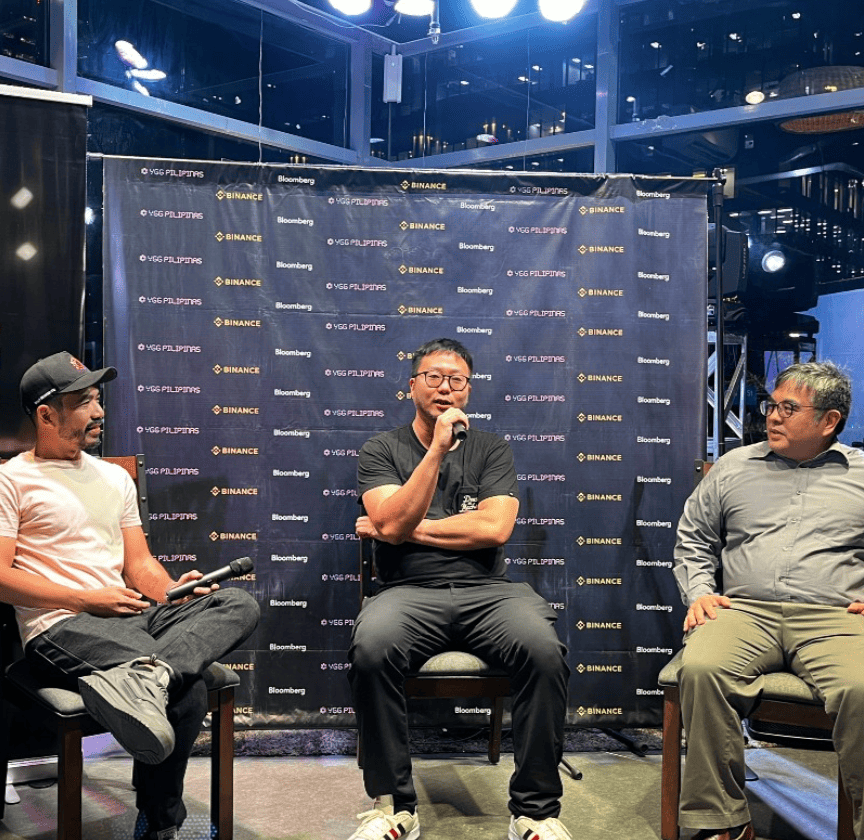

- Crypto leaders Leon Foong of Binance and Luis Buenaventura of YGG Pilipinas discuss Ether’s classification as a security or commodity at a Bloomberg event in Taguig, following the US SEC Chairman Gary Gensler’s refusal to provide a definitive answer on the matter.

- Buenaventura proposes that Ether may not fit neatly into existing categories and calls for the creation of new classifications for emerging technologies like cryptocurrencies, while Foong mentioned about classifying Ether as a commodity based on recent CFTC reports.

- Both industry experts stressed the importance of a proper understanding and classification system for cryptocurrencies and virtual assets to guide regulatory efforts as the crypto industry continues to evolve and expand.

Leon Foong, Director of Asia Pacific (APAC) at Binance, and Luis Buenaventura II, Country Manager at YGG Pilipinas, shared their insights on whether Ether should be classified as a security or a commodity, at a recent Bloomberg event co-organized by both companies in Taguig.

The discussion came on the heels of a U.S. House Financial Services Committee hearing, during which the U.S. Securities and Exchange Commission (U.S. SEC) Chairman Gary Gensler refused to provide a definitive answer to the same question, repeatedly stating that, though “all securities are commodities under the Commodity Exchange Act,” classifying Ether still “depends on the facts and the law.”

Ether’s Classification: Perspectives from Industry Experts

Binance APAC Head: The Need for Precise Language and Terminology

Foong expressed his belief that Ethereum serves as a fundamental security layer as well as an incentive layer, driving growth and utility beyond investment returns.

Referring to recent CFTC (U.S. Commodity Futures Trading Commission) reports, he said, “I think they very much classify Ether as a commodity.” He also emphasized the importance of understanding the differences between various types of coins and having the right terminology to classify virtual assets.

Foong elaborated on the need for precise language and terminology, stating, “For us to actually have the right dictionary, actually have the right classification of terms, actually really affects the way we think.” He compared the evolution of crypto terminology to the historical development of languages and the importance of context when classifying different assets.

YGG Pilipinas Country Manager: Neither a Commodity nor a Security

Buenaventura, however, suggested that Ether might not fit neatly into existing categories.

“I think that Ethereum is neither a commodity or a security, but it is also both a commodity and security,” he said, suggesting the need for creating new categories for emerging technologies like Ether, as traditional regulatory approaches may not be suitable.

The YGG Pilipinas Chief also explained the reason for having new categories, saying, “We’re inventing stuff at a pace where regulators are basically trying to see if they can still retrofit old thinking onto new tech.”

He also mentioned that this issue is not exclusive to the crypto industry and might also surface when dealing with AI regulation:

“I don’t think that works in the first few iterations of a new industry.”

Why is There Even a Debate on Ether

Whether Ether should be treated as a security or as a commodity has become a hot topic, especially as the Ethereum network recently transitioned to proof-of-stake. In proof-of-stake, there are validators that secure the network, and they “stake” the ETH they already have to do this. They are incentivized for doing so in the form of new ETH minted as well as transaction fees.

The debate stems from the fact that Ether has characteristics of both. As a security, Ether’s value could be seen as tied to the performance of the Ethereum network, while as a commodity, it serves as a medium of exchange within the network.

The distinction is crucial because securities and commodities are regulated differently in the U.S. and in many other countries. In the U.S., securities fall under the jurisdiction of Gensler’s SEC, and commodities under the CFTC.

There will also be immediate repercussions if Ether is classified as a security. For example, all cryptocurrency exchanges where Ether is available might immediately be in violation of regulations related to listing securities without proper registration from the authorities.

The contrasting statements made by the CFTC and the U.S. SEC contribute to the lack of clarity on the matter. John Lagman, Bloomberg’s Crypto Lead, commented:

“In the U.S, you have the CFTC and SEC at times saying different things. I think there’s a lot of people talking but not a lot of clarity. So it’s gonna be a fluid situation. In other markets, sometimes, they do this. I think what they want to see is that, if you keep things kind of vague, they want to see what people do, so that the people that step out of the line, and probably don’t like, they will probably slap on the wrist,” Lagman said, suggesting that regulators intentionally maintain ambiguity to observe how people react, keep an eye on those who cross the line or engage in unfavorable practices, and take corrective action, such as issuing a warning.

The Need for a More Nuanced Approach

Both Foong and Buenaventura agreed on the importance of developing a proper understanding and classification system for cryptocurrencies and virtual assets to reflect their unique characteristics and to help guide regulatory efforts.

Buenaventura ended the talk by saying that eventually, newer rules might be in place:

“I think that eventually we’ll just have to come up with new categories for this stuff. We’re not there yet, and that’s why none of these regulations seem to really fit.”

This article is published on BitPinas: Is Ether a Security or a Commodity? YGG, Binance Execs Weigh In at Bloomberg Event in the Philippines

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.