Finance Secretary Mulls Imposing Tax on Digital Transactions

The former Bangko Sentral ng Pilipinas (BSP) Governor insisted that digital transactions should be taxed on the basis of fairness.

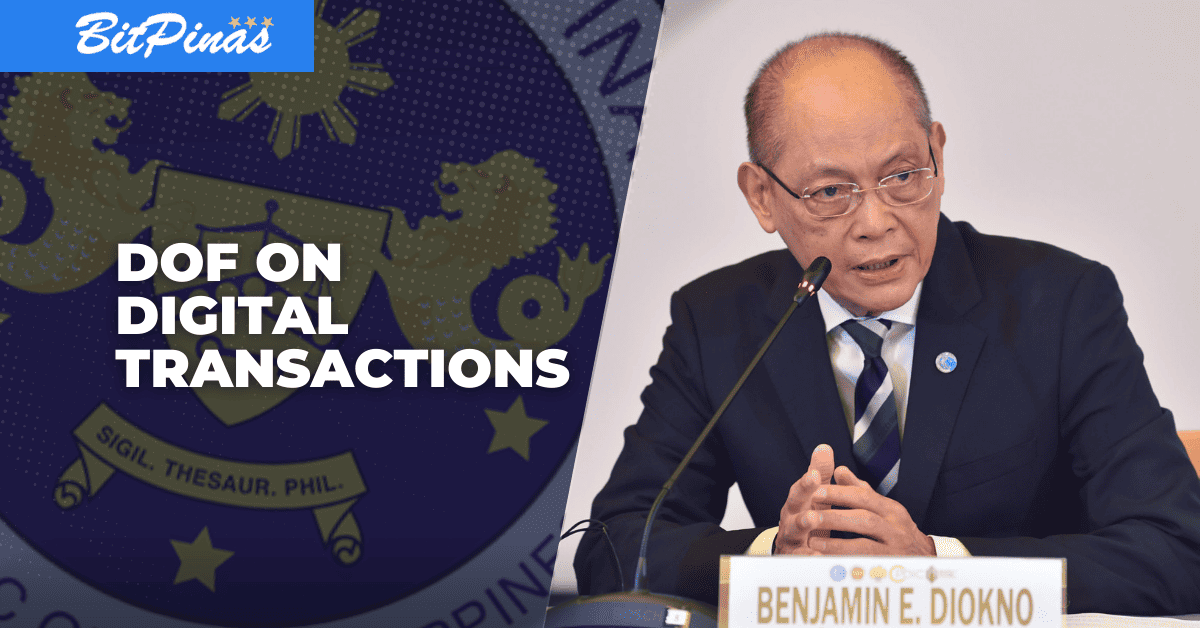

Department of Finance (DOF) Secretary Benjamin Diokno in a press conference on Wednesday hinted at adding taxation on digital services, stating that it is fair to tax digital transactions like how physical transactions are taxed.

“Kasi if you’re going to buy sa regular stores, (nagbabayad ka ng) tax eh. Bakit naman ‘pag (sa) digital (transactions), hindi ka magta-tax, hindi ba?” said Diokno.

[“If you are going to buy in regular stores, taxes are imposed. So why will you not impose a tax on digital transactions?]

The former Bangko Sentral ng Pilipinas (BSP) Governor insisted that digital transactions should be taxed on the basis of fairness.

It should be noted that the Department of Finance under the previous administration of President Rodrigo Duterte proposed a last-minute tax reform that included new (with clear guidelines) tax on digital goods, including cryptocurrencies. At that time, Diokno, who was already announced to be the next DOF chief, disagreed with the proposals. He noted that must first prioritize tax administration.

He also remarked that those people who avail digital services are those that are in the upper class of society, “If you really think about it, ‘yung mga nakakaangat ang siyang nakakakuha ng mga ganyan, (nakakapag-avail ng mga) digital payment.”

[“If you really think about it, those who are in the upper class are the ones that can avail digital payment.”]

Diokno, 74, though not yet confirmed by the Commission on Appointments, will serve as the Finance Chief under the newly sworn-in Marcos Administration.

[Learn more about DOF Secretary Benjamin Diokno here.]

Before assuming the office, he said that his goal is to attain an A-level credit rating, which can be achieved by improving tax administration and adopting a fiscal consolidation framework.

Diokno also stressed that a taxpayer-friendly system will be prioritized in his leadership.

There are two tax packages remaining on the reform program that the Duterte Administration started, which the Secretary sees to be implemented next year.

“I think ang estimate no’n is that, it is supposed to be revenue-neutral – walang additional revenues na makukuha dun. But it will simplify a lot (in) the tax system. So, we will push for that. And then we expect that to be approved before the end of the year. And it will be implemented next year,” Diokno added.

[“I think the estimated scenario is that it is supposed to be revenue-neutral – no additional revenues will be gained there. But it will simplify a lot in the tax system. So, we will push for that. And then we expect that to be approved before the end of the year. And it will be implemented next year.”]

During his term as the BSP Chief, the Central Bank approved a digital banking framework to allow digital banks to operate in the country, and granted Virtual Asset Service Providers (VASP) licenses to fintech firms to engage in cryptocurrencies during his term.

As BSP chief, Diokno was the key decision-maker when it came to rules and regulations regarding cryptocurrency in the Philippines. Under his watch, the BSP increased the number of licensed virtual currency exchanges to 19 and made central bank digital currency (CBDC) a priority, to be implemented via a pilot this fourth quarter of 2022.

This article is published on BitPinas: Finance Secretary Mulls Imposing Tax on Digital Transactions

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.