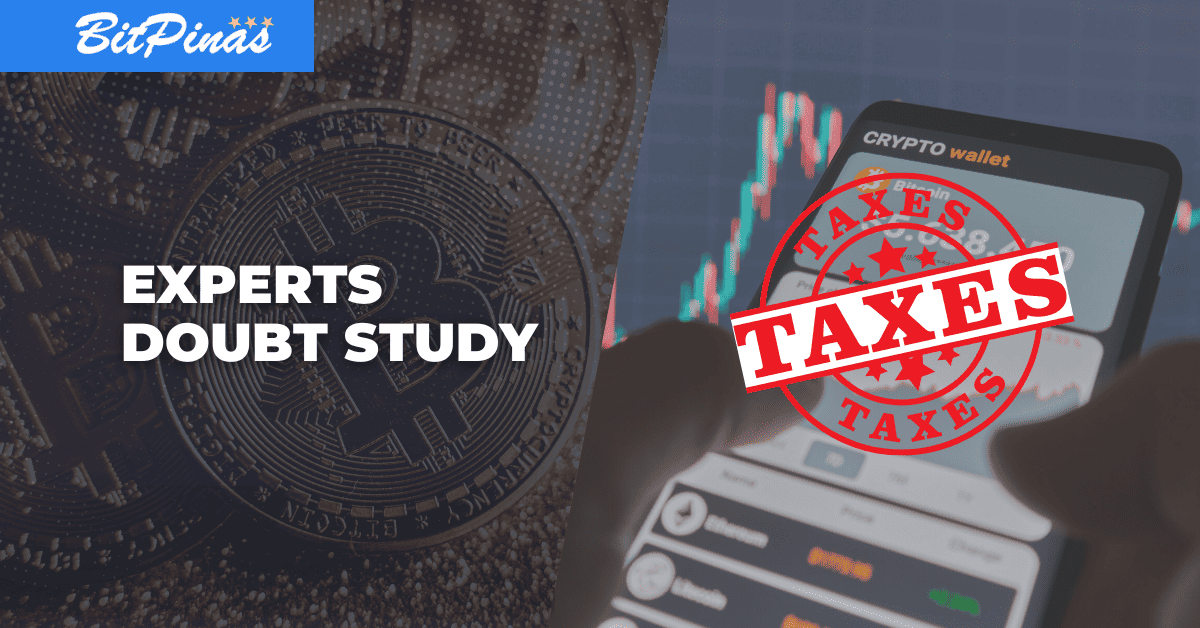

PH Has Lowest Tax Compliance Rates According to Study, But Experts Doubt the Report’s Accuracy

Explore Divly’s controversial Global Cryptocurrency Taxation Report, which claims only 0.5% of crypto investors paid taxes in 2022, and learn why tax experts question its accuracy.

Subscribe to our newsletter!

- Divly’s Global Cryptocurrency Taxation Report reveals that only 0.5% of global crypto investors paid taxes in 2022, with the Philippines having one of the lowest rates at 0.03%.

- Tax experts raise concerns about the study’s accuracy, questioning its methodology and reliance on search volume data to estimate tax compliance rates.

- The Philippines currently lacks specific cryptocurrency tax regulations, although the Department of Finance proposed a crypto tax by 2024, and a working group was formed to study digital asset taxation.

Despite the fact that major local crypto wallets and exchanges, Coins.ph and PDAX, reported having 16 million and 800,000 users by the end of 2022, respectively, only 0.03% of Filipino crypto HODLers are said to pay their taxes on their cryptocurrency holdings, a study by Swedish crypto tax firm Divly revealed.

Divly’s Global Cryptocurrency Taxation Report 2022

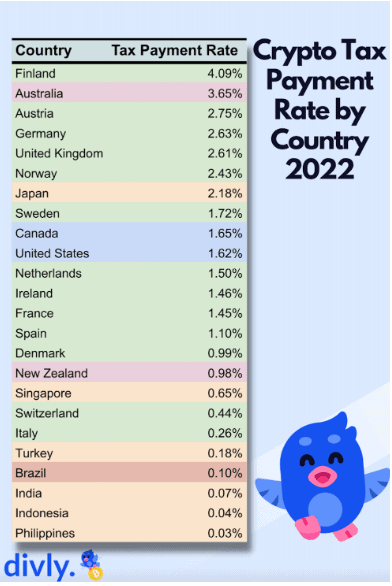

The report revealed that 99.5% of global crypto investors have not paid taxes on their cryptocurrency holdings in 2022. As per their data, only a mere 0.53% rendered their dues—with the Philippines having the lowest rates of tax-paying crypto investors of just 0.03%.

According to the report, Finland had the highest percentage of crypto investors who paid their taxes at 4.09%, followed by Australia at 3.65%. The United States ranked 10th with approximately 1.62% of crypto holders paying taxes. Along with the Philippines, countries India and Indonesia have the lowest taxpayer rate, with 0.7% and 0.4% respectively.

According to think tank Houbi Research, the number of crypto users worldwide is approximately 320 million as of November 2022. Following the data from Divly, the crypto investors that filed their taxes last year only amounted to around 1,696,000 payors.

Tax Experts’ Concern on the Study’s Accuracy

Tax experts have raised concerns about the accuracy of the figures and methodology used in the report. To get the data, the study estimated the number of individuals who declared cryptocurrency on their tax returns in different countries by analyzing the correlation between tax declarations and search volume for crypto tax-related keywords. It also considered the number of crypto holders in each country based on Statista’s Global Cryptocurrency Report.

“It is likely that 99.5% is not reflective of countries that have specific crypto tax guidance and strict compliance requirements such as the USA, Canada, Australia and India,” global head of tax at crypto tax software Koinly Danny Talwar told Cointelegraph.

Experts noted that the study’s methodology is questionable as it relies on search volume data, which may not accurately reflect the actual number of crypto taxpayers.

In addition, the report itself acknowledges that not everyone who pays taxes searches for crypto tax-related information online. Moreover, the research also assumes that search volume related to crypto tax reporting is consistent across countries, which may not be true, as the quality of internet accessibility varies from country to country.

State of Crypto in the Philippines

According to the online publication Coin Journal, the Philippines is the eighth country with the most crypto owners globally—with a total of 6,986,919 Filipinos in the space. Moreover, they also ranked the Philippines as the 16th most successful cryptocurrency country in the world, noting the country’s 46 financial services startups focusing on blockchain technology and 34 crypto companies–which produced an estimated gain of $989.86 million in the crypto industry. (Read more: 7 Million Pinoy Hodlers: Philippines in Top 8 for Crypto Ownership)

However, these numbers may be lower than the current total of crypto owners in the Philippines as the local virtual asset service providers (VASP) have been continuously growing.

By the end of 2022, homegrown exchange Philippine Digital Asset Exchange (PDAX) revealed that it has reached 800,000 users–it supports a total of 37 cryptocurrencies. On the other hand, in November 2022, e-wallet and crypto exchange Coins.ph disclosed it has 16 million users. Its application currently has 24 available coins for trade while Coins Pro — which allows users to directly trade cryptocurrencies using Philippine Peso — currently has 32 available trading pairs on its platform.

Mobile e-wallet Maya — which launched Maya crypto in April 2022 — has 50 million registered users as of October 2022. Users can trade 10 cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Polygon (MATIC), and others.

Recently, fintech firm Gcash unveiled GCrypto and other new features during its Futurecast Summit. It has 77 million registered users. (Read more: Beginners Guide to GCrypto | How to Buy & Sell Crypto on GCash)

State of Crypto Taxation in PH

In the Philippines, there are still no definite and specific cryptocurrency tax implemented. However, it can be remembered that in May last year, the Department of Finance (DOF) submitted a proposal regarding taxation on cryptocurrency by 2024. In 2018, the DOF expressed its desire to explore utilizing blockchain technology for its tax collection, transparency, business, and extermination of illegal smuggling. (Read more: Dept. of Finance Proposes Crypto Tax by 2024 in the Philippines)

In August 2022, Rep. Joey Salceda, as Chairman of the Ways and Means Committee, shared his plans to create a group that would study the possibility of taxing digital assets like cryptocurrencies and non-fungible tokens (NFT). As of writing, there are no updates regarding the study group. Prior to this, in 2020, Salceda also filed the House Bill 7864 or the “Blockchain Digital Technology Act” which aims to identify the uses of blockchain technology and encourage its use in the broader economy.(Read more: Solon Will Form Working Group to Study NFT, Crypto Taxes)

In the same month, both the Bangko Sentral ng Pilipinas (BSP) and the Securities and Exchange Commission, asked the legislation to draft bills regulating digital assets. The BSP wants to draw lines on the regulations on digital assets and space while the SEC requests to have specific jurisdictions to regulate the said assets.

Last July, DOF Secretary Benjamin Diokno hinted at adding taxation on digital services, noting that it is fair to tax digital transactions like how physical transactions are taxed.

In 2021, during the crypto bull run and the rise in popularity of the popular play-to-earn NFT game Axie infinity, the DOF and the Bureau of Internal Revenue (BIR) stated that the earnings Filipinos get from playing online games are taxable. (Read more: BIR, DOF are Looking Into Axie Infinity, Earnings are Taxable says Finance Undersecretary)

So far, there are still no filed bills or resolutions regarding crypto tax regulation in the country. Tax expert Mon Abrea commented last year that Philippine financial agencies and regulators must first implement a defined mechanism for cryptocurrency before proper taxes can be collected from it. According to him, the Philippine tax code is all-encompassing and there is no clear guideline. (Read more: Crypto Tax PH: No Clear Rules But Tax Code is All-Encompassing, Says Tax Expert)

This article is published on BitPinas: PH Has Lowest Tax Compliance Rates According to Study, But Experts Doubt the Report’s Accuracy

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.