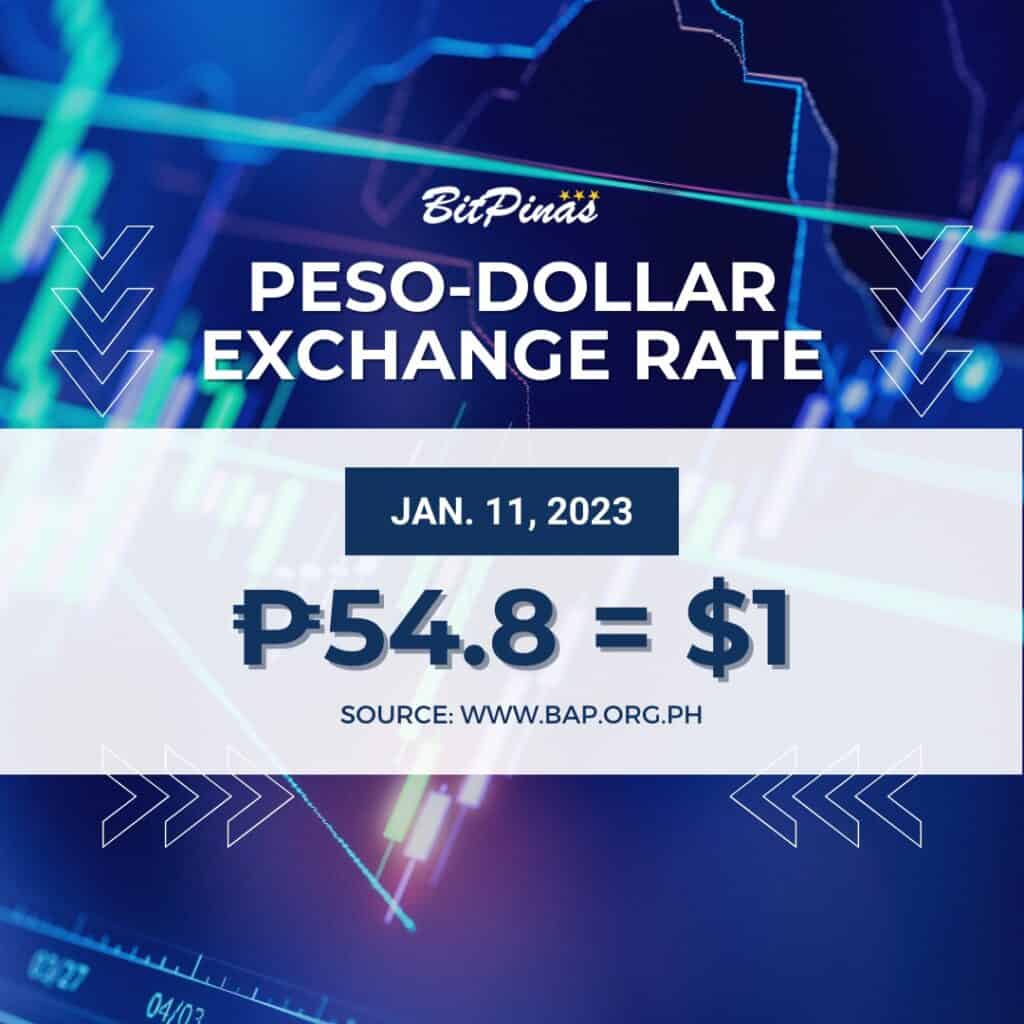

Medalla: ‘Worst is Over’ as PHP Rallies Back to 54.8, Strongest Since June 2022

With this good sign, the Monetary Board can finally focus on inflation targeting rather than foreign exchange rate management, Medalla said.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

- BSP Governor Felipe Medalla expressed his optimistic vision for the Philippine Peso as it is showing signs of regaining its strength over the USD, which overpowered the country’s currency since the second quarter of 2022.

- According to Medalla, with these good signs, the Monetary Board can finally focus on inflation targeting rather than foreign exchange rate management.

- The Governor also explained that one of the factors of the Peso weakening against the Dollars was the interest rate differential between the country and the U.S.

“It seems the strong dollar period is over. Second, we’re beginning to see oil prices to drop.

Weak peso further aggravating the inflation is no longer a big problem.”

This is the statement of Bangko Sentral ng Pilipinas (BSP) Governor Felipe Medalla, as the Philippine Peso is currently showing signs of regaining its strength against the U.S. Dollar, which overpowered the country’s fiat for the last six months.

The Philippine peso started to sharply weaken and continued to decline in the second quarter of 2022, where the last strongest level was recorded on June 30 and closed at ₱54.87 against the USD. Where in July, the currency even plunged to its 18-year low of ₱56.37, then on October 3, the value event went down to its lowest rate to date of ₱59.

As of this writing, the ratio of the country’s peso to the dollar is valued at ₱54.80 according to the data from the BSP.

Medalla also highlighted that he expects better economic figures this month amid a possible recession overseas, disclosing that their forecast for this year’s inflation is just below 2%.

In a recent interview, the Central Bank Governor emphasized that these positive numbers have given the Monetary Board time to finally focus on inflation-targetting rather than foreign exchange rate management.

“Inflation targeting is an approach to monetary policy that involves the use of a publicly announced inflation target set by the Government, which the BSP commits to achieve over a two-year horizon. Promoting price stability is the BSP’s main priority, and the target serves as a guide for the public’s expectations about future inflation, allowing them to plan ahead with greater certainty,” the BSP stressed on its website.

According to him, last year’s peso weakening was caused by the interest rate differential between the Philippines and the United States, which caused fund flows out of the Philippines as well as other emerging markets back into the United States and US dollar-denominated treasuries:

“We may not be as concerned about the interest rate differential,” Medalla stated as he noted the current Peso resurgence, which will enable them to have more space to focus on inflation, rather than foreign exchange volatility.”

This article is published on BitPinas: Medalla: ‘Worst is Over’ as PHP Rallies Back to 54.8, Strongest Since June 2022

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.