SEC Pushes For Balance in Fintech Regulation Beyond COVID-19

Commissioner Lee acknowledged that regulating fintech is challenging because it entails foreseeing the risks and making room for them in order to encourage innovation.

By Shiela Bertillo

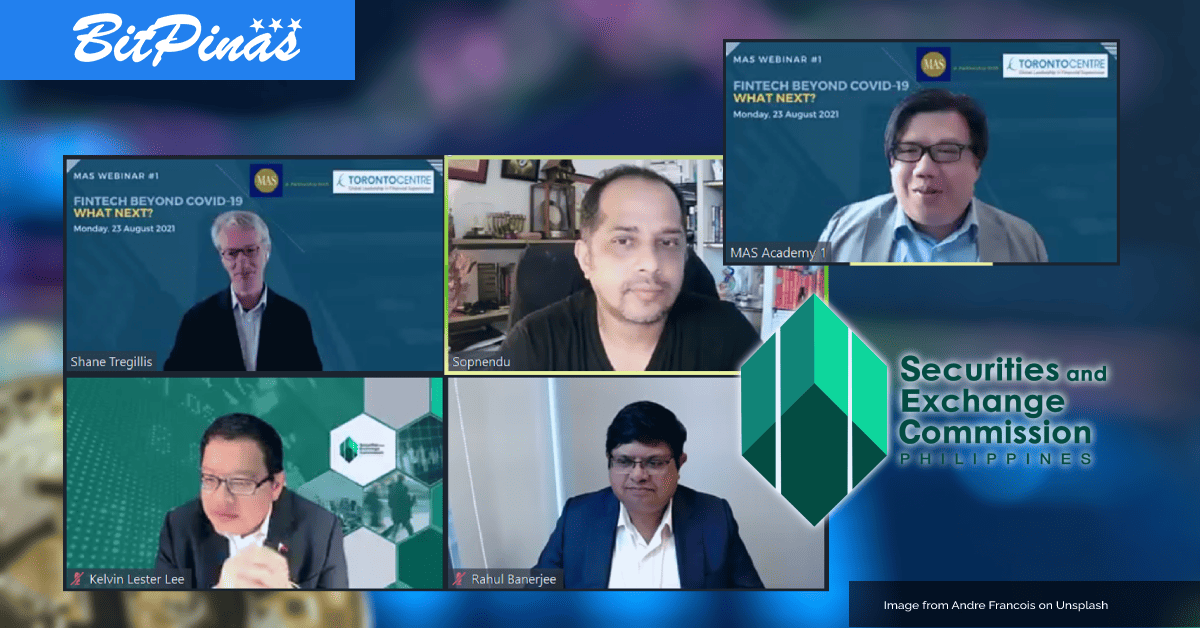

The Securities and Exchange Commission (SEC) emphasized the importance of maintaining balance between promoting innovation in financial technologies (fintech) and ensuring investor protection and market stability in the15th Regional Leadership Program for Securities Regulators organized by the Monetary Authority of Singapore in partnership with the Toronto Centre, held on Monday, August 23. Commissioner Kelvin Lester K. Lee, Supervising Commissioner of the SEC’s Philifintech Innovation Office (PIO), noted how the COVID-19 pandemic highlighted the role of fintech in making financial services accessible.

Commissioner Lee noted the larger importance of fintech in its role in allowing access to financial services despite restrictions on our movements during the pandemic during the webinar titled “Fintech Beyond COVID-19: What Next?”.

“It is with this realization that we, at the SEC, understand that fintech and innovation now play a large role in the Philippine economy,” Lee stated.

Consequently, he noted that the Philippines is primed for fintech innovation; citing the 2021 Technology and Innovation Report of the United Nations Conference on Trade and Development, which ranked the Philippines 44th out of 158 counties for readiness for frontier technologies and second for information and communications technology deployment, skills, research and development, industry activity and access to finance.

“So, fintech clearly is important for the Philippines,” Mr. Lee said. “But of course, to effectively implement and roll out fintech innovations in a particular jurisdiction, we need to discuss the role of the regulators.”

The commissioner underscored the role of regulators in managing the pros and cons of fintech, clarifying that the rise of new innovations could bring risks to financial stability, market integrity and investor interests.

“It’s a delicate balancing act,” he said. “On the one hand, as regulators we don’t want to stifle innovation; in fact, we want to encourage growth. But on the other hand, we need to be aware of the risks, some of which are very uncertain at this point, that may arise by allowing new innovations to operate.”

Accordingly, Commissioner Lee acknowledged that regulating fintech is challenging because it entails foreseeing the risks and making room for them in order to encourage innovation. Thus, the SEC will adhere to the principle that no one size fits all; adopt an activity-based rather than an entity-based approach; implement principles-based regulations rather than specific rules; and remain technology neutral.

Recently, SEC launched the PIO, a new office under its Corporate Governance and Finance Department that will focus on the regulation of the use of fintech in the country. (Read More: SEC Commits to Finalize Rules on Digital Asset Exchanges This 2021, Launches Fintech Innovation Office)

“Our aim is that through our innovation office, we can regularly touch base with our stakeholders, and we get to learn from each other,” Lee said.

Earlier, the SEC paved the way for new financial investment products and platforms boosted by fintech such as Bonds.PH, which enabled the distribution of government bonds through distributed ledger technology and Landbank’s Overseas Filipino Bank (OFBank). The OFBank is the country’s first digital-only bank where overseas Filipino workers may invest in government securities.

Furthermore, the SEC is finalizing its rules on digital asset exchanges, digital asset offerings, and online lending applications.

“Bottom line, our approach at the Commission is that we make every effort to keep an open mind to allow innovations to flourish without losing sight of our mandate to protect the investing public and secure our corporate and capital market sector,” Lee concluded.

Aside from the commissioner, the event was joined by a panel of highly esteemed authorities on fintech: Mr. Sopnendu Mohanty, Chief Fintech Officer of MAS; Dr. Rahul Banerjee, founder of BondEvalue; and Mr. Shane Tregillis, Toronto Centre Program Leader, former Australian Securities and Investment Commission Commissioner and former Chief Ombudsman of the Australian Financial Complaints Authority.

Mohanty provided an overview of market and fintech developments (innovations and related supervisory concerns/risks), including the impact of the current disruption caused by COVID-19. Meanwhile, Banerjee provided a deep dive by means of an example of how fintech is being used in the bond market.

This article is published on BitPinas: SEC Pushes For Balance in Fintech Regulation Beyond COVID-19