How Bank Failures in the US Could Impact Philippine Crypto Regulations

With the collapse of US banks, we explore the perspectives of different stakeholders on if this contagion will lead to stricter regulations.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

- US bank failures spark reevaluation of Philippine crypto regulations: The collapse of Signature Bank, Silicon Valley Bank, and Silvergate Bank in the US has led to discussions about potentially tightening regulations and policy changes in the Philippine banking sector.

- Philippine crypto industry leaders argue against blaming cryptocurrencies for bank collapses: Coins.ph CEO Wei Zhou asserts that the failures are due to a duration mismatch on the banks’ balance sheets and not crypto involvement, while PDAX CEO Nichel Gaba believes local regulations will remain unaffected.

- Calls for better governance and transparency measures: Both crypto and fiat institutions need to improve stakeholder relations and public communications, says Amor Maclang, Digital Pilipinas Convenor, as regulators and industry leaders discuss the future of crypto regulations in the Philippines.

The recent collapse of Signature Bank, Silicon Valley Bank (SVB), and Silvergate Bank in the US has prompted discussions about the re-evaluation of the Philippine regulators’ approach to cryptocurrencies and the banking sector.

Overview

On March 8, Silvergate Capital, a subsidiary of Silvergate Bank, a traditional bank lending to cryptocurrency firms, announced that it will “voluntarily liquidate” its assets and wind down operations to mitigate the recursions of the recent turmoil in the crypto industry.

Then on March 10, Silicon Valley Bank collapsed, following a bank run and a capital crisis, which resulted in the second-largest failure of a financial institution in US history.

After Silicon Valley Bank’s collapse was Signature Bank. According to online publication The Wall Street Journal, like Silicon Valley Bank, Signature Bank had a relatively large amount of uninsured deposits because of its business model catering to private companies.

However, despite these consecutive bank failures, the Bangko Sentral ng Pilipinas (BSP) and the Bankers Association of the Philippines (BAP) have assured the public that these had no substantial or material impact on the Philippine banking sector.

Which, according to the BAP, the prudential measures implemented by the BSP have provided the necessary support that allows the Philippine banking system to withstand economic shocks.

But this does not mean that the BSP will not change the capital and liquidity ratio requirements it has set as some industry experts believe that this could lead to tighter regulations or policy changes. In this article, we explore the perspectives of different stakeholders on this issue.

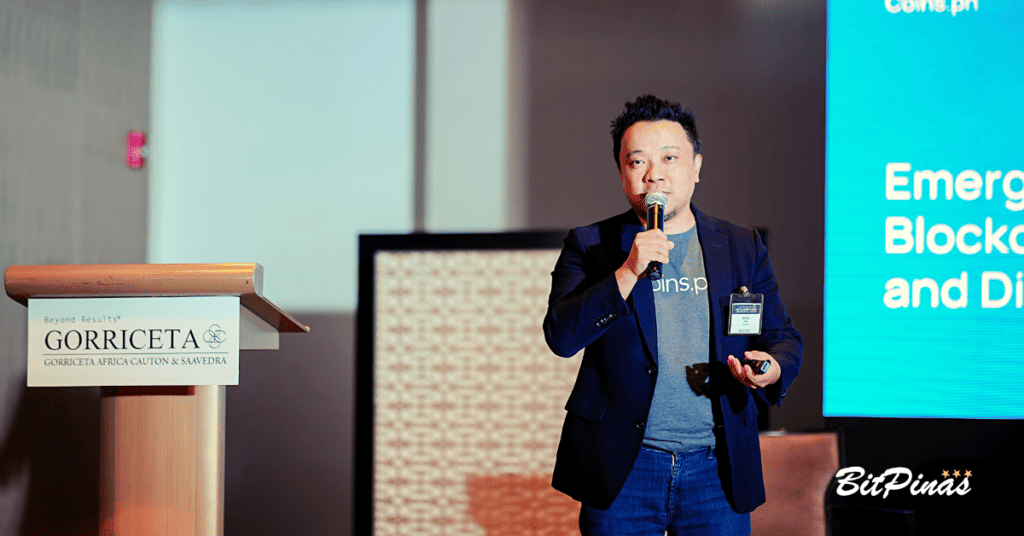

Crypto Not to Blame for Bank Failures – Coins.ph CEO

While the banks that collapsed, primarily Signature Bank and Silvergate Bank were both recognized as some of the friendliest banks when it comes to crypto companies, the collapse of these banks should not be blamed squarely because of cryptocurrency. This is according to Wei Zhou, the CEO of Coins.ph, a licensed virtual asset service provider (VASP) in the Philippines.

“The collapse of the SVB and Silvergate originates from the duration mismatch on their balance sheet between liabilities and assets. The rapid interest hike in 2022 devalued the assets of these banks, which led to a crisis of confidence in the safety of customer deposits,” Zhou explained, adding that this crisis of confidence has led to contagion among the entire banking system in the U.S.

The Coins CEO also mentioned that the two other major banks that collapsed in the past few weeks, the First Regional Bank and Credit Suisse, had little to do with crypto. So, “to try to blame this crisis on cryptocurrency is just wrong.”

“At its core, it is a new asset class driven by the principles of self-custody and blockchain transparency. These principles will drive the next wave of technological innovation in banking and finance,” Zhou clarified while recognizing the volatility of the crypto market.

Crypto Regulations Unlikely to be Affected – PDAX CEO

To reiterate, BSP was quick to issue a press release that no banks in the country were affected during the contagion, with BSP Governor Felipe Medalla insisting that the “banks’ FCDU (Foreign Currency Deposit Unit) assets are mostly loans, Republic of the Philippines dollar bonds, and sovereign bonds of countries with high credit ratings.”

For Nichel Gaba, the CEO of PDAX, which is also a licensed VASP in the Philippines, the collapse of the U.S.-based banks will not affect local crypto regulation because of how strict the Central Bank is to the licensed crypto exchanges in the Philippines.

“Over the past year, our regulators have already been increasing their supervision of cryptocurrencies and exchanges, especially around consumer protection,” Gaba said.

It can be recalled that in the wake of the FTX fiasco last year, the BSP said it has asked local exchanges of their exposure to FTX and its sister company, Alameda Research, after both companies have reported having misused funds, as well as issued a public statement to the local exchanges to not misuse customer funds.

However, Gaba warned that while there is no effect in regulation, banks servicing crypto might take a harder stance against it. In 2021, Philippine-based banks like BPI took this approach, not allowing crypto-related transactions:

“I don’t think that the recent bank collapses will affect crypto regulation locally, but unfortunately, these events may influence the banking sector’s appetite to service the crypto industry.”

Regulators Already Reevaluating – Tetrix CEO

Emman Navalan, the CEO of Tetrix believes that while there would be no impact on existing crypto regulations, regulators are already reevaluating and discussing internally and with their consultants their approach to cryptocurrencies.

“And as a matter of fact, earlier this morning during our meeting with the Philippine Blockchain Council, we were talking to a senator and we were discussing how they could help us as an industry and how this industry is vital to the government and for the people,” explained Navalan.

And regulators are indeed re-evaluating. The Securities and Exchange Commission of the Philippines (PH SEC), in light of the U.S. banks’ collapse situation, revealed that they are retooling their draft crypto rules, which was supposed to be publicized in November of last year, the month when the FTX contagion started.

“We were actually ready to launch late last year [the] draft public dissemination, but because of what happened with FTX, it was the time where things came crashing and a continuation of what they call crypto winter. So, because of that we chose to forgo the release, we held it back; our decision was to make the rules a little more strict in light of what is happening,” Commissioner Kelvin Lee explained in an earlier TV interview.

Kenneth Stern, the General Manager of Binance in the Philippines also emphasized that a stable environment around regulation will better protect users:

“A stable regulatory environment provides greater protections for everyday users while fostering innovation and progress,” Stern said, adding that his company, Binance, is committed to working with policymakers around the world “to develop a regulatory framework that will bring order to the markets, instill consumer confidence, outline the limits of permissible activity, and provide a safe space for useful innovation to continue.”

Is the situation good for Bitcoin?

For Navalan, the recent crises have revealed the need for better governance and transparency measures, which would benefit crypto and fiat institutions.

But what can provide more transparency than the blockchain?

The Tetrix CEO also said he has observed people turning to Bitcoin as a store of value as they fear a recession could happen sooner.

At the time this article was written, Bitcoin was trading at around $28,000. While this is less than half of its all-time high price, the largest cryptocurrency by market capitalization is also up 70% since the beginning of the year.

“In terms of these banks collapsing in relationship with Bitcoin, we are now seeing Bitcoin unfolding its true potential, to be a store of value. So I think this is one of the reasons why Bitcoin jumped from 20,000 to 28, because people are now seeing that, ‘Alright, we cannot put our money inside the banks. They keep on defaulting during crisis and during recession,’” Navalan said.

Better Governance and Transparency Measures Needed

Meanwhile, Amor Maclang, convenor of Digital Pilipinas and co-founder of GeiserMaclang, insisted that both crypto and fiat institutions did an equally poor job in stakeholder relations and public communications during the recent crises.

“The first one, mass media and social media were used to escalate the panic, then the second one, poor internal and external communications, was the tipping point: imagine what the CEO of SVB said that tipped the melt down ‘the last thing we want you to do is panic,’” Maclang said.

According to the Digital Pilipinas Convenor, the rules are fundamentally the same whether the investment is in crypto or fiat, and there should be more enabling rules and regulations related to the protection of both, not just one.

“No one is saying that trading should be as safe as putting money in a bank, there is no reward without risk. But that doesn’t mean that we should turn a blind eye to how these platforms and institutions govern themselves,” she emphasized.

To conclude, Maclang ended her explanation with this statement:

“Just because one is “undetermined” doesn’t mean it deserves less protection.”

This article is published on BitPinas: How Bank Failures in the US Could Impact Philippine Crypto Regulations

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.

![[Newsletter] CryptoPH Wrap-Up - How Will the Infrawatch vs Binance Story End? 9 [Newsletter] CryptoPH Wrap-Up – How Will the Infrawatch vs Binance Story End?](https://bitpinas.com/wp-content/uploads/2022/07/CRYPTO-INSIGHT-NEWSLETTER-2-1-768x402.png)