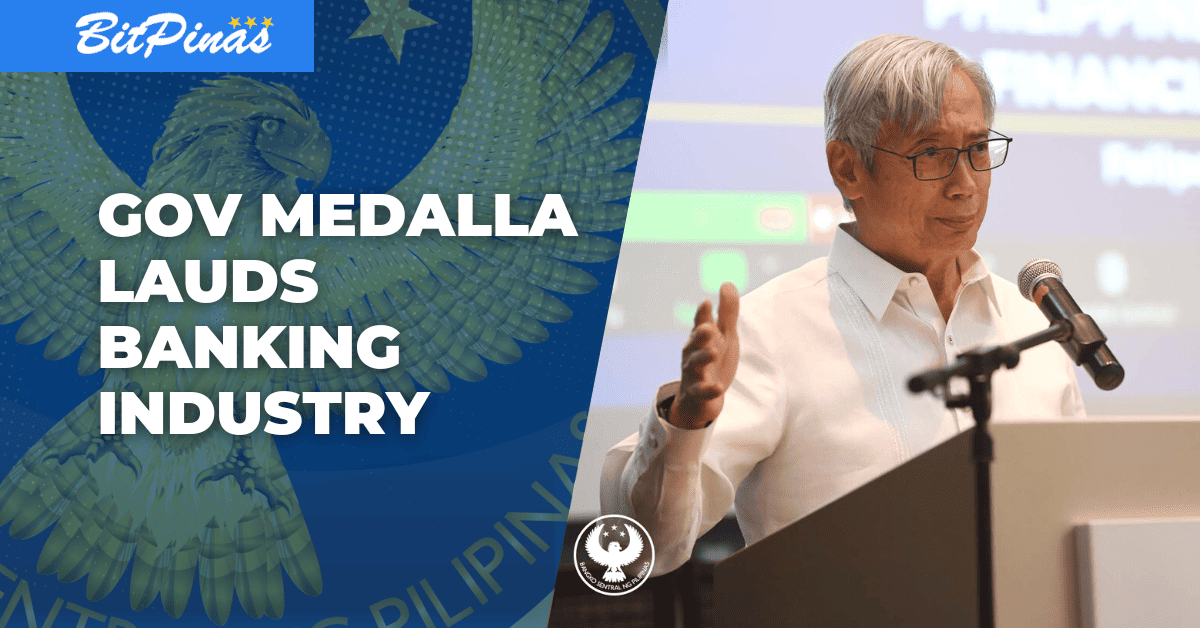

BSP Recognizes Banking Industry Efforts In Supporting Economic Growth, Digitalization

The BSP said that it appreciates the offer of the banking industry in supporting the government’s economic and digitalization efforts.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

The Bangko Sentral ng Pilipinas (BSP) recently stated that the central bank appreciates the collective effort of the banking industry in supporting the country’s economic growth and ongoing digitalization. The BSP noted this during the recent “Annual Reception for the Banking Community.”

BSP Governor Felipe M. Medalla especially thanked the banking sector for their

collective effort and long-standing collaboration with the central bank, noting that the banking system is well-managed, shown by its continuous growth in assets, loans, and deposits that support the funding needs of the country’s growing economy.

Moreover, the BSP chief also recognized the digitalization initiatives of the banks through InstaPay and PESONet, which now allow convenient electronic fund transfers between banks, improving service delivery for their clients.

The event was also attended by Monetary Board Members (MBMs) Eli M. Remolona; V. Bruce J. Tolentino; Peter B. Favila; Benjamin E. Diokno, who is also Finance Secretary; Antonio S. Abacan, Jr.; Anita Linda R. Aquino; Mamerto E. Tangonan; Bernadette Romulo Puyat; Francisco G. Dakila, Jr.; Chuchi G. Fonacier; and Eduardo G. Bobier.

In the recently submitted list of priority bills of the BSP for the 19th Congress, the central bank highlighted that it will further prioritize and strengthen the banking sector and expand payment systems in the country. (Read more: BSP Includes Sim Card Registration, Digital Payments Bill as Priorities to 19th Congress)

In line with improving the payment solutions in the Philippines, Director Mhel Plabasan stated that stablecoins can be a plausible solution for more efficient payment transactions in the country. Stablecoins are a type of cryptocurrency that is pegged with fiat, or can also be gold, at a 1:1 ratio. (Read more: BSP Director: Stablecoins Can Make Payments More Efficient)

Accordingly, last month, the BSP and its Monetary Board (MB), BSP’s policy-making body, approved the Test and Learn Framework, or the Regulatory Sandbox, which will allow the central bank-regulated institutions to test and offer some innovative products in a controlled environment. (Read more: Bangko Sentral OKs Regulatory Sandbox for Banks)

Lastly, last September, the central bank approved the proposed changes to the establishment of digital banks and clarified prudential requirements, licensing, and documentation. The BSP completed distributing certificates of authority (COA) to all six digital banks a month prior. (Read more: BSP Updates Regulations on Digital Banks)

This article is published on BitPinas: BSP Recognizes Banking Industry Efforts In Supporting Economic Growth, Digitalization

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.