CZ Answers CFTC Allegations Against Binance, Denies Market Manipulation

CZ answered 3 out of the 5 allegations that the Commodity Futures Trading Commission has included in its lawsuit filed against Binance.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

- In a blog post, Binance CEO Changpeng Zhao expressed his disappointment over an “unexpected” charge by the Commodity Futures Trading Commission against Binance as the two entities have been working closely for over two years.

- CZ also answered some of the main points that the CFTC included in the 74-page lawsuit as illegal:

- System Bypass of U.S. Citizens: CZ clarified that they are blocking U.S. citizens who attempt to use the Binance platform and not the Binance U.S. They identify the citizenship of a user through their KYC program.

- Cooperation and Transparency with Law Enforcement: As per CZ, Binance is the top crypto exchange with the most licenses and registrations around the globe. This means that they are cooperating with the regulators.

- Insider Trading Allegations: Admitting that he has his two own Binance accounts, CZ revealed that his firm’s employees are not allowed to sell a coin within 90 days of their most recent crypto purchase, or vice versa.

- However, the blog post still did not answer all the allegations of CFTC, as there are two allegations left unanswered: the alleged 300 Binance accounts of CZ, and the VIP program for large traders that give them exclusive perks, such as reduced transaction fees and improved customer service.

A few hours after the Commodity Futures Trading Commission (CFTC) of the United States charged crypto exchange Binance and its two top executives for allegedly encouraging employees and customers to go around compliance controls, Binance CEO Changpeng Zhao (CZ) expressed his disappointment in the civil complaint, pointing out that the case filing was unexpected because they have been working cooperatively with the CFTC for over two years.

“Upon an initial review, the complaint appears to contain an incomplete recitation of facts, and we do not agree with the characterization of many of the issues alleged in the complaint,” he wrote in a statement.

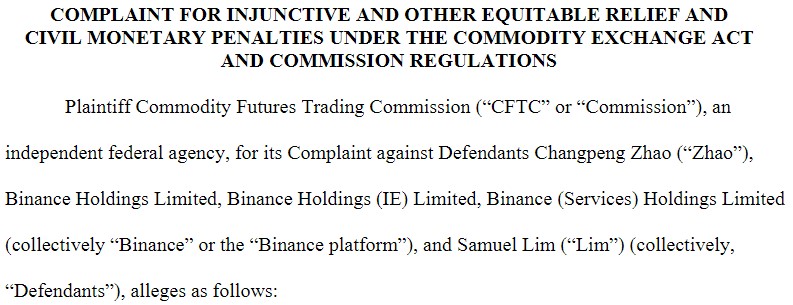

In the 74-page filing released on Monday, March 27, Binance, CZ, and Chief Compliance Officer (CCO) Samuel Lim, are being sued for purportedly breaking trading and derivatives rules. The CFTC also noted that the largest crypto exchange by trade volume has never registered with the federal agency in any capacity and has “disregarded federal laws” for U.S. financial markets.

Read the summary from BitPinas here.

System Bypass of U.S. Citizens

To address the allegations regarding Binance allowing U.S. citizens to use the global exchange instead of the only allowed Binance U.S., CZ highlighted that Binance utilizes its own-developed “best-in-class technology” to ensure compliance. Binance U.S. has different deposit and withdrawal methods, trading fees, and liquidity to the Binance app

According to CZ, since their system can detect commonly used VPN endpoints outside of the U.S., they can block U.S. nationals that use the Binance platform. It was made possible through Binance’s Know-Your-Customer (KYC) program, through the users’ IP mobile carrier, device fingerprints, bank deposits and withdrawals, blockchain deposits and withdrawals, credit card bin numbers, and more.

“We are aware of no other company using systems more comprehensive or more effective than Binance,” the CEO emphasized, boasting that Binance, despite being the first non-U.S.-based exchange to have a mandatory KYC program, still has “one of the highest standards in KYC and AML.”

Cooperation and Transparency with Law Enforcement

As per CFTC Chairman Rostin Behnam, Binance has been violating the Commodity Exchange Act (CEA) and CFTC regulations since July 2019:

“For years, Binance knew they were violating CFTC rules, working actively to both keep the money flowing and avoid compliance.”

This is where the CEO stressed that Binance is “committed to transparency and cooperation with regulators and law enforcement (LE)—in the US and globally.”

According to him, the exchange currently has more than 750 individuals on its compliance team, and several of them have prior law enforcement and regulatory agency backgrounds. CZ also disclosed that the team has handled more than 55,000 LE requests and assisted the U.S. LE to freeze and seize more than $125 million in funds in 2022 alone and $160 million in 2023 to date.

“We intend to continue to respect and collaborate with the U.S. and other regulators around the world,” he assured.

In addition, the firm also highlighted that it currently has 16 and counting current licenses and registrations around the globe, as well as being “well regarded by our user community.” As per the last update in the Philippines, Binance is still trying to acquire a local entity with the necessary licenses to operate in the country, as it was affected by the three-year moratorium of the Bangko Sentral ng Pilipinas (BSP) regarding Virtual Assets Service Provider (VASP) license—the firm was also constantly targeted by local think tank Infrawatch for operating in the country without a license.

Insider Trading Allegations

According to the lawsuit, Binance allegedly instructed its employees and customers to circumvent compliance controls in order to maximize corporate profits, to which CZ responded that the exchange “does not trade for profit or ‘manipulate’ the market under any circumstances.”

CZ also disclosed that although Binance “trades” in a “number of situations,” such as converting their crypto revenues from time to time to cover expenses in fiat or other cryptocurrencies, he assured that the exchange provides liquidity for fewer liquid pairs on the platform, adding that they have affiliates for such and those are being monitored specifically not to have large profits.

“Personally, I have two accounts at Binance: one for Binance Card, one for my crypto holdings. I eat our own dog food and store my crypto on Binance.com. I also need to convert crypto from time to time to pay for my personal expenses or for the Card,” CZ shared.

Talking about having system repercussions against internal manipulation, the CEO reiterated that Binance employs a 90-day no-day-trading rule for its employees to prevent any employees from actively trading. This means that employees are not allowed to sell a coin within 90 days of their most recent crypto purchase, or vice versa.

Employees are also prohibited from trading in Futures, a derivative contract agreement to buy or sell an asset at a set future date for a set price. Further, employees with access to private information, such as details, Launchpad, etc., also follow strict rules and are not allowed to buy or sell those coins.

“I observe these policies myself strictly. I also never participated in Binance Launchpad, Earn, Margin, or Futures. I know the best use of my time is to build a solid platform that services our users,” CZ noted.

Unaddressed Allegations

- CZ allegedly has 300 Binance accounts

As of this writing, the CEO is yet to answer the accusation in the lawsuit directly alleging him for owning over 300 separate Binance accounts that are trading on the platform, as well as having some control by entities he owns like Merit Peak Limited and Sigma Chain AG.

As per a statement, the CFTC also noted that these more than 300 accounts may have been exempted from anti-fraud and anti-manipulation surveillance and have been exempted from the Binance ‘insider trading’ policy.

- VIP Program for Large Traders

In an article, Binance reportedly has a VIP program for large traders that gives them exclusive perks, such as reduced transaction fees and improved customer service. According to them, Binance offers VIPs a special service where the company reportedly provides a warning if law enforcement asks about their account.

“Binance told their VIP team to make sure that they unfreeze the account 24 hours after the notification, and make sure to contact the VIP through all available means to let them know it is now unfrozen and is being investigated,” the report read.

Note: As of this writing, CZ has yet to react to these issues.

“At Binance, we look for amicable solutions to all problems. We are collaborative with regulators and government agencies all around the world. While we are not perfect, we hold ourselves to a high standard, often higher than what existing regulations require. And above all, we believe in doing the right thing by our users at all times. In this journey towards freedom of money, we do not expect everything to be easy. We do not shy away from challenges,” CZ concluded.

Prior to this response, Zhao tweeted “4,” a couple of hours after the news broke out. The cryptic tweet references to his older post stating, “Ignore FUD, fake news, attacks, etc.”

This article is published on BitPinas: CZ Answers CFTC’s Allegations Against Binance

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.