How to Buy MKR at Coins.ph!

This is the BitPinas comprehensive guide about MKR, what is it, how does it work, what is it used for, and how to get MKR on Coins.ph!

Maker (MKR) is an ERC-20 token that fuels the Maker DeFi lending platform launched by MakerDAO to give holders governance rights on its DAO and ecosystem. MakerDAO has introduced a dual token system with MKR and DAI, a stablecoin backed by various types of cryptocurrencies and is pegged to 1 USD. MKR is utilized to maintain the security and stability of the DAI stablecoin. MKR holders have the privilege to partake in the decision-making of MakerDAO regarding present and future upgrades.

Maker is one of the pioneering projects of DeFi, and has grown so much since its launch in 2017, with over 400 applications integrated and roughly $20 billion total value locked (TVL).

How to Buy MKR at Coins.ph!

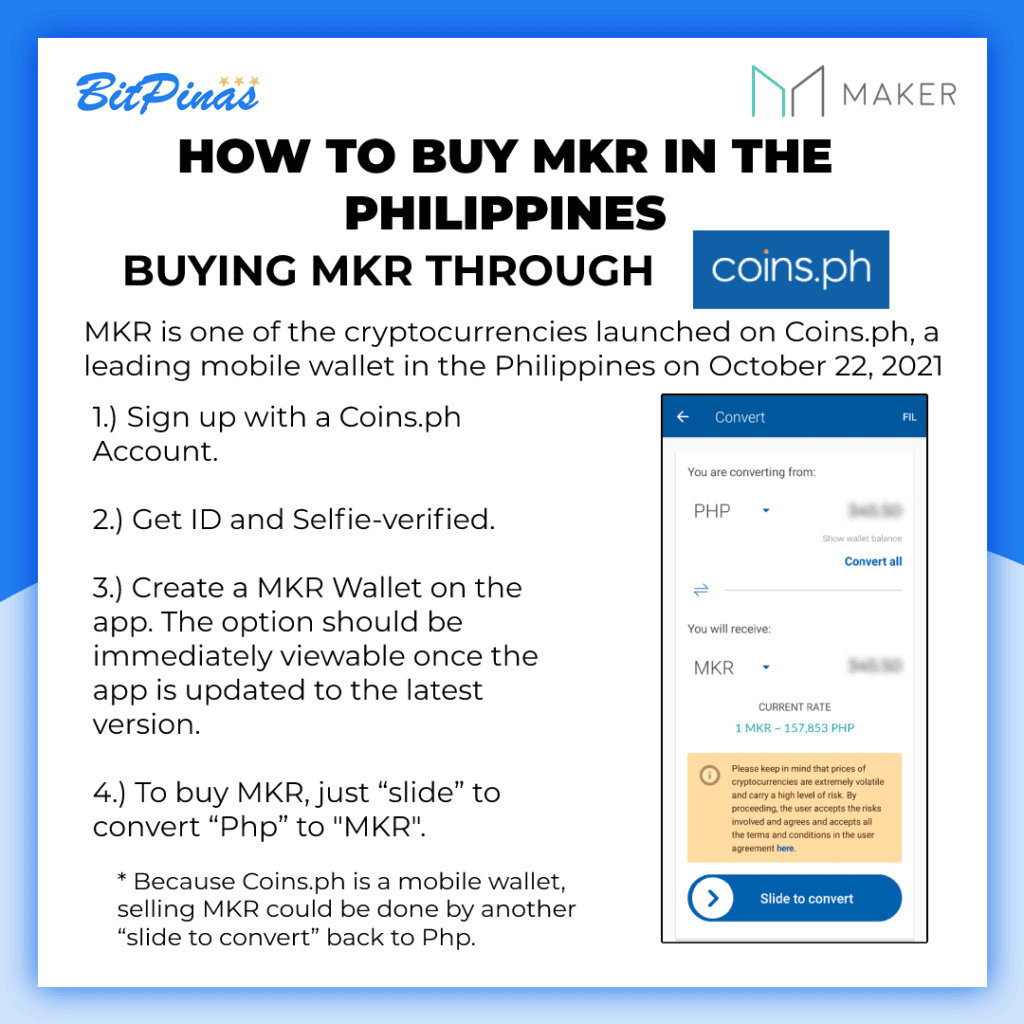

MKR is one of the cryptocurrencies launched on Coins.ph in October 2021, along with AAVE and UNI.

1) Sign up with a Coins.ph account (if you already have an account and are already ID and selfie-verified, proceed to step 3.)

2) Get ID and selfie-verified.

3) Create a MKR wallet on the app. The option should be immediately viewable once the app is updated to the latest version. (If you cannot see this option, update your app to the latest version.)

4) To buy MKR, just “slide” to convert “Php” to “MKR.”

What is a DAO?

A decentralized autonomous organization (DAO) is a leaderless group of individuals governed by the members themselves whose rules are encoded in computer programs, allowing transparent processes not controlled nor influenced by a central government.

The Maker DAO governs the Maker platform.

How Does Maker Work?

The Maker Protocol allows users to produce DAI by leveraging various cryptocurrencies as collateral. MakerDAO, which is composed of a decentralized group of MKR holders, administers the Maker Protocol by voting on important parameters such as security charges, collateral types, rates, etc.

MKR holders are akin to governors in the Maker system and are incentivized to maintain its operation and expand its reach. Through their work, end-users can easily take out loans and use DAI to conduct DeFi activities like yield farming, liquidity mining, staking, etc.

MKR is only produced or destroyed in response to DAI price changes using financial grounds to support DAI’s utility to remain firmly pegged to $1. Prominently, when the performance of a lending smart contract ends, an MKR token is terminated and removed from the supply.

Essential MakerDAO Mechanisms

As mentioned earlier, Maker offers two different cryptocurrencies as a component of its policy, DAI and MKR. The system also uses three main mechanisms to support DAI even during sharp market drops. These three mechanisms are:

Target Price

The Target Price maintains DAI’s stable 1:1 soft peg to USD.

Target Rate Feedback Mechanism (TRFM)

This second mechanism splits the USD peg to depress DAI’s volatility in difficult market circumstances, such as during a market crash. Particularly, the protocol works to adjust the price over the period. There is also a sensitivity tool that follows the price of DAI’s correction about the US dollar change.

Collateralized Debt Position (CDP)

CDP contracts are responsible for making Maker independent. These high-level smart contracts are novel to the Maker environment. A CDP contract starts whenever users transfer ERC-20 tokens to the Maker program in exchange for DAI tokens.

These tokens are fastened into a security debt smart contract. Users are then allotted DAI in exchange for their invested money before the smart contracts implicitly issue the collateralized assets when the credit is reimbursed. Whenever a user completes a CDP, it kills a number of DAI equivalent to the amount produced using it.

What are Maker Vaults?

The Maker Vault is a basic element of the Maker Protocol, which promotes the creation of Dai in exchange for collateral. The vault method collectively modifies the cumulative amount of Dai.

What are the uses of MKR?

As a governance token, MKR is utilized by MKR users to vote for the uncertainty control and market philosophy of the Maker system. Every decision, whether it’s to change certain parameters of the system or upgrade its underlying protocol, needs to be decided by the decentralized governors or MKR holders.

Like any cryptocurrency, MKR can also be used as a medium of exchange, but note that it isn’t stable like Dai. Some users also speculate on the value of the Maker system and decide to hold MKR for exposure.

How to vote with MKR

All MKR holders can decide (vote) on important decisions using a method identified as Executive Voting. If an Executive Vote is established, then the programming code in the Maker Protocol is developed or modified to match the winning proposition.

Before an Executive Vote can be executed, another method of voting called a Proposal Polling, a process for MKR holders to assess their opinion on a recommendation before performing any modifications to the software, needs to be processed first.

The third set of a vote can be determined by non-MKR owners utilizing threads in the MakerDAO discussion. While normal users may present proposals to MakerDAO, only MKR owners can decide on them.

A vote is then ranked by the number of MKR tokens allotted to a proposal. For instance, if 20 MKR owners with 2,000 MKR vote for Program X, while 10 MKR holders with 10,000 MKR vote for Program Y, Program Y is the winner as more MKR tokens maintain it. Only the amount of tokens, not the number of token owners, determine the vote’s result.

Things to Consider about MKR

MKR is an essential token for the Maker system, which means that holding it gives you direct exposure to the protocol and its DAO. Its value will rise and fall depending on the accomplishments of the DAO and its community. As one of the leading and pioneering DeFi platforms in the space, Maker has established itself ahead of the curve, well not really. Curve still has the largest TVL, but Maker comes at a close second.

Although decentralized finance (DeFi) has been overshadowed by the GameFi and metaverse narrative lately, it is nonetheless expanding at a rapid rate and is expected to grow exponentially in the next few years. More importantly, people are already using MKR to gain above-average returns in DeFi activities even today. While many expect it to only grow from here, we also have to consider some of the present and future competition that could take away some of Maker’s market share.

This article is published on BitPinas in collaboration with Coins.ph: How to Buy MKR at Coins.ph!

![[Event Recap] YGG Roadtrip in Baguio City 5 [Event Recap] YGG Roadtrip in Baguio City](https://bitpinas.com/wp-content/uploads/2022/06/ygg-roadtrip-baguio-1-2-768x402.png)