Maya Responds to GCash’ “Silver Bullet” Comment

Maya, formerly known as PayMaya, stated that it is confident with its rebranding and the addition of digital banking in its list of services.

Fintech firm Maya, formerly known as PayMaya, stated that it is confident with its rebranding and the addition of digital banking in its list of services. The firm commented this to address the statement of GCash that “digital banking is not a silver bullet in fintech business success.”

“Everything, including digital banking, is now just in one app. We like where we are headed.”

Pepe Torres, Maya Chief Marketing Officer

In a press briefing, Martha Sazon, GCash president and CEO commented a few days after Maya launched its rebranding and digital banking offering that they “don’t believe that having a digital banking license is a silver bullet or magic. It’s not like a signboard that you just turn on then expect everyone to come in. There’s real work to acquire users and educate them on more complex financial services.” (Read more: GCash Not Bothered by PayMaya’s Crypto Offerings)

Maya, on the other hand, continues to add and upgrade its services with new features including a new savings feature called Personal Goals, new crypto coins, higher transaction limits, and promos.

“The customer response to our relaunch has been overwhelmingly positive, and our Early Access program was a smashing success. Maya’s unique all-in-one money app, which seamlessly brings together digital banking services, crypto, and an e-wallet for the customer, clearly addresses the pent-up demand for world-class financial services.”

PEPE TORRES, MAYA CHIEF MARKETING OFFICER

To serve and help their customers save, this month Maya presents the new feature; Personal Goals, a Savings feature with a 6% interest rate that enables customers to set aside money for specific purposes – whether it’s for a new laptop for school, airfare for a long-awaited vacation, tickets for a music fest, down payment for a condo unit, an emergency fund, or starter fund for a small business.

“With Personal Goals, you can create savings goals and personalize their names and target amounts. You can set up a Personal Goal for up to six months, and you can keep up to five at a time, allowing you to see how everything is progressing at a glance.” –Maya

Maya noted that the Personal Goals complement their Maya Savings, which is now available for all upgraded Maya customers. Maya Savings is a digital savings account with a 6% interest rate that’s as easy to use as an e-wallet. This service was initially offered in early access mode during the Maya launch.

On top of offering Personal Goals, Maya announced that customers with Maya Savings will automatically be upgraded as Maya Power Users. The upgrade will allow them to cash in up to P500,000 to their Wallet and quickly transfer it to their Maya Savings account. Maya also pointed out that “customers can enjoy 99.9% app uptime reliability, enabling access to their savings anytime.”

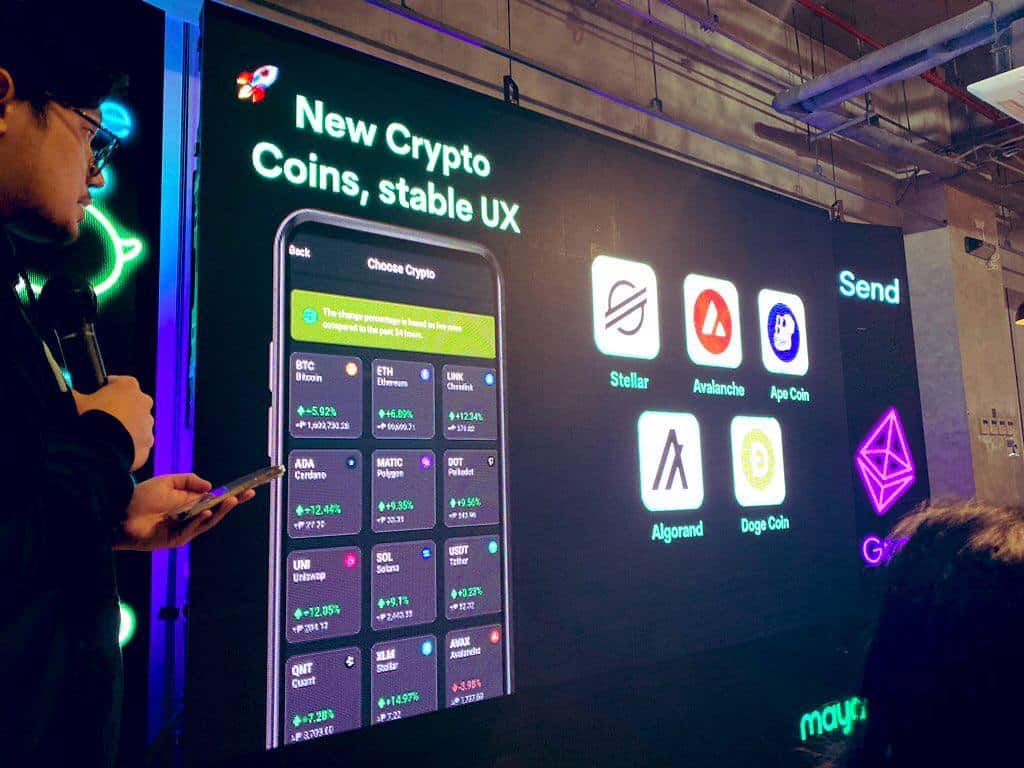

To further widen their crypto portfolio, the firm added five new cryptocurrencies to their app. The new coins are Algorand, Ape Coin, Avalanche, Doge, and Stellar, increasing their list of coins to 15. (Read more: What are the New Cryptocurrencies in Maya this June 2022?)

“What makes Maya Crypto better is the seamless, integrated experience – no need to cash in/out or buy crypto using another app – it’s an all-in-one experience with Maya.” –Maya

Maya stated that the firm combines the power of an e-wallet with new features like crypto, credit, and an innovative digital banking experience powered by Maya Bank, to allow their users to spend, save, grow, invest, and master your money — all in just one app.

“Customers are connecting to our new brand’s bold look, feel, and sound. This transformation would not have been possible without a world-class team of Filipino creatives who have brought our brand to life. The process reflects our culture and how we built Maya to be the first-of-its-kind money app for Filipinos,” Torres added.

This article is published on BitPinas: Maya Responds to GCash’ “Silver Bullet” Comment

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.

![[First on BitPinas] Smart, FIBA to Utilize BlockchainSpace’s YEY Platform for Gilas NFTs 8 [First on BitPinas] Smart, FIBA to Utilize BlockchainSpace’s YEY Platform for Gilas NFTs](https://bitpinas.com/wp-content/uploads/2023/08/Smart-to-Distribute-NFTs-to-FIBA-World-Cup-2023-Fans-from-BlockchainSpace-Powered-Platform-YEY-1-768x402.jpg)