Report: Crypto VC Investment Drops 70% In One Year

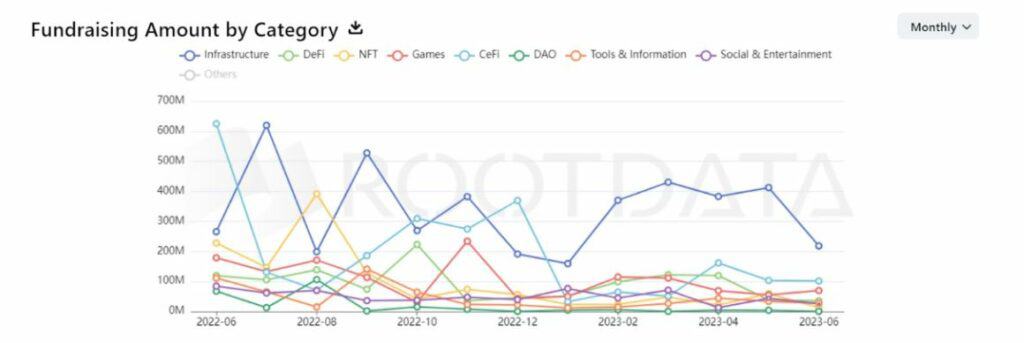

RootData revealed that venture capital investments in cryptocurrency companies have declined over 70% in the past year.

- Venture capital investments in cryptocurrency companies have declined over 70% in the past year, according to a report by RootData.

- June recorded the lowest number of investments, with only 83 projects receiving $520 million in funding, compared to 149 rounds and $1.81 billion invested in June of the previous year.

- Despite the decline, sectors like decentralized finance (DeFi), non-fungible tokens (NFTs), and centralized finance (CeFi) still received substantial funding in the digital asset space.

Amid the bear market and continuous crypt meltdown, venture capital investments in cryptocurrency companies have experienced a significant decline of over 70% in the past 365 days. The information was published by crypto data provider RootData.

Report Results

Aside from disclosing venture capital investments in the digital asset space experiencing a significant decline in funding, the report also revealed that the lowest number of investments was recorded in June. As per the report, there were 149 rounds with a total of $1.81 billion invested in 2022, however, this year, only 83 projects received funding amounting to $520 million.

These numbers indicate a clear downtrend in VC interest in the digital asset space, despite occasional increases in funding in some months. The highest recorded funding month was September 2022, with $1.85 billion invested in 138 rounds. Additionally, June of the previous year had the highest number of recipients, with 149 rounds.

Sectors that received most funding

Although there was a significant decline in investments, the decentralized finance (DeFi), non-fungible token (NFT) and centralized finance (CeFi) still received several millions of funding over the year.

After infrastructure, the second most funded category in the digital asset space is CeFi, or centralized finance followed by Games, DeFi and NFTs.

In addition, for the p[ast 12 months Ethereum saw funding for 1,826 projects, while Polygon (MATIC) followed from a distance with 1,076 funding rounds.

Crypto in the Philippines

Accordingly, a recent study conducted by ConsenSys and YouGov unveiled that Filipinos possess a restricted comprehension of web3 technology, as only 25% of the respondents indicated familiarity with it. The study also revealed that Filipinos’ highest level of familiarity was found with the metaverse, with 38% of respondents indicating awareness. NFTs followed closely behind at 35%, while web3 had the lowest level of familiarity, with only 25% of respondents indicating knowledge of it.

The same survey revealed that 51% of Filipinos believe that crypto should be regulated to protect investors and safeguard traditional financial markets–34% of them emphasized the importance of regulators establishing regulations that promote responsible engagement in cryptocurrencies while protecting investors.

In addition, the respondents also shared what they thought are the top skills needed to enter and engage within the crypto and web3 industry. According to them, the top 4 skills are financial trading, marketing, software engineering and creativity in art and music.

This article is published on BitPinas: Report: Crypto VC Investment Drops 70% In One Year

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.