BSP Report: P2P & Merchant Payments Propel Digital Payments Adoption in the Philippines

The BSP reports significant growth in digital payments adoption in the Philippines, with a volume share of 42.1%,

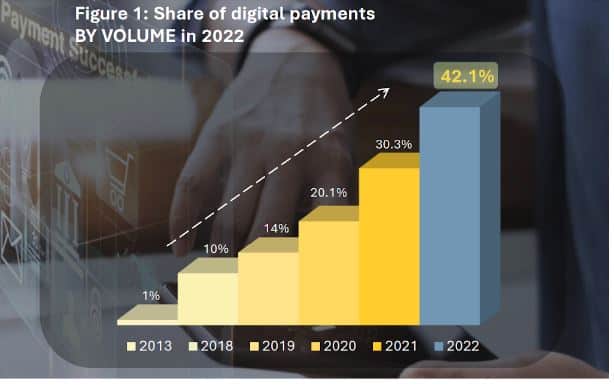

- In 2022, digital payments accounted for a significant share of total retail payments in the Philippines, with a volume share of 42.1% and a value share of 40.1%, amounting to 78 billion USD.

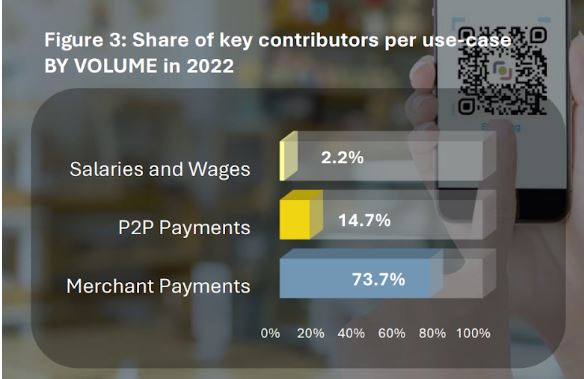

- Person-to-business (P2B) merchant payments were the primary driver of digital payments growth, representing 73.7% of total digital transactions. Person-to-person (P2P) payments and business-to-person (B2P) salaries and wage payments also contributed to the increase.

- Digital merchant payments saw a 35.6% increase in volume, while P2P transfers nearly doubled with a 91.2% year-on-year surge. The widening usage of account-to-account electronic fund transfers played a significant role in this growth.

In line with its mission to reach the goal in its Digital Payments Transformation Roadmap (DPTR), the Bangko Sentral ng Pilipinas (BSP) shared in its 2022 Status of Digital Payments report that merchant payments and person-to-person (P2P) transactions have been actively pushing forward the digital payments adoption in the country.

2022 Digital Payments in the Philippines

According to the report, digital payments accounted for a significant share of total retail payments in 2022, with a volume share of 42.1% and an increase of 611.7 million transactions compared to the previous year. The value share of digital payments reached 40.1%, amounting to a total of 78 billion USD–a 32.8% increase as compared to 2013.

Although most of the transactions in the country are still non-digital by volume, digital payments are not being left behind. Person-to-person (P2X) payments continue to dominate the total retail digital payments volume, comprising 68.6% of the share. Payments made by businesses (B2X) account for 30.3% of the volume, followed by government payments (G2X) at 1.1%.

“The BSP has high hopes that the broadening digital payments usage and acceptance in recent years will sustain its rising trajectory in the post-COVID Philippine economy… The result of the BSP’s measurement on the level of adoption of digital payments in 2022 is extremely encouraging,” then-BSPGovernor Felipe Medalla wrote in a statement.

P2P and Merchant Payments: Driving Factors in Digital Payments Growth

The recent diagnostic reveals that the growth in digital payments is primarily driven by person-to-business (P2B) merchant payments, accounting for 73.7% of the total digital transactions. Person-to-person (P2P) payments and business-to-person (B2P) salaries and wage payments also contributed to the increase, representing 14.7% and 2.2% of the total digital payments volume, respectively.

The BSP noted the increase in utilization of these use-cases mainly because these are high-frequency, low-value retail transactions. The top three contributors to the growth in digital payments comprised 90.6% of the total volume, with merchant payments leading the way, followed by P2P payments and B2P salaries and wages.

The Rise of Merchant Payments and P2P Transfers in Digital Payments

According to the BSP, merchant payments played a crucial role in the adoption of digital payments; in 2022, the volume of digital merchant payments increased by 35.6%, growing from 1,112.1 million transactions in 2021 to 1,507.5 million transactions. On the other hand, P2P transfers experienced significant growth, nearly doubling with a 91.2% year-on-year increase, from 156.7 million to 299.7 million transactions in 2022. The central bank highlighted that the widening usage of account-to-account electronic fund transfer services contributed to this surge.

“Together with key stakeholders from the government, the business community and the individual consumers, we will continue to carry out initiatives to further promote the widespread use of digital payments and enable each Filipino to reap the benefits of a growing and inclusive Philippine digital economy,” said BSP Deputy Governor Mamerto E. Tangonan.

Moreover, Medalla recently revealed that digital payments now make up over 40% of the total volume of retail transactions in the country where it surged to 30.3% of the volume of transactions in 2021–a significant increase from 20.1% the previous year.

This article is published on BitPinas: BSP: P2P, Merchant Payments Drive Digital Payments Adoption

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.

![[Web3 Interview Series] Paytaca Introduces Bitcoin Cash to Students in Leyte 8 [Web3 Interview Series] Paytaca Introduces Bitcoin Cash to Students in Leyte](https://bitpinas.com/wp-content/uploads/2024/02/Paytaca-Tacloban-768x402.jpg)