Startups Among Key Players That Will Drive Economic Growth in PH

The entities remarked that the fintech industry is revolutionizing the way people access and manage their finances by developing cutting-edge products and services.

- Fintech-centered entities Digital Pilipinas, partnering with the Singapore FinTech Association and the National Development Company, highlighted innovation, finance, and startups as drivers of economic growth.

- The Singapore FinTech Association fosters collaboration among FinTech ecosystem participants. While the National Development Company is a state-owned enterprise investing across industries.

- The industry leaders emphasized that fintech and digitalization are transforming financial services accessibility and affordability globally. Startups were advised to consider trends carefully, ensuring relevance, before investing resources.

Innovation, finance, and startups: These are the “keys” to further driving economic growth in the country.

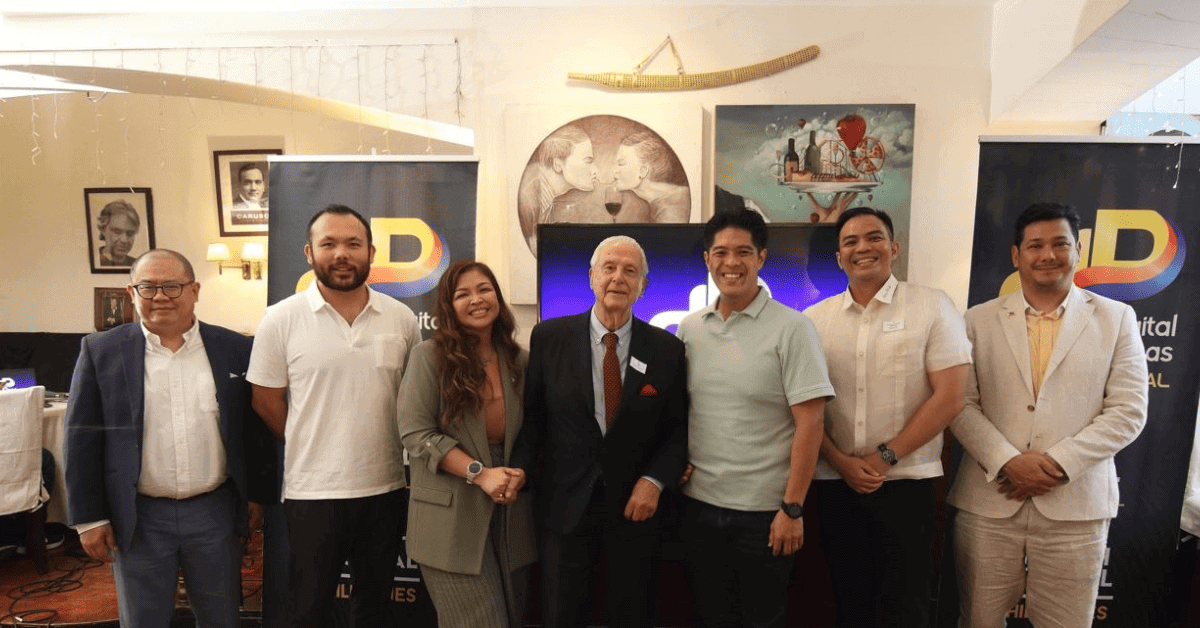

This was discussed during a recent event hosted by Digital Pilipinas, a private sector-led movement that aims to create an innovation and technology ecosystem in the country, in partnership with the Singapore FinTech Association, a non-profit initiative that claims to bring together stakeholders in the fintech ecosystem to facilitate collaboration, and the National Development Company, a state-owned enterprise that invests in diverse industries.

Drive for Economic Growth

The entities remarked that the fintech industry is revolutionizing the way people access and manage their finances by developing cutting-edge products and services. By working together, stakeholders can make financial services more accessible, affordable, and sustainable for all.

While it is important for startups to stay up-to-date on the latest trends, especially in the current digital age, industry leaders have expressed that it is also important to remember that not all trends are created equal, adding that it is important to carefully consider whether a trend is relevant to a business model before investing time and resources into it.

“The Filipino voice is the pulse of the digital economy. Our thoughts and opinions matter, and they have the power to guide brands, legislators, and the government. Digital Pilipinas is coming up with original research on that, together with one of our partners, to help shape the future of the digital economy for the benefit of all Filipinos,” DP Convenor Amor Maclang said.

Further, the movement also emphasized that as fintech and digitalization for startups possess the capacity to serve as constructive catalysts for global transformation, these initiatives have the ability to enhance the accessibility and affordability of services universally, irrespective of individuals’ income levels or geographical positions.

“Startups can harness digitalization to understand their target market, create a distinct value proposition, and enhance customer experiences. Rather than simply following trends, strive to provide unique value to your customers. Assess your market position and discover how you can stand out. That could be a good start,” Dennis Gatuslao, the chief commercial marketing officer of Bayad, echoed.

Accordingly, Vincent Tobias, head of innovation at Ayala Corporation, shared case studies on how Ayala Corporation has been innovating to thrive in the digital age. He disclosed that in 2012, Ayala created a corporate innovation unit to help its subsidiaries evolve their portfolios and business models in the digital age by investing in new technologies and businesses that have the potential to help the Philippines achieve financial inclusion.

The Event

The event, “Championing Sustainable Finance and the Startup Community in a Digital Pilipinas” was held at Caruso Ristorante Italiano in Makati on August 11. Apart from Tobias and Gatuslao, the event was also attended by:

- Proptech Consortium of the Philippines Executive Director AJ Rocero

- National Development Company General Manager Antonilo Mauricio

- Global Associates Consultancy Managing Partner Thomas Cheung

- Inventi Philippines CEO Francis Henares

- REPHIL CEO Abu Rahman

- APAC SG Delegate of Singapore Pte Ltd. Head of Business Development and Partnerships William Seow Synfindo

- Dragonpay COO Christian Reyes

- Global Associates Consultancy Managing Partner Thomas Cheung

- Tangere CEO Martin Peñaflor

- Doconchain CEO Olivier Bariou

- AND Solutions Head of Sales and Marketing Batbaatar Purev-Ochir

- Cyberbeat CEO Rajan Narayan

“These individuals represent a diverse range of industries and perspectives, which made for a stimulating and informative discussion. They discussed the latest trends in digitalization and sustainable finance, and how these trends are impacting the Philippines and the world,” Digital Pilipinas wrote.

Digital Pilipinas Recent Collaborations and Initiative

Recently, Digital Pilipinas hosted a roundtable discourse involving key figures and stakeholders from the insurance and health sectors. The discussion centered on highlighting sustainability and innovation. Additionally, the event unveiled early findings from The Voice of Digital Pilipinas survey, showcasing robust trust levels in government agency applications.

Moreover, the firm and the Bank of the Philippine Islands (BPI) also introduced the TrustTech Movement, aimed at bolstering cybersecurity across the nation. TrustTech’s objective is to endorse a comprehensive nationwide strategy against cyber scams, drive public awareness, and establish protective measures for both businesses and consumers.

Digital Pilipinas organized an event about blockchain and crypto in ASEAN. The Philippine Panel discussed the current crypto landscape and how to attract more Filipinos to the crypto space. The panel discussed initiatives such as grassroots-level education and collaborations with regulatory authorities.

Moreover, the firm and other key players from the Africa and ASEAN fintech industries will launch Africa x ASEAN Digital Economies and Fintech Month in October 2023. The event aims to attract local investments and promote innovation, benefiting the Philippines and the combined population of two billion in the participating regions.

It is also set to host the upcoming Digital Pilipinas Festival and Philippine FinTech Festival in November.

This article is published on BitPinas: Startups Among Key Players That Will Drive Economic Growth in PH

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.