Wholesale CBDC vs Retail CBDC: A Comparative Guide

As of this writing, 72 countries are exploring retail CBDC systems, and 11 of them have fully launched a retail CBDC.

- From the name itself, a CBDC is a digital currency that is issued and regulated by a central bank.

- A wholesale CBDC is the one used for transactions between financial institutions that hold reserve deposits with the country’s central bank.

- A retail CBDC is a digital currency that can be used by the general public as legal tender.

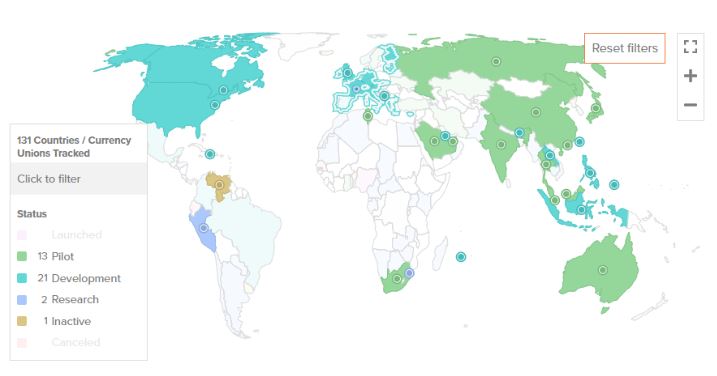

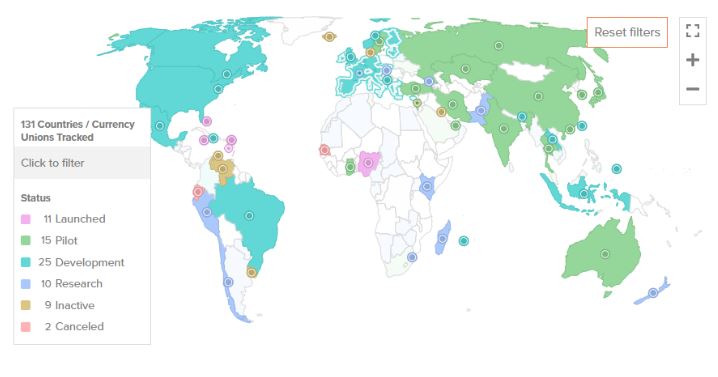

According to the online publication Atlantic Council, 131 out of 195 countries around the world have already launched, piloted, developed, or shown interest in having their own central bank digital currencies (CBDCs).

A CBDC is a digital form of a central bank’s traditional money that can serve as a medium of exchange or store of value. From the name itself, it is a digital currency that is issued and regulated by a central bank.

And unlike cryptocurrencies, CBDC is centralized by a country’s central bank, governed in terms of supply and value by a country’s monetary policies, trade surpluses, and more.

(Read more: BSP Selects Hyperledger Fabric as Blockchain for Pilot CBDC Project)

However, most of the countries’ CBDC systems focus on having retail CBDCs, while only a few focus on having wholesale CBDCs, like the Philippines.

What is the difference between a retail CBDC and a wholesale CBDC system?

What is a Wholesale CBDC?

A wholesale CBDC is the one used for transactions between financial institutions that hold reserve deposits with the country’s central bank.

The Pros and Cons of Wholesale CBDC

For the Bank of International Settlements (BIS), a wholesale CBDC could potentially improve the efficiency and security of payments and securities settlement systems because the ledger that is used to process and record transactions is expected to provide more transparency and traceability compared to traditional systems.

The central bank can also implement negative interest rates through wholesale CBDCs, which could help improve the effectiveness of monetary policy.

(Read more: List of 10 Major Philippine Banks in BSP CBDC Project)

However, some experts say that a wholesale CBDC system could disrupt the role and function of commercial banks and other financial intermediaries. If a central bank allowed non-bank financial institutions to access central bank money, the demand for bank deposits could reduce and the competition in the payments market could increase, according to a paper published on The Global Treasurer website.

Lastly, a wholesale CBDC system also requires a reliable technological architecture that could support its issuance, distribution, and maintenance. The central bank must ensure the interoperability, scalability, and security of the platform because central bank money is involved.

As of September 2023, 37 countries are exploring wholesale CBDC systems, but none of them have fully launched a wholesale CBDC.

(Read more: Global Perspectives: The List of Countries With CBDC Initiatives )

What is a Retail CBDC?

While wholesale CBDC is limited to financial institutions, a retail CBDC is a digital currency that can be used by the general public as legal tender.

According to the professional website, International Banker, a retail CBDC could be described as purely electronic money that would complement, not replace, cash and bank deposits. This type of CBDC would be available to households and businesses, allowing them to make payments using this electronic form of central bank money.

The Pros and Cons of Retail CBDC

Moreover, experts predict that having a retail CBDC system will promote financial inclusion, as it can be accessed and used without opening a bank account. And because it can be transferred directly between users without middlemen, lower transaction costs are also expected.

Lastly, a retail CBDC system can improve the country’s financial stability, as it can provide a risk-free and liquid alternative to bank deposits, which could lead to less cash reliance.

However, it also has its disadvantages. Since this system is for public use, it can be attractive to dirty players and vulnerable to hacking, or even phishing and other scams. It must captivate the public trust through a reliable and always available platform.

Also, as a public CBDC system, it requires challenging development, testing, implementation, and maintenance, which is the central bank’s concern.

As of this writing, 72 countries are exploring retail CBDC systems, and 11 of them have fully launched a retail CBDC.

This article is published on BitPinas: Wholesale CBDC vs Retail CBDC: A Comparative Guide

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.