Gemini Is Sued by US Regulator, Will Also Cut 10% of Staff Because of Bear Market

Impacted team members will receive a calendar invite for individual conversations about separation packages and health care benefits.

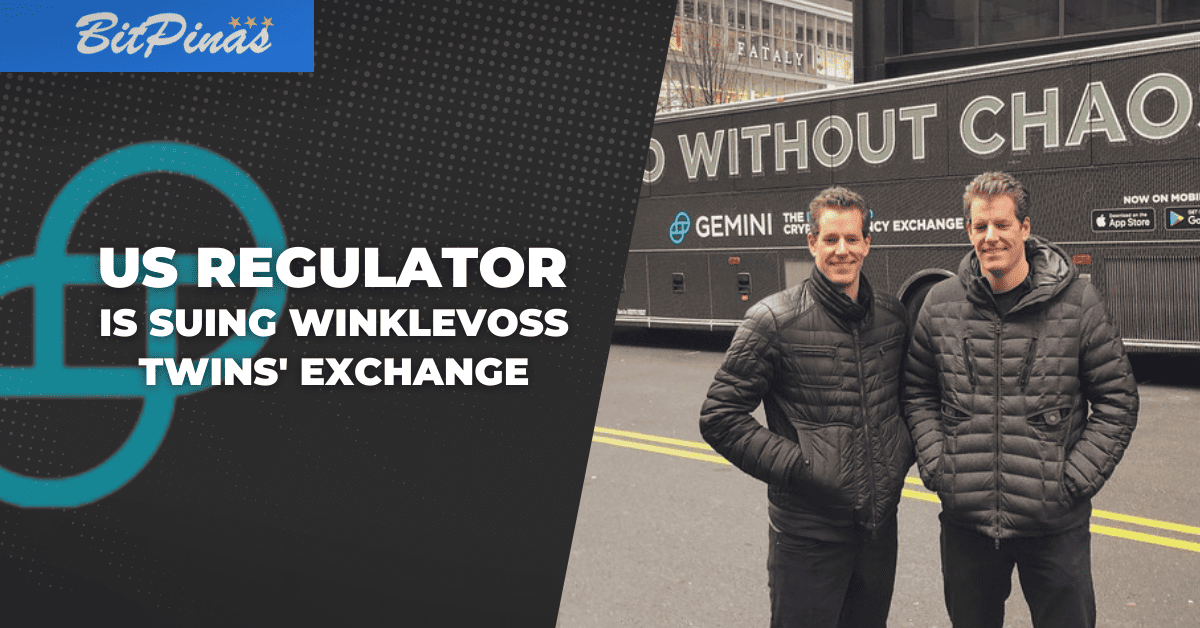

Gemini, the crypto company owned by the billionaire Winklevoss twins Tyler and Cameron, was sued by the Commodity Futures Trading Commission (CFTC) saying it misled regulators by misrepresenting key details of the exchange and futures contracts in meetings with regulator as part of an effort to gain approval for bitcoin futures in 2017.

“Making false or misleading statements to the CFTC in connection with a futures product certification undermines the CFTC’s work to ensure the financial integrity of all transactions,” – Gretchen Lowe, CFTC acting director of enforcement

Gemini Exchange is Sued by US Regulator CFTC

According to the CFTC’s lawsuit, the case focuses on the broadside against one of the crypto industry’s best-known brands. The regulator accused the company of using undisclosed incentives to goose trading during an important period of the day.

“This enforcement action sends a strong message that the Commission will act to safeguard the integrity of the market oversight process,” Lowe said in a statement.

CFTC noted that the alleged efforts to boost trading volumes weren’t revealed to the regulator even though Gemini executives met directly with them to answer questions about the exchange’s operations and whether trading during the critical window could be manipulated.

Moreover, they also included instances where Gemini allegedly made unsecured loans to market participants and the company allegedly allowed for trades before transfers had settled.

“Credits and advances could misleadingly skew the apparent volume, liquidity or number of participants trading on the Gemini exchange and in the Gemini bitcoin auction,” the complaint reads.

For the punishment, the commission is calling for civil monetary penalties and an order blocking Gemini and its affiliates from trading commodities or soliciting investments.

On the other hand, Gemini is disagreeing with the claims and plans to contest the charges in court.

“We have an eight year track-record of asking for permission, not forgiveness, and always doing the right thing… We look forward to definitively proving this in court,” a Gemini spokesperson told Coindesk.

Gemini Say Crypto Winter is Here, Will Cut 10% of Staff

While the suit is ongoing, the Winklevoss twins announced in a blog post that Gemini will be laying off 10% of the workforce because the industry is in a “contraction phase” known as “crypto winter,” which has been “further compounded by the current macroeconomic and geopolitical turmoil.”

Currently, Gemini–established since 2014 and is valued at $7.1 billion as of its last funding round– has 1,033 people on its payroll, and the 10% cutoff translates to about 100 employees affected.

According to the firm, its physical offices were closed in order to protect employee privacy. Impacted team members will receive a calendar invite for individual conversations about separation packages and health care benefits. While the remaining employees will take part in a “company-wide standup” to talk about Gemini’s future.

This article is published on BitPinas: Gemini Is Sued by US Regulator, Will Also Cut 10% of Staff Because of Bear Market

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.