Another Stablecoin – DEI from DEUS FINANCE Collapses, Loses $1 Peg

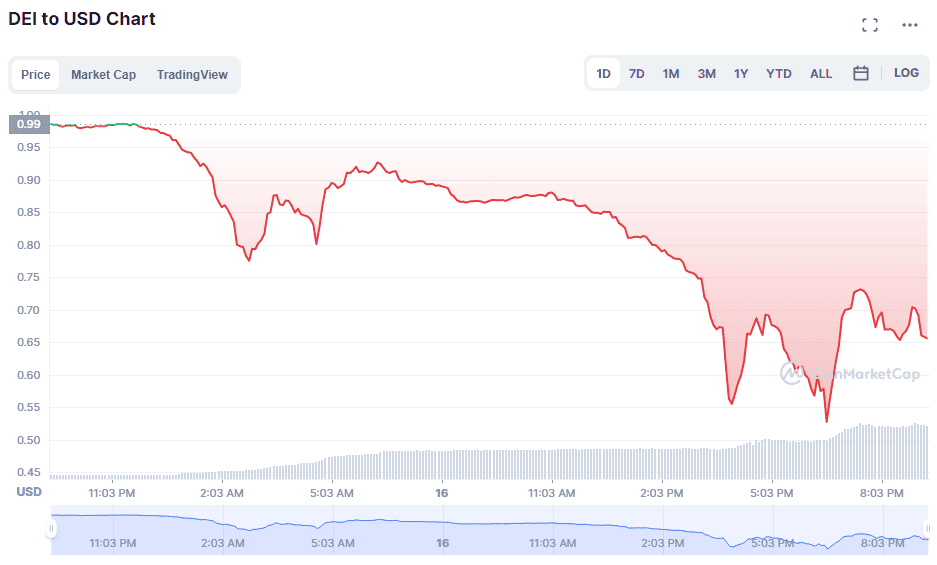

DEI, which is a hybrid algorithmic stablecoin from DEUS FDinance, lost its 1 = 1 peg to the US dollar on Sunday.

Another stablecoin becomes unstable. DEI, which is a hybrid algorithmic stablecoin from DEUS FDinance, lost its 1 = 1 peg to the US dollar on Sunday, data from CoinMarketCap confirms.

DEI, which is supposed to be at $1, is currently trading at $0.65.

What is DEUS FINANCE and DEI?

DEUS and DEI are the tokens in this ecosystem. When minting DEI, a user can deposit 80% of another coin such as USDC and then 20% of DEUS. Alternatively, users can use only DEUS as collateral. It has a similar mechanism like in LUNA and TerraUSD (UST). Still, when a user decides to redeem or swap their deposited DEI for the collateral, the user will receive 80% USDC and 20% DEUS if the collateral was originally 100% USDC.

Check how TerraUSD and LUNA work to have a general idea of the mint and burn mechanism of algorithmic stablecoins.

DEUS Finance previously suffered two flash loan attacks, resulting in a loss of $30 million.

According to Deus Finance’s Telegrap Group:

“Bonds has been identified as a means for short-term repeg and building to a sustainable collat ratio again. at the same time, due to UST situation/exploit etc,. there is PTSD in the market. DEI depeg results in fear and panic and huge sell-offs which people interpret as a luna-type death spiral when it is not related. halting redeeming is a natural stopgap to avoid any possible gaming of the system etc while the team works on restoring peg and implementing fixes.”

Furthermore:

“As a result, the DEI price will return to normal within a week.

Because DEI can be issued in USDC unlike UST, which is collateralized with Luna, when the foundation starts purchasing DEI with USDC, it will return to its original price.

And DEI’s selling volume is not as high as expected.

However, the reason this happened is that the USDC/DAI/DEI ratio of the pool currently provided by BEETHOVEN is abnormal.

It should be set to a 50/50 ratio.”

This is a developing story.

This article is published on BitPinas: Another Stablecoin – DEI from DEUS FINANCE Collapses, Loses $1 Peg

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.

![[Exclusive] GCash Partners with PDAX for GCrypto Trading 5 [Exclusive] GCash Partners with PDAX for GCrypto Trading](https://bitpinas.com/wp-content/uploads/2022/10/draft_feature-1-2-768x402.png)