Will BTC Price Surge to $45K Amid Potential Bitcoin ETF Approval?

Bitcoin’s potential rally to $45,000 amid ETF anticipation and a strong year-end outlook — Matrixport

The potential introduction of Bitcoin Exchange-Traded Funds (ETFs) and the upcoming year end have led crypto investors and enthusiasts to speculate that the price of the leading cryptocurrency might rally and break out to the $45,000 mark. It will be the highest it will be since its decline from its all-time-high value in 2021.

Table of Contents

Bitcoin Price

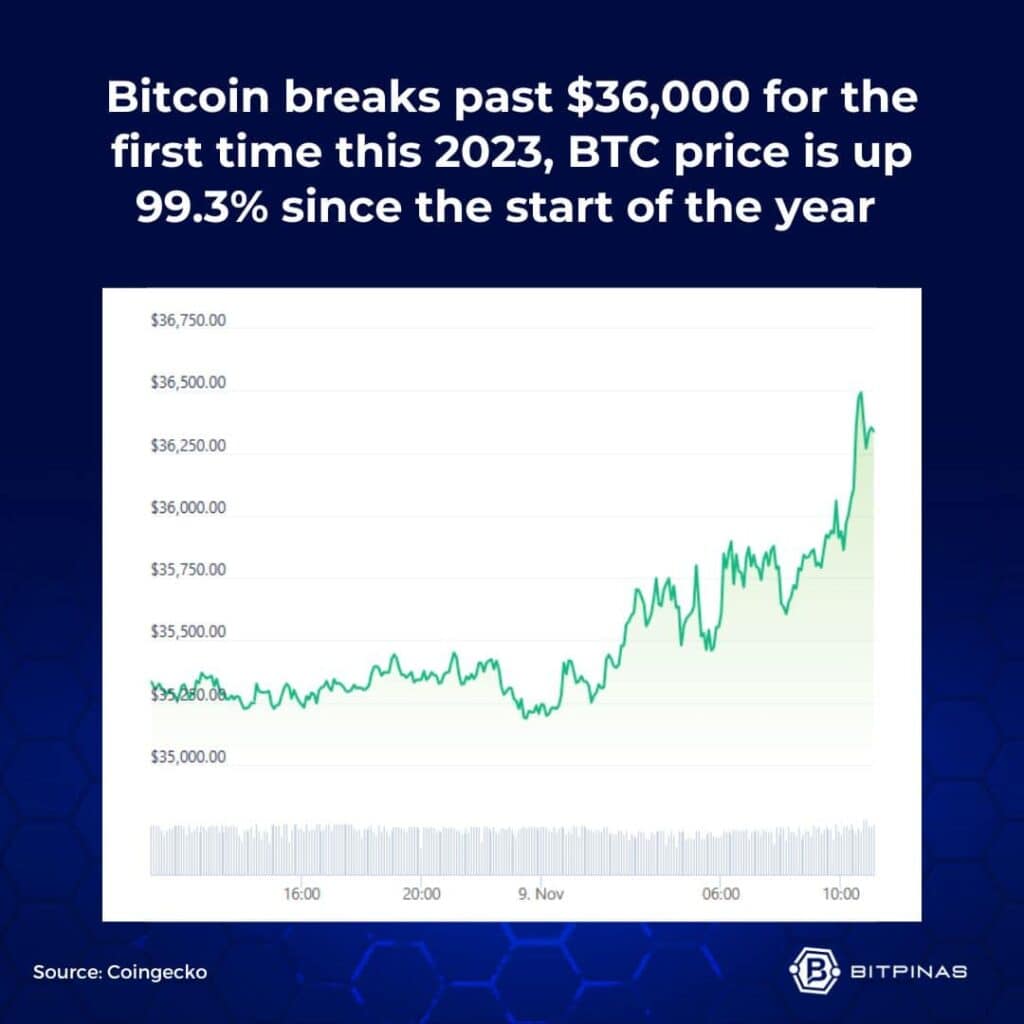

Bitcoin surpassed the $36,000 mark for the first time this year on November 9.

As of writing, CoinGecko data shows that BTC is currently valued at $36,495.66 and was up by 3.5% in the last 24 hours. The leading crypto increased by 100.1% over the past year.

Santa Claus Rally

According to Matrixport, a crypto investment services firm, Bitcoin might hit the $45,000 mark soon. The firm stated that the projection is underpinned by consistent BTC acquisitions during U.S. trading hours and a conducive macroeconomic backdrop. This backdrop is marked by the Federal Reserve’s accommodative stance, decreasing bond yields, and a reduced pace of long-term debt issuance by the U.S. Treasury Department.

“The Santa Claus rally could start at any moment… With a steady increase in buyers during U.S. trading hours and an ongoing attempt for bitcoin to break out, we could see prices rallying into the end of the month and year,” Matrixport stated.

Moreover, it noted that if Bitcoin breaks above $36,000, which it recently did, it could propel BTC toward the next technical resistance level at $40,000, “potentially reaching $45,000 by the end of 2023.”

Previously, Matrixport even predicted that BTC could reach as high as $56,000 by the end of the year. The forecast was based on historical patterns, which show that if Bitcoin has increased by at least 100% by this time of year, there is a 71% chance that it will finish the year higher, with average year-end rallies of around 65%.

The time frame stretching from early November to mid-December is commonly known as the “Santa Claus Rally” for Bitcoin, given its historical tendency to perform exceptionally well during this period. On November 10, 2021, the cryptocurrency reached a historic high of $69,000, coinciding with a surge in inflation to a 31-year peak.

Bitcoin ETF Approval

After Grayscale’s successful appeal to the United States Securities and Exchange Commission (SEC) to convert its Bitcoin Trust into an ETF, interest in the fund has significantly increased. However, the SEC now only has until November 17 if it wants to approve all 12 spot bitcoin (BTC) ETF applications this year.

According to Bloomberg Intelligence analysts Eric Balchunas and James Seyffart, the SEC could issue approval orders for 12 spot bitcoin ETF applications on November 9 through 17. Moreover, comment periods for seven of the applications end on Wednesday.

“We still believe 90% chance by Jan 10 for spot #Bitcoin ETF approvals. But if it comes earlier we are entering a window where a wave of approval orders for all the current applicants *COULD* occur,” Seyffart posted.

Additionally, it was noted that three applicants, specifically Global X Bitcoin Trust, Hashdex Bitcoin ETF, and Franklin Bitcoin ETF, could undergo separate comment periods; starting on November 17, the comment period will resume. As a result, any approval or denial for these filings is expected no earlier than November 23.

Consequently, Seyyfart noted that if the SEC is open to temporarily setting aside these applications, they could potentially grant approvals for the initial nine submissions. These nine include BlackRock, Grayscale, 21Shares & Ark, Bitwise, VanEck, Wisdomtree, Invesco & Galaxy, Fidelity, and Valkyrie.

A Bitcoin ETF is a financial tool enabling investors to access Bitcoin through traditional stock exchanges instead of cryptocurrency platforms. It operates like an investment fund, tracking and trading Bitcoin’s price as if it were a stock.

Recent News about Bitcoin

CoinDesk Indices recently reported that Bitcoin had its most profitable day in 2023 on October 23, which was attributed to the positive sentiment surrounding the introduction of a spot BTC ETF.

Read BitPinas’ Bitcoin Series:

- Bitcoin Month: Origins and Key Milestones in Bitcoin’s History

- Bitcoin Pizza Day: The Story Behind the First-Ever Real-World BTC Transaction

- How to Buy and Store Bitcoin: A Step-by-Step Guide

- Bitcoin and the Lightning Network: An Introduction to Scalability Solutions

- Bitcoin in the Philippines: Adoption, Regulation, and Use Cases

- Understanding Bitcoin: What is it, How it Works, and Why it Matters

- Bitcoin Halving Explained: How It Influences BTC’s Price

- The Ultimate Guide to Bitcoin Books: Recommended Reads for Filipinos

- Wrapped Bitcoin | WBTC Guide and Usecase

- How to Use Wallet of Satoshi in the Philippines: A Complete Guide to Receiving and Sending Bitcoin

This article is published on BitPinas: Ahead of 2023 Bitcoin ETF Approval, Will BTC Surge to $45k?

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.