60% of Banks in PH Plans to Implement Digital Money Management Tools in the Next 12 Months

Currently, the BSP has given five companies the go signal to operate as digital banks in the country.

By Shiela Bertillo

In a recently published survey commissioned by Backbase, a banking software solution company, it revealed the new direction taken by the Filipino retail banking sector that could help consumers manage their crippling debt.

The commissioned study conducted by Forrester Consulting found that 78% Filipino banks are the most likely to cite organizational silos as a key challenge in developing digital money management tools in Asia Pacific (APAC); however 60% of these banks still plan to implement digital money management tools in the next 12 months.

As part of an accelerated transition to digital banking, banks developed digital financial wellness and money management tools that will provide consumers with a range of new tools including spending analysis, scheduling of bill payments, automatic debt repayments, budgeting and more, delivered directly into their pocket via a smartphone app.

Regarding managing finances, Regional Vice President for the Asia Pacific at Backbase, Iman Ghodosi, talked about the main challenges Filipinos face when it comes to their finances: “Our research showed that managing debt was the main concern of Filipinos; more so than the rest of APAC.”

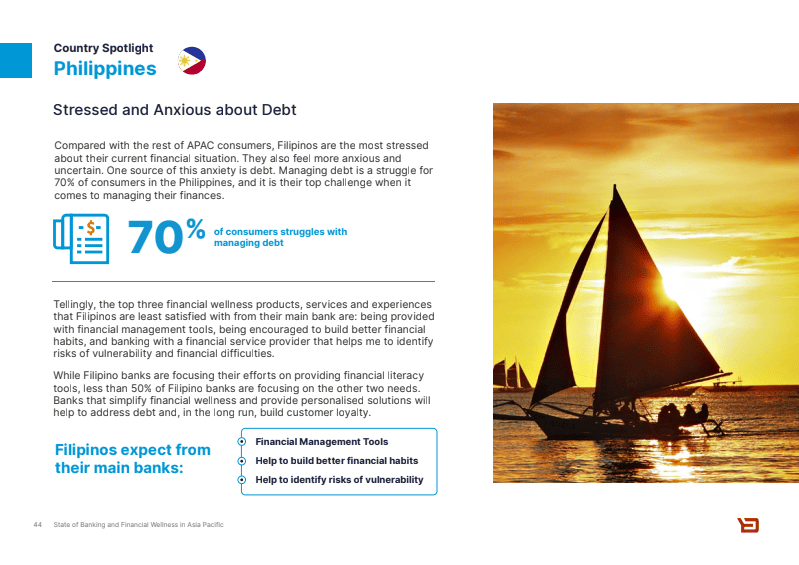

Among the rest of APAC consumers, Filipinos are revealed to be more anxious and uncertain and the most stressed about their current financial situation. Debt is recorded as one of the stressors and source of this anxiety. With 70% of consumers in the Philippines struggling to manage their debts, it was revealed as their top challenge when it comes to managing their finances.

“67% of banking customers in the Philippines said they feel overwhelmed by debt, 60% said debt negatively impacts their abilities to pay bills – this leads to more debt – and 63% said debt makes building savings difficult. Household debt in the Philippines is at a near-record of over two trillion pesos.” Ghodosi stated.

He also added that “through advancements in digital technology, banks can now offer digital services to assist in managing debt correctly.”

During the pandemic, digital banking increased in popularity in the country. And last year, the Bangko Sentral ng Pilipinas (BSP) has approved to recognize “digital bank” as a new bank category separate from existing bank categories, making it the seventh bank category in the Philippines. (Read more: BSP Approves ‘Digital Bank’ as New Category of Bank)

However, according to the report, trust in digital banks is low with only 18% of respondents saying they trust a digital bank, compared to 60% for a traditional bank.

Ghodosi noted that lower trust in new ways of banking is to be expected but he also reiterated that “the more information and control we can put into the hands of customers to make their own informed financial choices, the more they will trust the organizations providing them with this opportunity.”

“Technology now enables us to do this. We see from our research that in the Philippines 68% of people use their smartphone to bank with, so by building out that interface and offering more tools, digital banks can address the trust issues, and traditional banks can compete in digital,” Ghodosi stated.

Accordingly, as stated in the study, with consumer expectations and the banking landscape constantly evolving, many banks in the Philippines say they find it difficult to keep up with progress and meet new demands. 70% say it is a key challenge to keep pace with customer expectations and remain both profitable and relevant. This is above the APAC average of 63%. (Read More: UnionBank to Launch Digital Bank in 2022)

“Now more than ever, it is important to own the relationship with your customer. We’ve entered the Engagement Banking Era, an evolution that stresses a one unified platform approach for banking. The number one priority in this new era is to completely re-architect the bank around the customer, moving away from siloed technology investments.” Ghodosi added.

The majority of the local financial institutions acknowledged that they face unique organisational challenges to develop digital money management tools. When asked what the key challenges are facing their company in developing these solutions for customers, 78% answered ‘organizational silos’, 70% said ‘outdated technology’, 72% stated ‘lack of understanding of customer needs and outcomes’ and 72% said ‘unsure of how to work with/partner with fintech’.

To address these concerns, 80% said their company is ‘planning to’ or ‘actively expanding’ its financial wellness initiatives and 48% said it was of ‘critical priority.’ When asked about spending on digital financial wellness tools, 52% said their company plans to spend more over the next 12 months.

“This is fairly normal at this stage of technological adoption to have some challenges, but they need to be addressed,” according to Backbase Regional Sales Director for ASEAN and South Asia Riddhi Dutta.

“We have seen many banks around the world face similar challenges at some point in their journey. Change is not easy. However, for those institutions who want to take the lead, the slowness of some players is definitely an opportunity for others,” Dutta added.

Nevertheless, Dutta emphasized that the consumers will be the winners in all of this as new apps will increase levels of financial literacy, encourage customers to build better financial habits, help prevent vulnerable customers from making bad financial decisions, help manage debt, and identify risks of vulnerability and financial difficulty far earlier.

“Financial lives will be improved,” Dutta continued. “We see a future not far from now when financial wellness and money management apps will be the primary interface between financial intuitions and their customers and managing debt will be far easier. Technology now allows banks to better meet the needs of their customers, and the future for everyone looks very bright.”

Currently, the BSP has given five companies the go signal to operate as digital banks in the country. These are the Overseas Filipino Bank of state-run Land Bank of the Philippines, Tonik Digital Bank, UNObank, Union Digital Bank of Aboitiz-led Union Bank of the Philippines and GOtyme. The BSP is no longer receiving applications for new digital banks including banks wanting to convert their status for the next three years.

This article is published on BitPinas: 60% of Banks in PH Plans to Implement Digital Money Management Tools in the Next 12 Months