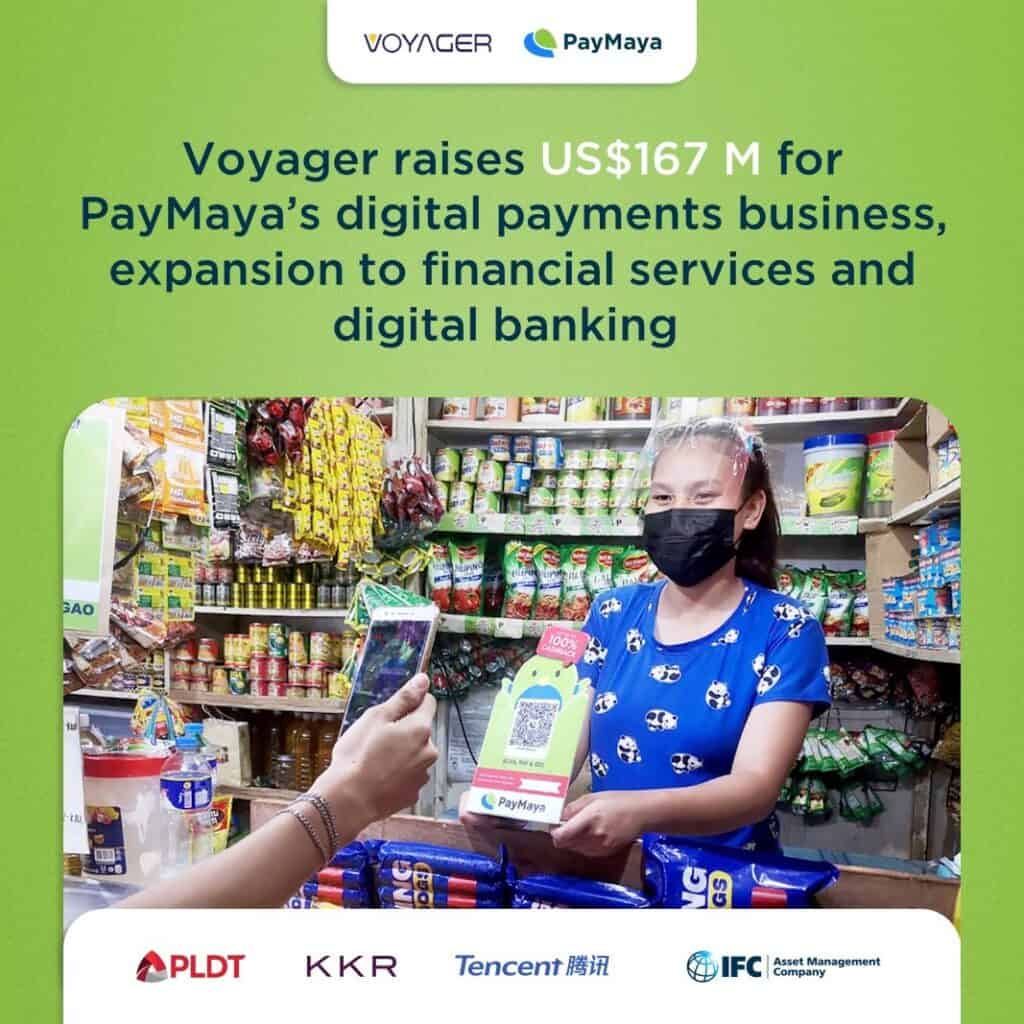

PayMaya Eyes Digital Banking License After Securing $167M from Tencent, PLDT, IFC

Voyager Innovations, the parent company of PayMaya secured $167 million investment which will be used to expand to digital banking & other financial services.

Voyager Innovations, the parent company of PayMaya secured $167 million investment which will be used to expand to digital banking & other financial services.

28 percent of the capital (around $46 million) came from previous pledge funds and the remaining (around $121 million) came from existing PLDT shareholders; KKR, a global investment firm; Tencent, a Chinese multinational technology conglomerate holding company; International Finance Corporation (IFC), a member of the World Bank Group; and IFC Financial Institutions Growth Fund, a fund managed by IFC Asset Management Company (IFC-AMC) which is operating under IFC & a new investor.

The capital raise will be used to accelerate their expansion & obtain a digital banking license from the Bangko Sentral ng Pilipinas (BSP). Once granted, PayMaya could provide a more low-cost, mobile first, neo-banking service on the back of its tech stack. (Read more: BSP Approves ‘Digital Bank’ as New Category of Bank)

PayMaya recorded triple-digit growth rates throughout 2020. Within the last 18 months, it has reached 38 million total registered users.

PayMaya is also part of the National Retail Payment System (NRPS), also known as the “InstaPay/PESONet Network”, which promotes interoperability of financial products and services. It is also the first fintech app to adopt QR PH, the national standard for merchant payments.

This article is published on BitPinas: PayMaya Eyes Digital Banking License After Securing $167M from Tencent, PLDT, IFC