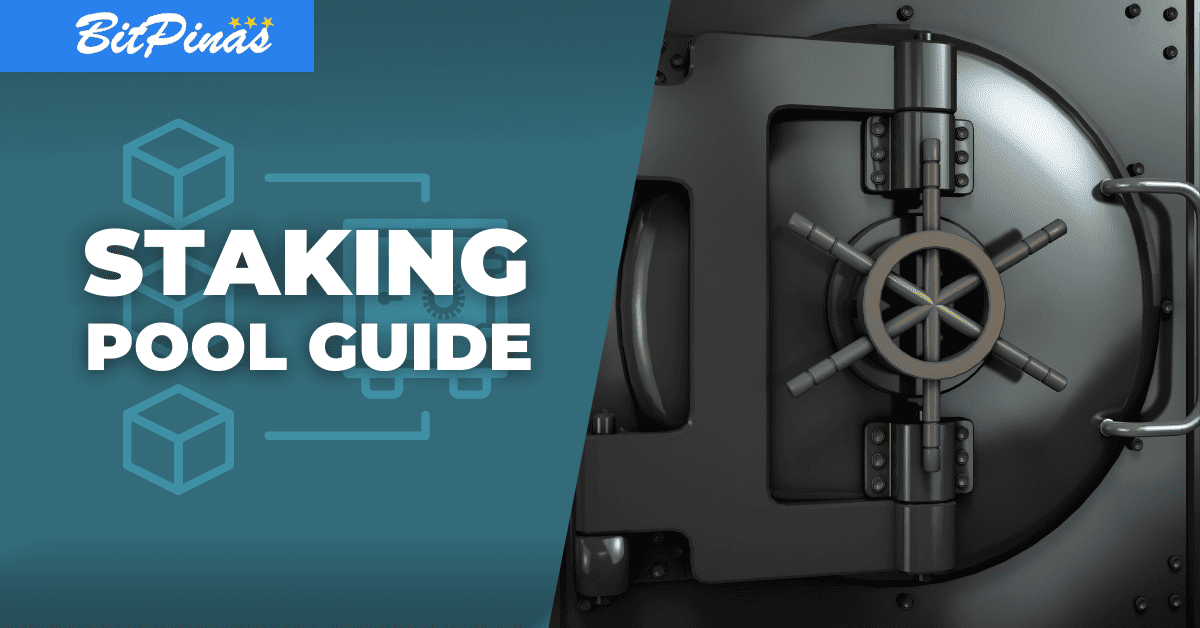

What is a Staking Pool? How Does It Work?

A staking pool is when a group of crypto holders put their resources. The consolidation allows them to increase their chances of validating new transactions

There are different ways of earning aside from trading crypto in the market. One of them is through staking pools.

This article attempts to explain how staking pools work in simpler terms. Even the pros and cons of doing staking pools will be discussed later.

This article does not serve as financial advice but as a guide for crypto enthusiasts. Practice due diligence in researching before investing in cryptocurrencies.

So, What are Staking Pools?

A staking pool is when a group of crypto holders puts their resources together. Hence, making it a pool of resources. The consolidation allows them to increase their chances of validating new transactions in the blockchain and receive rewards in return.

How does Staking Pool Work?

For the purpose of comparison, mining cryptocurrencies need to compute for the missing node to create new records in the ledger. Miners need the Proof-of-Work (PoW) to receive the reward in crypto for creating supercomputers to help produce more blocks into the network. While for staking, the cryptocurrencies that are placed in the pool are used to validate new information within the network. By doing so, stakers need the Proof-of-Stake (PoS) for them to receive rewards for staking their assets into the pool.

A loose illustration of this is when bankers lend their money to banks, and the banks use this pool of resources to operate and in return bankers are given interest. Although, in staking, participants don’t receive interest but a percentage based on the number of people sharing in the pool.

The more stakeholder provided in the staking pool, the greater reward is received. There are staking pools that incentivize stakeholders that have placed their assets in the pool for a longer period. These rewards are estimated and expressed in annual percentage yield (APY).

The Pros and Cons of Using Staking Pools

There are platforms that have two types of staking: Flexible and Fixed Staking. Flexible staking gives the stakeholder the liberty to withdraw his assets from the pool anytime. Unfortunately, this can abrupt the daily reward and the stakeholder may not receive the reward in the process. Fixed staking, on the other hand, the assets are locked for a certain period of time and stakeholders have to wait for the expiration of the duration to be able to withdraw his assets and claim his reward.

Impermanent loss can happen to stakeholders who use two cryptocurrencies to stake in a liquidity pool. A liquidity pool is where stakeholders place two different cryptocurrencies that have equal value. Due to the volatility of the market, the prices will vary over time. If one crypto decreases in value, the same value will be applied to the other when the stakeholder decides to withdraw his assets and reward from the liquidity pool. But when both assets increase in value, the stakeholder will receive a higher value than when he placed his assets in the pool. If a stakeholder placed a small value in the liquidity, there is a chance that he may lose the value greatly.

A more detailed discussion on impermanent loss and liquidity pol, refer to this BitPinas article.

Staking pools are a good platform for crypto enthusiasts that still have a small portfolio for them to receive rewards in cryptocurrency for staking. This can help them gain more in the long term. But before staking, a crypto enthusiast needs to research the platform and cryptocurrency before placing their asset into the staking pool.

This article is published on BitPinas: What is a Staking Pool? How Does It Work?

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.