BDO’s New Mobile Banking Platform Received Mixed Reviews From Users

The app has received a low rating due to issues reported by users such as errors and incorrect credentials.

Subscribe to our newsletter!

- BDO Unibank has launched a new mobile banking app called BDO Online for easy and secure banking, available for users to download.

- The BDO Online app has several features such as account summary, transaction details, bill payments, and InstaPay transfers, and is free to download on both Google Play Store and the App Store.

- The app has received a low rating due to issues reported by users such as errors and incorrect credentials. This comes after a 2021 cyber attack that affected 700 BDO clients and led to sanctions from the Bangko Sentral ng Pilipinas.

Philippine banking company giant BDO Unibank, Inc., commonly known as Banco de Oro (BDO), has silently started the operations of its new mobile banking application, BDO Online, on January 18, 2023, a different app from its old mobile banking app, BDO Digital Banking.

The new app has been recognized and promoted by the BDO on its website:

“Be the first to upgrade to a better online banking experience, and enjoy our new look and smoother navigation – built with you in mind. We’re keeping the old version of Online Banking up and running as we add more features to the new app. You can access the old Online Banking page here.”

Features Available on the New Mobile App:

- Sign up for a BDO Online Banking account.

- Device Biometric/PIN setting. forgot/reset password, forgot username, change PIN, enable/disable biometrics, create account nickname, enable push notifications, manage (hide or show) viewable accounts.

- View account summary (Checking Account, Savings Account, Time Deposit, PHP Credit Card, and Loans).

- View transaction details (Checking Account and Savings Account, and Credit Cards).

- Send Money to your own account, any other BDO account, or other banks and wallets via InstaPay using the user’s account number or QR code.

- Schedule and manage to Send Money to own account for future transactions.

- Pay Bills.

- Buy Load.

- Request Money via QR code.

As per BDO, more features are coming soon as BDO Digital Banking undergoes more updates. It is free to download on the Google Play Store for Android users and the App Store for iOS users.

“The BDO Online app is the new and improved version of the BDO Digital Banking app, designed for easy and secure on-the-go banking! It lets you manage your accounts, keep track of your finances, and make different types of transactions anytime, anywhere,” the bank claimed.

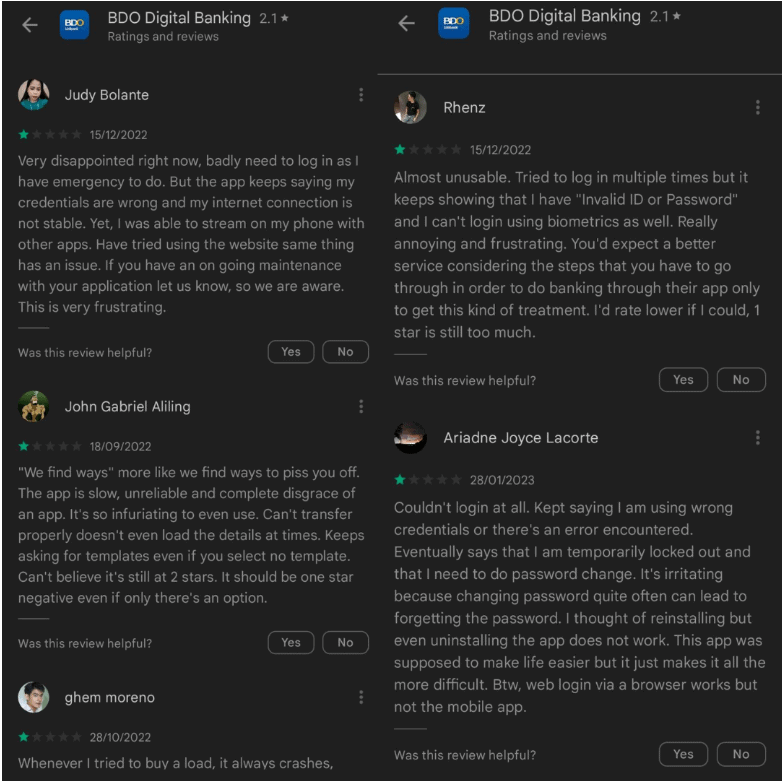

However, as of writing, the new mobile banking app has only been rated 2.1 stars out of 67,831 reviews.

Some of the users insisted that the app says that users are giving the wrong credentials. Others even say that they cannot transfer their funds or even buy loads as the app keeps on showing that “an error occurred.”

On July 18, 2022, the bank also released a mobile banking app called BDO Pay. According to BDO, it has decided to make the said app available to non-BDO clients to support the Digital Payments Transformation Roadmap of the Bangko Sentral ng Pilipinas (BSP), which seeks to provide 70% of Filipino adults with formal financial accounts by 2023.

It can be recalled that in December 2021, BDO accounts were hacked by cybercriminals, stealing from ₱25,000 to ₱50,000 pesos per account. The money stolen from BDO accounts was transferred to the scammer named “Mark D. Nagoyo,” who has multiple UnionBank accounts.

In the middle of the issue, a Twitter user revealed that there was a line in the bank’s electronic banking terms and conditions that states that BDO “shall not be liable for any loss or damage” regarding the use of their online banking services from hacking or any other security breaches “with or without your participation.” The updated terms implied that the bank does not have to compensate online hacking victims even if it is their fault and not the customer’s.

The bank immediately denied these allegations.

Then, in May 2022, the BSP announced that it was sanctioning the two involved banks for the unauthorized bank transfers during the December 2021 cybersecurity breach, which victimized 700 BDO clients.

This article is published on BitPinas: BDO’s New Mobile Banking Platform Received Mixed Reviews From Users

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.