Not USDT: SEC Warns Public vs Tether Pay Limited for 210% Promised Profit

Though the fraudulent entity uses USDT for the public to invest in, it is not affiliated with the firm behind USDT.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

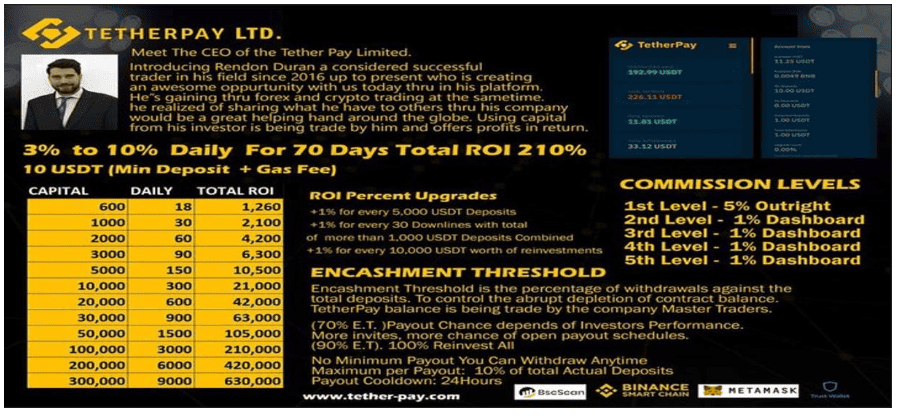

- The SEC has issued a public warning about Tether Pay Limited, which is reportedly soliciting investments for foreign exchange and cryptocurrency trading and promising guaranteed returns of 3-10% daily for 70 days.

- The SEC warns that Tether Pay Limited is offering unregistered securities in the form of investment contracts and is engaging in a fraudulent scheme, and that individuals acting as agents for the company may be prosecuted and face fines and imprisonment.

- The SEC has advised the public not to invest with Tether Pay Limited and to be cautious when dealing with any individuals or groups soliciting investments on behalf of the company.

- Tether Pay Limited is not to be confused with Tether Inc, the company behind the stablecoin Tether (USDT).

“This is to inform the public that TETHER-PAY/TETHER.PAY.COM/TETHER PAY LTD./TETHER PAY LIMITED IS NOT AUTHORIZED TO SOLICIT INVESTMENTS FROM THE PUBLIC.”

Securities and Exchange Commission (SEC)

To address the reports received and the information gathered by the SEC itself, the Commission has issued a public warning against the entity Tether Pay Limited for soliciting investments purportedly to be invested in foreign exchange and cryptocurrency trading.

The SEC also warned investors to be wary of individuals or groups of individuals representing the said entity, specifically naming a certain Rendon Duran, the chief executive officer (CEO) of Tether Pay Limited.

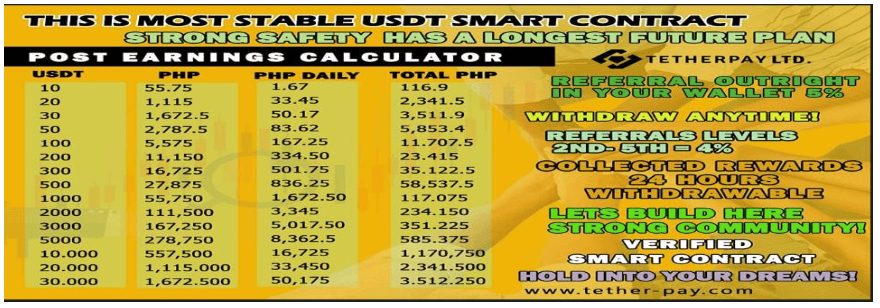

According to the Commission, the entity is enticing the public to invest online in an amount ranging from 10 USDT (∼₱557.50) up to 300,000 USDT (∼₱1,672,500)—according to Tether Pay, investors can earn a guaranteed 3% to 10% daily profit in 70 days. For the same period, investors are promised a 210% return, or approximately ₱1,169 up to ₱3,515,250.

Aside from the already generous investment return, the said entity likewise offers return on investment (ROI) percentage upgrades and commission levels.

Tether is a stablecoin, a type of cryptocurrency that mirrors the value of the US Dollar. It was launched by the company Tether Limited Inc., owned by Hong Kong-based company iFinex Inc., in 2014. The entity Tether Pay is not affiliated with Tether Limited or iFinex Inc. (Read more: How to Buy Tether in the Philippines)

Following this, the SEC stressed that “TETHER-PAY/TETHER.PAY.COM/TETHER PAY LTD./TETHER PAY LIMITED appears to be engaged in a fraudulent scheme of offering and selling unregistered securities in the form of investment contracts in violation of Sections 8 and 26 of the Securities Regulation Code.”

Accordingly, the Commission warned individuals acting as the entity’s salesmen, brokers, dealers, agents, representatives, promoters, recruiters, uplines, influencers, endorsers, abetters, and enablers may be prosecuted and held criminally liable under Section 28 of the SRC and penalized with a maximum fine of ₱5,000,000.00 or a penalty of 21 years of imprisonment or both pursuant to Section 73 of the SRC (G.R. No. 195542, 19 March 2014).

“In view thereof, the public is advised NOT TO INVEST or STOP INVESTING in any investment scheme being offered by TETHER-PAY/TETHER.PAY.COM/TETHER PAY LTD./TETHER PAY LIMITED vis-à-vis RENDON DURAN as well as to any other entities having the same or similar schemes, and to exercise caution in dealing with any individuals or group of persons soliciting investments or recruiting investors for and on behalf of TETHER-PAY/TETHER.PAY.COM/TETHER PAY LTD./TETHER PAY LIMITED vis-à-vis RENDON DURAN,” the SEC stressed.

Consequently, the SEC recently advised the public to be wary of unregistered cryptocurrency exchanges, noting that Philippine law requires business entities to register with the Commission. It also emphasized that it is illegal to sell securities in the country without the necessary licenses to do so. The SEC and Google also required crypto advertisers to show a license to operate locally. (Read more: SEC Warns Public Against Unregistered Cryptocurrency Exchanges in Philippines)

Prior to the recent warning, the Commission previously advised the public in a webinar through Vicente Graciano P. Felizmenio, Jr., the SEC’s director of the Markets and Securities Regulation Department, highlighting that the public must be cautious in dealing with digital and cryptocurrency investments earlier this year. (Read more: SEC Advises Public to be Cautious on Crypto Investments)

Throughout 2022, the SEC has been actively flagging fraudulent entities leveraging the increasing popularity of cryptocurrency in the country. It has published over 23 advisories on firms offering investments in cryptocurrency, non-fungible tokens (NFT), blockchain, play-to-earn, and other digital assets:

- SEC Issues Advisory Against “Outrace Play-to-earn”

- SEC Warns Public Against Investment Scheme “CRYPTOSTAKERS”

- SEC Issues Advisory against CryptoPayz

- SEC Warns Public Against Staking Scam YDYS Trading

- SEC ADVISES FILIPINOS TO STOP INVESTING TO METAPROFIT

- SEC Issues Warning Against Leefire Limited’s Enticing Investment Scheme

- SEC Issues Advisory Against Autotrade International

- SEC Issues Warning Against Sengre and its Crypto Coin Scheme

- SEC Issues Cease and Desist Order Against Astrazion Group, AZNT Token

- SEC Issues Advisory Against USDT-Centered Scheme of Decentra

- SEC Warns Public Against Crypto Schemer Paynance

- SEC Responds to Infrawatch: Binance is Not Registered, Cautions Public Not to Invest

- SEC Warns Public Versus Peak Finance

- SEC’s Cease-and-Desist Order vs Astrazion Group Now Permanent

- SEC Issues Advisory Against Sophia Francisco Holding

- SEC Issues Advisory Against PURECASH, SUGERCOIN, TCREDUT, GOLDAPPLE, SPENDCASH

- SEC Warns Public Against BitDefi Hub

- SEC Warns Public: Stop Investing in Movie Daddy’s Watch-to-Earn Scheme

- THE END: SEC Revokes Astrazion’s Corporate Registration

- SEC Issues Public Advisory vs ‘CRYPTO MARKETERS’ Company

- SEC Cautions Public Not to Invest in HeroMining Scam

- 528% Return in 240 Days, SEC Flags BitBank Crypto Scam

- LUXURY OF EARNING WHILE PLAYING GAMES? SEC Releases Advisory vs Gameloot for a Potential Ponzi Scheme

To date, the Commission is still seeking specified legislation that would give it jurisdiction and appropriate powers to regulate cybercrimes that involve digital assets. (Read more: SEC: Law Focusing on Digital Assets Needed)

Find more SEC advisories here.

This article is published by BitPinas: Not USDT: SEC Warns Public vs Tether Pay Limited for 210% Promised Profit

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.